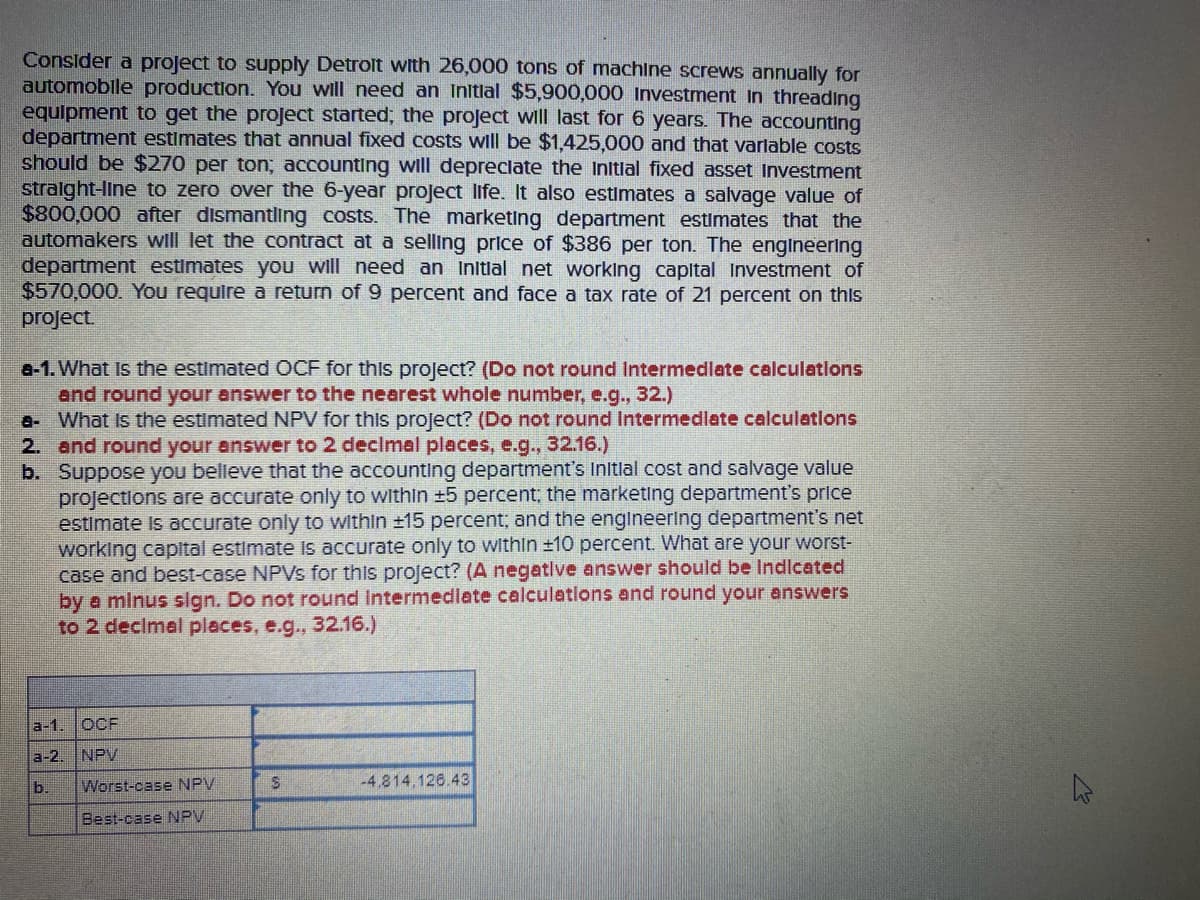

Consider a project to supply Detrolt with 26,000 tons of machine screws annually for automobile production. You will need an Initlal $5,900,000 Investment In threading equlpment to get the project started; the project will last for 6 years. The accounting department estimates that annual fixed costs will be $1,425,000 and that varlable costs should be $270 per ton; accounting will depreclate the Initlal fixed asset Investment stralght-ine to zero over the 6-year project life. It also estimates a salvage value of $800,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $386 per ton. The engineering department estimates you will need an Initlal net working capltal Investment of $570,000. You require a return of 9 percent and face a tax rate of 21 percent on this project. a-1. What Is the estimated OCF for this project? (Do not round Intermedlate calculations and round your answer to the nearest whole number, e.g., 32.) a- What Is the estimated NPV for this project? (Do not round Intermedlate calculations 2. and round your answer to 2 declmel places, e.g., 32.16.) b. Suppose you belleve that the accounting department's Initlal cost and salvage value projections are accurate only to within ±5 percent; the marketing department's price estimate Is accurate only to within ±15 percent; and the englneering department's net working capital estimate is accurate only to within ±10 percent. What are your worst- case and best-case NPVS for this project? (A negatlve answer should be Indlcated by a minus sign. Do not round Intermedlate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-1. OCF a-2. NPV Worst-case NPV -4,814,126.43 b. Best-case NPV %24

Consider a project to supply Detrolt with 26,000 tons of machine screws annually for automobile production. You will need an Initlal $5,900,000 Investment In threading equlpment to get the project started; the project will last for 6 years. The accounting department estimates that annual fixed costs will be $1,425,000 and that varlable costs should be $270 per ton; accounting will depreclate the Initlal fixed asset Investment stralght-ine to zero over the 6-year project life. It also estimates a salvage value of $800,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $386 per ton. The engineering department estimates you will need an Initlal net working capltal Investment of $570,000. You require a return of 9 percent and face a tax rate of 21 percent on this project. a-1. What Is the estimated OCF for this project? (Do not round Intermedlate calculations and round your answer to the nearest whole number, e.g., 32.) a- What Is the estimated NPV for this project? (Do not round Intermedlate calculations 2. and round your answer to 2 declmel places, e.g., 32.16.) b. Suppose you belleve that the accounting department's Initlal cost and salvage value projections are accurate only to within ±5 percent; the marketing department's price estimate Is accurate only to within ±15 percent; and the englneering department's net working capital estimate is accurate only to within ±10 percent. What are your worst- case and best-case NPVS for this project? (A negatlve answer should be Indlcated by a minus sign. Do not round Intermedlate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-1. OCF a-2. NPV Worst-case NPV -4,814,126.43 b. Best-case NPV %24

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 4P

Related questions

Question

Please show work

Transcribed Image Text:Consider a project to supply Detrolt with 26,000 tons of machine screws annually for

automobile production. You will need an Initlal $5,900,000 Investment In threading

equlpment to get the project started; the project will last for 6 years. The accounting

department estimates that annual fixed costs will be $1,425,000 and that varlable costs

should be $270 per ton; accounting will depreclate the Initlal fixed asset Investment

stralght-Iline to zero over the 6-year project life. It also estimates a salvage value of

$800,000 after dismantling costs. The marketing department estimates that the

automakers will let the contract at a selling price of $386 per ton. The engineering

department estimates you will need an Initlal net working capltal Investment of

$570,000. You require a return of 9 percent and face a tax rate of 21 percent on this

project

a-1. What Is the estimated OCF for this project? (Do not round Intermedlate calculations

and round your answer to the nearest whole number, e.g., 32.)

a- What Is the estimated NPV for this project? (Do not round Intermedlate calculations

2. and round your answer to 2 declmal places, e.g., 32.16.)

b. Suppose you belleve that the accounting department's Initlal cost and salvage value

projections are accurate only to within ±5 percent; the marketing department's price

estimate is accurate only to within ±15 percent; and the engineering department's net

working capital estimate is accurate only to within ±10 percent. What are your worst-

case and best-case NPVS for this project? (A negatlve answer should be Indlcated

by a minus sign. Do not round Intermedlate calculations and round your answers

to 2 decimal places, e.g., 32.16.)

a-1.

OCF

a-2. NPV

b.

Worst-case NPV

-4.814,126.43

Best-case NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning