Consider a two-period, small open economy with endowments on tradable and nontradable goods. The representative household has lifetime utility U(CT1CN1, Cr2CN2) = log C₁₁ +log C1 + Blog Cr2+ Blog CN2 N1 Endowments are 21 22=5 and Qr₁=2.5, Qr2 = 7.5. interest rate is r* = 0.04 and the discount factor is 3=1/1.04 = 0.9615. = Initial NFA is zero. The world a. Compute equilibrium consumption of both goods, the trade balance, and the real exchange rate in both periods. b. Suppose that after the household chooses how much to borrow/save in period 0, the world interest rate rises to r=0.10. Recompute the equilibrium variables for period 2, and compute the difference between lifetime utility between this scenario and the scenario in part 1.

Consider a two-period, small open economy with endowments on tradable and nontradable goods. The representative household has lifetime utility U(CT1CN1, Cr2CN2) = log C₁₁ +log C1 + Blog Cr2+ Blog CN2 N1 Endowments are 21 22=5 and Qr₁=2.5, Qr2 = 7.5. interest rate is r* = 0.04 and the discount factor is 3=1/1.04 = 0.9615. = Initial NFA is zero. The world a. Compute equilibrium consumption of both goods, the trade balance, and the real exchange rate in both periods. b. Suppose that after the household chooses how much to borrow/save in period 0, the world interest rate rises to r=0.10. Recompute the equilibrium variables for period 2, and compute the difference between lifetime utility between this scenario and the scenario in part 1.

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 13CQ

Related questions

Question

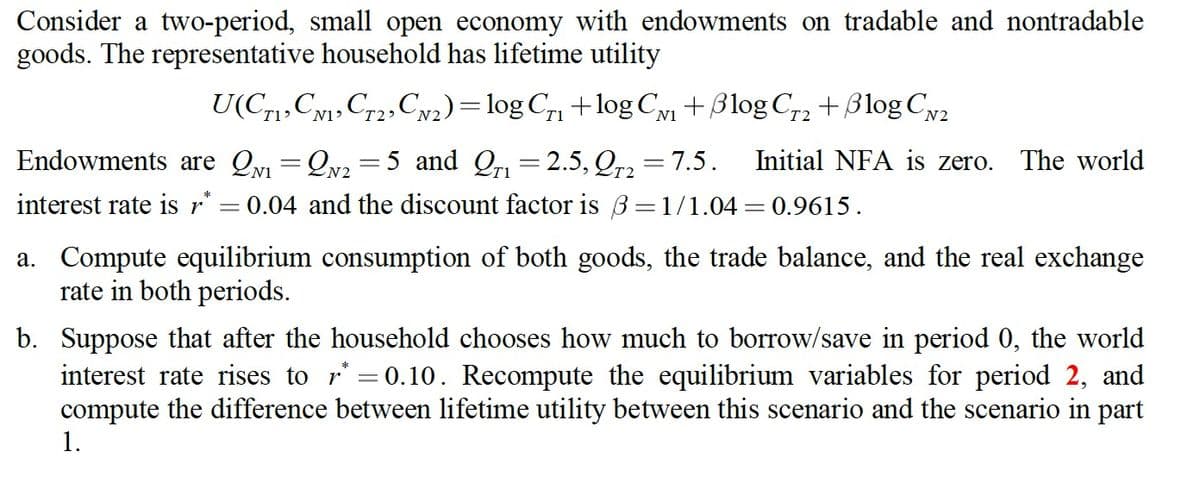

Transcribed Image Text:Consider a two-period, small open economy with endowments on tradable and nontradable

goods. The representative household has lifetime utility

U(C1, C1, C2, CN₂) = log C₁₁ +log C₁₁ + Blog Cr2+ Blog CN2

T1

N1

T2

Initial NFA is zero. The world

Endowments are Q₁=2N₂=5 and Qr₁=2.5, QT2 = 7.5.

interest rate is r* = 0.04 and the discount factor is 3 =1/1.04 = 0.9615.

a. Compute equilibrium consumption of both goods, the trade balance, and the real exchange

rate in both periods.

b. Suppose that after the household chooses how much to borrow/save in period 0, the world

interest rate rises to r=0.10. Recompute the equilibrium variables for period 2, and

compute the difference between lifetime utility between this scenario and the scenario in part

1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning