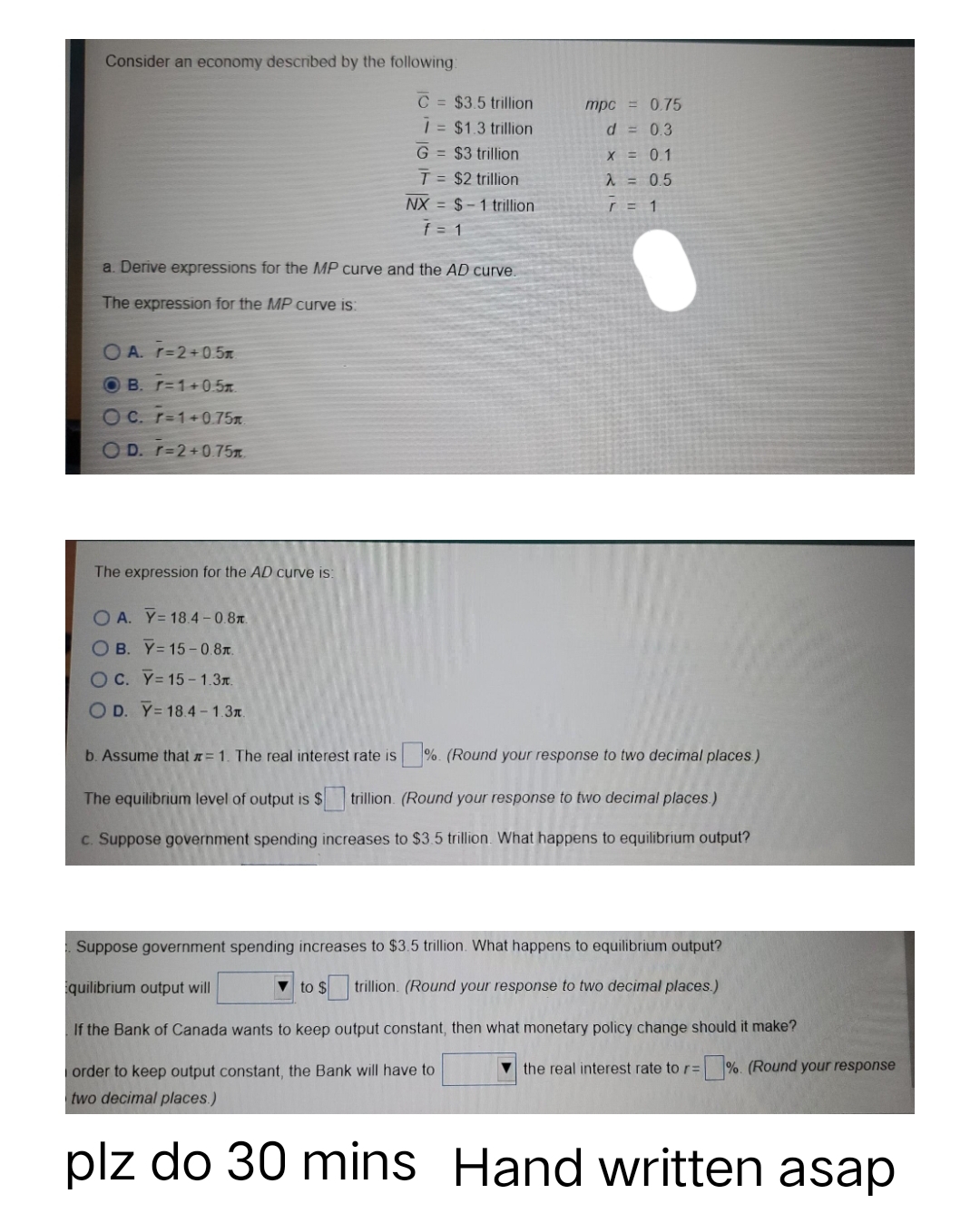

Consider an economy described by the following: a. Derive expressions for the MP curve and the AD curve. The expression for the MP curve is: OA. r=2+0.5m OB. r=1+0.5x O C. r=1+0.75m OD. r=2+0.75m C = $3.5 trillion 7 = $1.3 trillion G= $3 trillion T = $2 trillion NX $-1 trillion. f = 1 The expression for the AD curve is: mpc = 0.75 d = 0.3 X = 0.1 λ = 0.5 r = 1 OA. Y= 18.4-0.8. OB. Y=15-0.8m. OC. Y= 15-1.3. OD. Y= 18.4-1.3. b. Assume that = 1. The real interest rate is %. (Round your response to two decimal places) The equilibrium level of output is $ trillion (Round your response to two decimal places.) c. Suppose government spending increases to $3.5 trillion. What happens to equilibrium output? Suppose government spending increases to $3.5 trillion. What happens to equilibrium output? quilibrium output will to $ trillion. (Round your response to two decimal places.) If the Bank of Canada wants to keep output constant, then what monetary policy change should it make? order to keep output constant, the Bank will have to two decimal places.) the real interest rate to r=%. (Round your response

Consider an economy described by the following: a. Derive expressions for the MP curve and the AD curve. The expression for the MP curve is: OA. r=2+0.5m OB. r=1+0.5x O C. r=1+0.75m OD. r=2+0.75m C = $3.5 trillion 7 = $1.3 trillion G= $3 trillion T = $2 trillion NX $-1 trillion. f = 1 The expression for the AD curve is: mpc = 0.75 d = 0.3 X = 0.1 λ = 0.5 r = 1 OA. Y= 18.4-0.8. OB. Y=15-0.8m. OC. Y= 15-1.3. OD. Y= 18.4-1.3. b. Assume that = 1. The real interest rate is %. (Round your response to two decimal places) The equilibrium level of output is $ trillion (Round your response to two decimal places.) c. Suppose government spending increases to $3.5 trillion. What happens to equilibrium output? Suppose government spending increases to $3.5 trillion. What happens to equilibrium output? quilibrium output will to $ trillion. (Round your response to two decimal places.) If the Bank of Canada wants to keep output constant, then what monetary policy change should it make? order to keep output constant, the Bank will have to two decimal places.) the real interest rate to r=%. (Round your response

Macroeconomics: Principles and Policy (MindTap Course List)

13th Edition

ISBN:9781305280601

Author:William J. Baumol, Alan S. Blinder

Publisher:William J. Baumol, Alan S. Blinder

Chapter10: Bringing In The Supply Side: Unemployment And Inflation?

Section: Chapter Questions

Problem 3TY

Related questions

Question

I'll upvote if hand written

Transcribed Image Text:Consider an economy described by the following:

OA. r=2+0.5m

OB. r=1+0.5m.

OC. r=1+0.75m

OD. r=2+0.75m

C= $3.5 trillion

7 = $1.3 trillion

a. Derive expressions for the MP curve and the AD curve.

The expression for the MP curve is:

The expression for the AD curve is:

G = $3 trillion

T = $2 trillion

NX $1 trillion

f = 1

mpc = 0.75

d = 0.3

X = 0.1

λ = 0.5

r =

order to keep output constant, the Bank will have to

two decimal places.)

plz do 30 mins

1

OA. Y= 18.4-0.8.

OB. Y=15-0.8.

OC. Y=15-1.3.

OD. Y= 18.4-1.3.

b. Assume that = 1. The real interest rate is s%. (Round your response to two decimal places.)

The equilibrium level of output is $ trillion (Round your response to two decimal places.)

c. Suppose government spending increases to $3.5 trillion. What happens to equilibrium output?

Suppose government spending increases to $3.5 trillion. What happens to equilibrium output?

quilibrium output will

to $ trillion. (Round your response to two decimal places.)

If the Bank of Canada wants to keep output constant, then what monetary policy change should it make?

the real interest rate to r=%. (Round your response

Hand written asap

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning