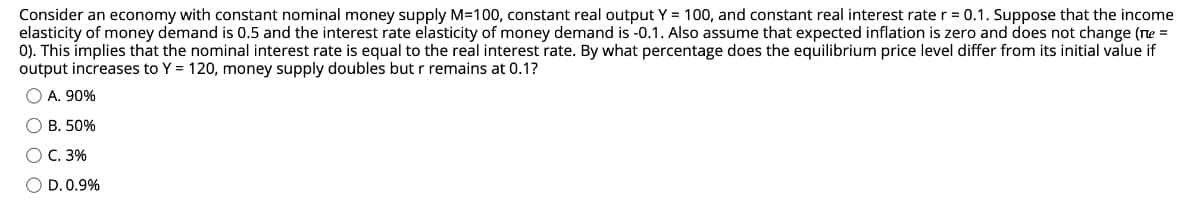

Consider an economy with constant nominal money supply M=100, constant real output Y = 100, and constant real interest rate r = 0.1. Suppose that the income elasticity of money demand is 0.5 and the interest rate elasticity of money demand is -0.1. Also assume that expected inflation is zero and does not change (Te = 0). This implies that the nominal interest rate is equal to the real interest rate. By what percentage does the equilibrium price level differ from its initial value if output increases to Y = 120, money supply doubles but r remains at 0.1? O A, 90% О В. 50% ОС. 3% O D. 0.9%

Consider an economy with constant nominal money supply M=100, constant real output Y = 100, and constant real interest rate r = 0.1. Suppose that the income elasticity of money demand is 0.5 and the interest rate elasticity of money demand is -0.1. Also assume that expected inflation is zero and does not change (Te = 0). This implies that the nominal interest rate is equal to the real interest rate. By what percentage does the equilibrium price level differ from its initial value if output increases to Y = 120, money supply doubles but r remains at 0.1? O A, 90% О В. 50% ОС. 3% O D. 0.9%

Chapter13: Inflation

Section: Chapter Questions

Problem 14SQ

Related questions

Question

Transcribed Image Text:Consider an economy with constant nominal money supply M=100, constant real output Y = 100, and constant real interest rate r = 0.1. Suppose that the income

elasticity of money demand is 0.5 and the interest rate elasticity of money demand is -0.1. Also assume that expected inflation is zero and does not change (ne =

0). This implies that the nominal interest rate is equal to the real interest rate. By what percentage does the equilibrium price level differ from its initial value if

output increases to Y = 120, money supply doubles but r remains at 0.1?

O A. 90%

О В. 50%

О С. 3%

O D. 0.9%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning