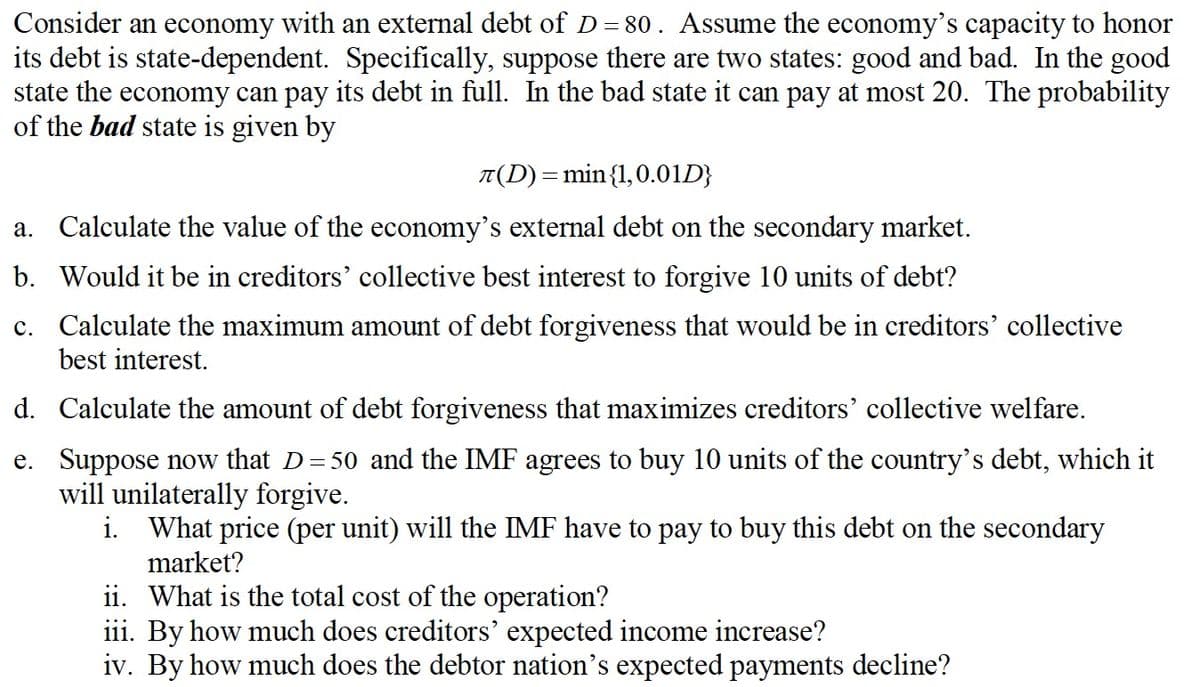

Consider an economy with an external debt of D=80. Assume the economy's capacity to honor its debt is state-dependent. Specifically, suppose there are two states: good and bad. In the good state the economy can pay its debt in full. In the bad state it can pay at most 20. The probability of the bad state is given by 7(D)= min {1,0.01D} a. Calculate the value of the economy's external debt on the secondary market. b. Would it be in creditors' collective best interest to forgive 10 units of debt? c. Calculate the maximum amount of debt forgiveness that would be in creditors' collective best interest.

Consider an economy with an external debt of D=80. Assume the economy's capacity to honor its debt is state-dependent. Specifically, suppose there are two states: good and bad. In the good state the economy can pay its debt in full. In the bad state it can pay at most 20. The probability of the bad state is given by 7(D)= min {1,0.01D} a. Calculate the value of the economy's external debt on the secondary market. b. Would it be in creditors' collective best interest to forgive 10 units of debt? c. Calculate the maximum amount of debt forgiveness that would be in creditors' collective best interest.

Chapter11: Fiscal Policy And The Federal Budget

Section: Chapter Questions

Problem 16QP

Related questions

Question

Transcribed Image Text:Consider an economy with an external debt of D = 80. Assume the economy's capacity to honor

its debt is state-dependent. Specifically, suppose there are two states: good and bad. In the good

state the economy can pay its debt in full. In the bad state it can pay at most 20. The probability

of the bad state is given by

T(D) = min {1,0.01D}

a. Calculate the value of the economy's external debt on the secondary market.

b. Would it be in creditors' collective best interest to forgive 10 units of debt?

c. Calculate the maximum amount of debt forgiveness that would be in creditors' collective

best interest.

d.

Calculate the amount of debt forgiveness that maximizes creditors' collective welfare.

e. Suppose now that D=50 and the IMF agrees to buy 10 units of the country's debt, which it

will unilaterally forgive.

i. What price (per unit) will the IMF have to pay to buy this debt on the secondary

market?

ii. What is the total cost of the operation?

iii. By how much does creditors' expected income increase?

iv. By how much does the debtor nation's expected payments decline?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

For question b, the new expected repayment is 35, which is 3 units more than the original expected repayment, 32. Isn't the answer Yes? It should be in the best interest.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning