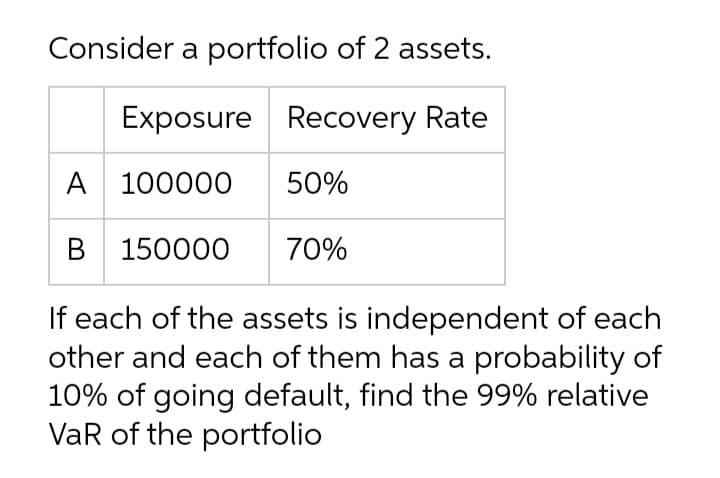

Consider a portfolio of 2 assets. Exposure Recovery Rate A 100000 B 150000 50% 70% If each of the assets is independent of each other and each of them has a probability of 10% of going default, find the 99% relative VaR of the portfolio

Q: The finance director of Netra co wishes to estimate what impact the introduction of debt finance is…

A: Modigliani and Miller's approach states that the capital structure of a firm does not affect the…

Q: You want to have $51,000 in your savings account 9 years from now, and you're prepared to make equal…

A: Payment per period is the regular payments made or received of an investment, while future value is…

Q: Payback IRR PI NPV NP-30 years. NX-20 years %

A: Please refer to the excel spreadsheet for answers. Consider the first cell in the spreadsheet to be…

Q: Two payments of $16,000 and $2,500 are due in 1 year and 2 years, respectively. Calculate the two…

A: Answer Interest Yearly 10.5% Compound Quarterly Quarterly Interest Rate 10.5%/4 2.63%…

Q: Problem 5-1 Valuing Bonds What is the dollar price of a zero coupon bond with 9 years to maturity,…

A: Yield to maturity is the expected return on a bond if it is held by the investor until maturity. It…

Q: Jack Frat Burger Shack reported 2022 net income of $11 million and depreciation of $3,500,000. The…

A: STEP 1 The portion of a company's cash flow statement titled "cash flow from operations" shows how…

Q: What is the expected effect on interest rates when there is a business cycle expansion? Please…

A: A business cycle expansion is a phase of economic growth that occurs after a contraction or…

Q: For an investment ending at time T we denote the net cash flow at time t by ct and the net rate of…

A: The net present value (NPV) of a project can be used to determine whether it is profitable or not.…

Q: 13-Your company is considering two possible projects but can only raise enough funds to proceed with…

A: Let us discuss the investment appraisal technique used in this question. 1. Payback period : This is…

Q: What is the expected rate of return on R. Halsey Inc. stock if it has a correlation coefficient…

A: Expected return The profit or loss an investor can anticipate realizing from an investment is known…

Q: Gateway Communications is considering a project with an initial fixed asset cost of $2.872 million…

A: NPV is the Present Value of future Cash Inflows reduced by Initial Investment. Investment in…

Q: 1) Find the duration of a 6% coupon bond making annual coupon payments if it has three years until…

A:

Q: The annuity would pay her Rs 70,000 until she lives. The insurance con expected that she would live…

A: The present value of the future cash flows from the annuity based on the time and interest rate…

Q: I Declining investments In August 2013, E-TRADE Financial indexed fund was tumbling by 1.5% (per…

A: A type of mutual fund known as an index fund is created to replicate the composition and performance…

Q: 2 3 4 5 6 7 8 9 ear 0 1 2 Cash Flow 58000 -34000 -45000 What is IRR for this project? If the…

A: We will use some capital budgeting tools here. Use of capital budgeting tools helps us to find if a…

Q: Ramona Garcia will be remodeling her kitchen before she places her home on the market to sell. She…

A: Monthly payments refer to the payment that is paid on a monthly basis for the repayment of the…

Q: You are offered the right to receive $1,000 per year forever, starting in one year. If your discount…

A: Perpetuity is constant series of periodic payments for an infinite time. The present value of a…

Q: Emphasis Plc. is facing a project with a known present value of abandonment £3000, but expected…

A: An abandonment project refers to a situation where a company decides to stop work on a project that…

Q: Sam is thinking about taking out a loan. The interest rate is 9.50 % p.a. and is calculated daily.…

A: The effective annual interest rate is generally representative of the rate of interest after…

Q: Dimi regrets that he didn’t buy stocks. He thinks it would be better to buy a stock of Air…

A: We have to create a portfolio of long stock and short call. We need to find the payoff for a range…

Q: In December 2022, the Fed raised interest rates to their highest levels in 15 years. This makes…

A: Time Value of Money states that a dollar earned today is more valuable than any time in the future,…

Q: a. Suppose you believe Nice's initial revenue growth rate will be between 10% and 20% (with growth…

A: In order to calculate the sensitivity of the share price relative to the initial growth rate, we…

Q: Direct Finance Lease - Lessor (PAS 17 and PFRS 16) Problem 18. On January 1,2011, SM leased an…

A: Annual Rental: The annual rental can be calculated as follows: Cost of Machinery / (1 + Implicit…

Q: Gerritt wants to buy a car that costs $27,000. The interest rate on his loan is 5.35 percent…

A: STEP 1 Loan terms are the terms that come with borrowing money. This can include the length of the…

Q: Maxine Peru, the CEO of Peru Resources, hardly noticed the plate of savory quenelles de brochet and…

A: Net Present Value (NPV) analysis: Initial investment: $10 million (possible cost overruns 10-15%)…

Q: What amount three years ago is equivalent to $4800 on a date 1_ 1 2 years from now if money earns 3%…

A: Interest is the charge received for the time period in which amount is invested or saved. It can be…

Q: You are evaluating the performance of two fund managers to help a client understand their strengths…

A: Portfolio are managed by the fund managers and each manager have own strength and own weekness but…

Q: You own 1,000 shares of stock in Avondale Corporation. You will receive a $3.45 per share dividend…

A: Any stock's market value indicates the current worth of all the expected cash flows from the stock.…

Q: A 182-day, $110,000 face value treasury bill was issued 88 days ago when yields were 0.75%. If the…

A: The government issues Treasury bills, which are short-term money market instruments with guaranteed…

Q: (c) Use the graph to estimate the amount of the mortgage. $ 300000 x

A: As mentioned in the question equity is the total amount paid in the home. It can also be said as…

Q: If you deposit$5,000in a 5 -year certificate of deposit earning2.0%per year, how much will it be…

A: This question provides information regarding the evaluation of an investment of $5,000 into a five…

Q: A trader bought ATM put for the strike price of 500@Rs. 19.72/- for Laurus Lab when stock was…

A: a) If the stock closes at 519, the trader would make a profit. The profit can be calculated as…

Q: Assume that your parents wanted to have $150,000 saved for university by your 18th birthday and they…

A: Annuity refers to a contract between the insurance company and the person in exchange for a fixed…

Q: Tesla stock is currently selling for $14000. You are thinking about buying it and you hope to sell…

A: The required return on investment refers to the amount of profit that an investor requires in…

Q: A transportation company is considering adding new busses for its transit system. The total cost of…

A: Fair price per trip depends on the cost of purchase of Bus and cost of finance of Bus and also other…

Q: Consider the following projects: Project C0 C1 C2 A −$ 2,100 +$ 2,000 +$ 1,200 B −2,100 +1,440…

A: Profitability index = Present value of future cash inflowsInitial investment

Q: a) You purchase 516 shares of ABC Co. stock on margin at a price of $37. Your broker requires you to…

A: STEP 1 MARGIN CALL A margin call is a notification from the brokerage business that the amount of…

Q: ask 4 Mr. M. Boy is the CEO of Money GmbH. His friends told him that the shares of Koinbase AG,…

A: In this question we will recording the company's Investments at the given stocks in the book of…

Q: You are offered the chance to participate in a project that produces the following cash flows: C0…

A: Net present value of the project is calculated as Net present value = C0 + C11+k1+C21+k2

Q: Part A: Based on the first scenario: Answer the following question utilizing the Future Value of an…

A: Assuming 52 weeks per year and Sally puts $100 in her account every other Saturday would make a…

Q: The table above represents the regression results of Stock A's monthly excess returns versus the S&P…

A: We have to use the CAPM formula as stated below. Expected return = Risk free rate + ? * ( Market…

Q: Five years ago, you invested 8,050.77. If you earned a compound annual rate of return of 3.50%, how…

A: This is a typical time value of money (TVM) concept based question. For an initial investment, the…

Q: Suppose that the bid price of Google stock is $497 per share and the ask price is $501 per share.…

A: The terms "bid price" and "ask price" relate to the highest and lowest prices, respectively, at…

Q: Paying Yourself for 20 Years Investing $500,000 sounds like a great idea, but you also want to spend…

A: An annuity is a payment series that provides its holders with a periodic payment in exchange for a…

Q: Xuemeihas been managing five portfolios for the last year. She has collected the following…

A: We have portfolio of two stocks being combined in different proportion. We have to find the…

Q: Find the future value of a 10-year annuity due with payments of $23,000 and an annually compounded…

A: The Future Value of Annuity Due refers to the concept which determines the sum total of all the cash…

Q: A small business borrows $12,000 for expansion at 12% compounded monthly. The loan is due in 4…

A: Solution: When an amount is borrowed from somewhere, interest is paid on it. The amount initially…

Q: A.How much money should be deposited each year for14 years if you wish to have $26,800 in the…

A: As per our guidelines we are supposed to answer only one question (if there are multiple questions…

Q: A forest products company owns a 1,000-acre tract of forest land which has a total of 200,000 tons…

A: a. If the real interest rate is 3 percent per year, the company should do clear-cutting. The future…

Q: Could you please show the breakdown of NPV calculation for each fraction

A: Net Present Value: It represents a profitability measure for an investment or a project. The…

Step by step

Solved in 2 steps

- Consider a position consisting of a $100,000 investment in asset A and a $100,000 investment in asset B. Assume that the daily volatilities of both assets are 1% and that the coefficient of correlation between their returns is 0.3. What is the 5-day 99% VaR for the portfolio?Consider a position consisting of a K200,000 investment in Asset A and a K300,000 investment in Asset B. Assume that the daily volatilities of the assets are 1.5% and 1.8% respectively, and that the coefficient of correlation between their returns is 0.4. What is the five day 95% Value at Risk (VaR) for the portfolio (95% confidence level represents 1.65 standard deviations on the left side of a normal distribution)?You invest R100 in a risky asset with an expected rate of return of 15% and a standard deviation of 20% and a T-bill with a rate of return of 4%. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 9%. What is the percentage invested in risky asset ?What is the percentage invested in risk-free asset ?

- If the T Bill rate is 1.1% and the market risk premium is 10.8%, what is the CAPM-implied expected return on a portfolio invested 50% in the risk-free asset and 50% in the market?Enter your answer as a percentage rounded to 2 decimal places.Consider the case of two financial assets and three market conditions (states). The tablebelow gives the respective probability for each market condition and the return of each assetin each one of them. Market Conditions State Recession Normal Expansion Probability of state 30% 40% 30% Return of asset A -30% 20% 55% Return of asset B -10% 70% 0% Consider the portfolio with 50% investment in each of the two assets above. Calculatethe expected return and the standard deviation of the portfolio.You have invested $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.11? What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.20? Calculate the slope of CAL. If the degree of risk aversion A=4, what proportion of the money should be invested in risky asset. Sub Parts to be solved

- You have invested $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.11? What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.20? Calculate the slope of CAL. If the degree of risk aversion A=4, what proportion of the money should be invested in risky asset.Set up the complete formula for Dollar Weighted Return (DWR) for the following portfolio including final value of the portfolio. Year 0 1 2 3 4 Actions at the ending of the year (Yr0)Starting with $1000 (Yr1)Adding $100 (Yr2)Withdrawing $200 (Yr3)Adding $300 (Yr4)Ending Value = ? ROR during each Yr (Yr0) - (Yr1) 8% (Yr2)-4% (Yr3) 9% (Yr4) 3% A. Calculate the time weighted return (TWR) Complete Questions with respect to ExcelFind the expected portfolio return and standard deviation if you were to invest 50% of your portfolio in Asset B, 50% in Asset C, with no allocation to Asset A. Compute your answers to the nearest tenth of a basis point. (See attached data file) We know that Asset A: B: C: expected return: 1.16 1.35 1.38 expected standard deviation: 2.88 1.58 2.19

- Suppose that each of two investments has a 4% chance of a loss of $10 million, a 2% chance of a loss of $1 million, and a 94% chance of a profit of $1 million. They are independent of each other. What is the VaR for a portfolio consisting of the two investments when the confidence level is 95%? Also calculate the expected shortfall. (show steps)A portfolio consists of $15 million of asset A (for which annual expected return is 10% and annual return volatility is 25%), $15 million of asset B (for which annual expected return is 15% and annual return volatility is 30%), and $20 million of asset C (for which annual expected return is 20% and annual return volatility is 35%). The return correlation between each pairing of assets A, B and C is 0.2. Assume the annual portfolio return is normally distributed. What is the 1-year 5% Value-at-Risk of the portfolio (i.e., there is a 5% probability that the portfolio will suffer a loss greater than what dollar value for the year)? a. $1.24 million b. $3.86 million c. $9.75 million d. $19.50 million e. None of the aboveYou estimate that the expected return of the portfolio is 8% and that the standard deviation is 15%. If you had invested 1 million in the portfolio, what is the size of a large loss as measured by the VaR? A) -20.00% B) -16.75% C) -17.25% D) -16.31%