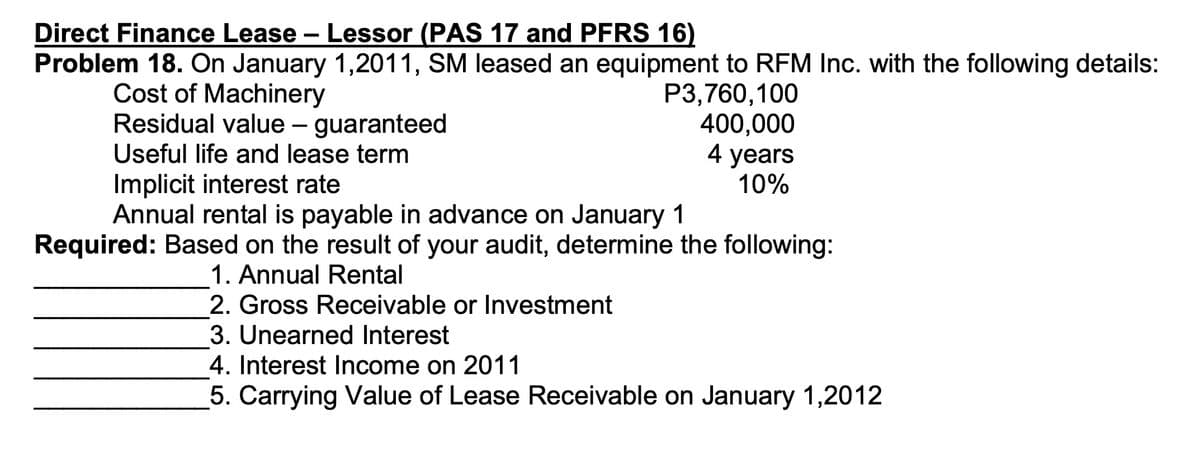

Direct Finance Lease - Lessor (PAS 17 and PFRS 16) Problem 18. On January 1,2011, SM leased an equipment to RFM Inc. with the following details: P3,760,100 400,000 4 years 10% Cost of Machinery Residual value - guaranteed Useful life and lease term Implicit interest rate Annual rental is payable in advance on January 1 Required: Based on the result of your audit, determine the following: 1. Annual Rental 2. Gross Receivable or Investment 3. Unearned Interest 4. Interest Income on 2011 5. Carrying Value of Lease Receivable on January 1,2012

Q: With an annual inflation rate of 1.58%, how much did an item that now costs $3500 cost 8 years…

A: Solution: Inflation refers to the increase in prices of commodities. We know, FV = PV x (1+i)n…

Q: Debt service funds are used to account for which of the following? Multiple Choice Payment of…

A: Debt service funds are the records of resources of funds for payment of interests and principal…

Q: A firm conducting an IPO of common staock sold 1 million new shares in the offering at an offer…

A: Given, Offer Price = $10 Per Share. Outstanding Share = 5 million share. Secondary Market Share…

Q: 2. Does the company have enough cash and liquidity to survive an economic slowdown? Enhance the…

A: Given that at the end of 2022, the company has $300 mullion in cash in spite of a loss of $504…

Q: 1. Suppose there is a mutual fund and each consumer buys a share in it for her endowment at t = 0.…

A: The mutual fund's optimization problem is to maximize the sum of the shareholders' utilities, given…

Q: Lebleu, Incorporated, is considering a project that will result in initial aftertax cash savings of…

A: Initial cost refers to the cost that the company pays at the beginning of the project. The…

Q: You are considering a project with cash flows of $44,500, $18,000, and $33,000 at the end of each…

A: Present value is a concept used in making valuations of financial modeling, stocks, bond pricing,…

Q: You are considering investing in Property B in question 4. Consider now that the listing price of…

A: Data given: Listing price of the property= $11 million Risk premium=5.5% Maturity (year) 1 2 3 4…

Q: A European candy manufacturing plant manager must select a new irradiation system to ensure the…

A: This is a typical capital budgeting project where two alternatives are to be compared basis annual…

Q: Company Z's earnings and dividends per share are expected to grow indefinitely by 4% a year. If next…

A: Dividend is the part or share of profits that is being distributed to the shareholders of the…

Q: How would you hedge this position on 1st January using Eurodollar futures contracts? Explain the…

A: To hedge the position on 1st January, you would enter into a short position in Eurodollar futures…

Q: A $250 Suede Jacket is on sale for 20% off. How much should you pay for the jacket with a 6% sales…

A: The amount of the sales tax or the tax applied is generally on the price after the discount. It is…

Q: Which of the following is true about WBS A. it is needed only on large projects B. it is required…

A: WBS stands for Work Breakdown Structure, it is a project management tool used to break down a…

Q: XYZ Ferries recently gained a slot in the Cyclades islands itineraries for the next 5 years and…

A: STEP 1 Net cash flow is the gain or loss in money over a time period. A company is said to have…

Q: You are offered the right to receive $1,000 per year forever, starting in one year. If your discount…

A: Perpetuity is constant series of periodic payments for an infinite time. The present value of a…

Q: A European candy manufacturing plant manager must select a new irradiation system to ensure the…

A: The process through which an entity/individual analyze and evaluate a project/investment's…

Q: 2. Which statement is not correct? a) Municipal bonds tend to have a lower yield than Treasuries b)…

A: Municipal bonds are securities issued by state, county or local government to raise money for…

Q: As the prize in a contest, you are offered $19,000 now or $45,300 in 9 years. If the money can be…

A: Future Value refers to the value of the current asset or investment or of cash flows at a specified…

Q: Harith is planning to renovate his parent's house in Penang. The contractor informed him that it…

A: A loan is a sum of money that is borrowed and repaid over a specified period of time, usually with…

Q: State four (4) main criticisms against the adoption of IFRSs in some countries.

A: A group of accounting standards called International Financial Reporting Standards (IFRS) specify…

Q: a) how much savings would Bilbo have in year 25 (t=25)? b) how much at most would Bilbo’s…

A: Given, APR = 6% Monthly compounding rate i = (1+6%)112-1 Monthly compounding rate i =0.49% Monthly…

Q: Question 5. You can invest in two risky assets, r₁ and r2 and one risk-free asset, r. The two risky…

A: The optimal portfolio can be found by solving the mean-variance optimization problem: Maximize:…

Q: Consider two firms L (Levered) & U (Unl

A: Value of firm L(levered) equity = EBIT-Cost of debt (Kd) *Debt/…

Q: A 182-day, $110,000 face value treasury bill was issued 88 days ago when yields were 0.75%. If the…

A: The government issues Treasury bills, which are short-term money market instruments with guaranteed…

Q: With a goal of purchasing one of the coveted trips to space offered by Pharoah, you deposit $53,000…

A: Present value is an estimate of the expected monetary value of future cash flows. Investors evaluate…

Q: The All-Mine Corporation is deciding whether to invest in a new project. The project would have to…

A: WACC stands for a weighted average cost of capital and refers to the method which is used for…

Q: Find the future value of the following ordinary annuities. Payments are made and interest is…

A: The Future Value of an Ordinary Annuity refers to the concept which gives out the compounded or…

Q: Strike 95 100 105 95 100 105 Expiration 18-Jan-2019 18-Jan-2019 18-Jan-2019 8-Feb-2019 8-Feb-2019…

A: Put option When you purchase a put option, you are given the choice—but not the obligation—to sell a…

Q: A Company recently invested in a project with 3 years life span. The initial investment was 80,000…

A: IRR stands for Internal Rate of Return, which is a metric used in finance and project evaluation to…

Q: What is the effective annual rate for an APR of 11.40 percent compounded quarterly?

A: The effective annual rate refers to the interest rate that takes into account the factors of…

Q: 1. What is the most accurate measure of interest rates? a) Current Yield b) Nominal Interest Rate c)…

A: Interest rates refer to the cost of borrowing money or the return on an investment. They can vary…

Q: QUESTION 2. Consider a stock valued So at time t = 0, and taking only two possible values S₁ = S₁ or…

A: a) To hedge a call option with strike price K, we need to construct a portfolio that has the same…

Q: Find the after-tax return to a corporation that buys a share of preferred stock at $42, sells it at…

A: Preferred stock is one of the important source of finance being used in business. Return on stock…

Q: Assume that the Canada Pension Plan promises you $20,000 per year starting when you retire 45 years…

A: Present Value: It represents the current value of the future expected cash flows discounted over a…

Q: How would an increase in the interest rate effect the present value of an annuity problem (all other…

A: Present value of the annuity The amount of money that would be required today to support a series of…

Q: Manufacturing Ltd. has projected sales of $145 million next year. Costs including depreciation are…

A: STEP 1 The exit multiple models uses a multiple of earnings to estimate cash flows when determining…

Q: Lever Age pays an 10% rate of interest on $10.50 million of outstanding debt with face value $10.5…

A: STEP1 In general, a coverage ratio is a metric used to assess a company's capacity to pay off debt…

Q: Suppose that the average investor in a hedge fund exhibits mild risk aversion with a utility…

A: (a) To verify that the average investor exhibits risk aversion, we can look at their utility…

Q: Jamie is going to buy some furniture with a single payment loan that is discounted. The loan will be…

A: APR refers to annual percentage rate. APR, essentially, is the total annual cost or the yearly…

Q: . What does "ADR" stand for? (just the full name-no explanation needed)

A: There are many investors in the US who wants to invest in the companies that are outside US…

Q: 1. Given an American call option and knowing that S(0) = 198, X = 20$, r = 10%, T = 5 months, CE =…

A: For an American call option, the exercise price (X) is the price at which the holder of the option…

Q: Xuemeihas been managing five portfolios for the last year. She has collected the following…

A: We have portfolio of two stocks being combined in different proportion. We have to find the…

Q: What is the amount to be recorded as a Non- Current Lease Liability in the books of Rib Ltd that is…

A: The annual lease is being paid at the beginning of every year. The lease given is $180,000 that…

Q: Use cells A6 to C17 from the given information to complete this questions. You must use the built-in…

A: As per instruction, the formula for empty cells will be provided. Please note that there are only 3…

Q: You plan to save $160 per month starting today for the next 35 years "just to start the month off…

A: More is the compounding of interest rate and than more is effective interest rate and more is…

Q: An Investor uses £7,500 of her money + £2,500 from a loan at 8% to invest in the shares of MLN. A…

A: Investments are goods or assets that are bought to produce income or appreciate in value. The…

Q: Discuss the three common Valuation Approaches, their applications, and give an example of Valuation…

A: Business or company valuation An organization's economic worth is assessed through a business…

Q: ii) Write down the arbitrage price pt at time t = [0, T] of a European-type contingent claim X which…

A: The arbitrage price of a European-type contingent claim X at time t ∈ [0,T] is given by the…

Q: McNabb Enterprises is considering going private through a leveraged buyout by management. Management…

A: a. If the prime rate is expected to average 10 percent over the next five years, the interest rate…

Q: 8. What is not an illustration of the European sovereign debt crisis around 2011? a) Interest rates…

A: European sovereign debt crisis is a debt crises which reflects that the European countries where at…

Step by step

Solved in 3 steps

- Sales-Type Lease with Guaranteed Residual Value Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. The annual rentals are 65,000, payable at the end of each year. The interest rate implicit in the lease is 15%. Darwin agrees to pay all executory costs directly to a third party. The cost of the equipment is 280,000. The fair value of the equipment to Calder is 308,021.03. Calder incurs no material initial direct costs. Calder expects that it will be able to collect all lease payments. Calder estimates that the fair value at the end of the lease term will be 50,000 and that the economic life the equipment is 9 years. This residual value is guaranteed by Darwin. The following present value factors are relevant: PV of an ordinary annuity n = 8, i = 15% = 4.487322 PV n = 8, i = 15% = 0.326902 PV n = 1, i = 15% = 0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next years payment approach to classify the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent.Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.

- Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease of equipment entered into on March 1, 2019. The lease is classified as a sales-type lease by the lessor (Anson Company) and as a finance lease by the lessee (Bullard Company). Assume that the lease payments are nude at the beginning of each month, interest and straight-line depreciation are recognized at the end of each month, and the residual value of the leased asset is zero at the end of a 3-year life. Required: 1. Record the lease (including the initial receipt of 2,000) and the receipt of the second and third installments of 2,000 in Ansons accounts. Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of 2,000), the payment of the second and third installments of 2,000, and monthly depreciation in Bullards accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar.Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Leased Assets Koffman and Sons signed a four-year lease for a forklift on January 1, 2016. Annual lease payments of $1,510, based on an interest rate of 8%, are to be made every December 31, beginning with December 31, 2016. Required Assume that the lease is treated as an operating lease. Will the value of the forklift appear on Koffmans balance sheet? What account will indicate that lease payments have been made? Assume that the lease is treated as a capital lease. Prepare any journal entries needed when the lease is signed. Explain why the value of the leased asset is not recorded at $6,040 (1,5104). Prepare the journal entry to record the first lease payment on December 31, 2016. Calculate the amount of depreciation expense for the year 2016. At what amount would the lease obligation be presented on the balance sheet as of December 31, 2016?

- Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Lessor Accounting with Guaranteed Residual Value Use the information for Edom Company in E20-8, except that the residual value was guaranteed by Davis Company (the lessee). Required: 1. Assuming that the lease is a sales-type lease, calculate the selling price. 2. Prepare a table summarizing the lease receipts and interest income earned by Edom. 3. Prepare journal entries for Edom tor the years 2019 and 2020.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.Owens Company leased equipment for 4 years at 50,000 a year with an option to renew the lease for 6 years at 2,000 per month or to purchase the equipment for 25,000 (a price considerably less than the expected fair value) after the initial lease term of 4 years. Why would this lease qualify as a finance lease?