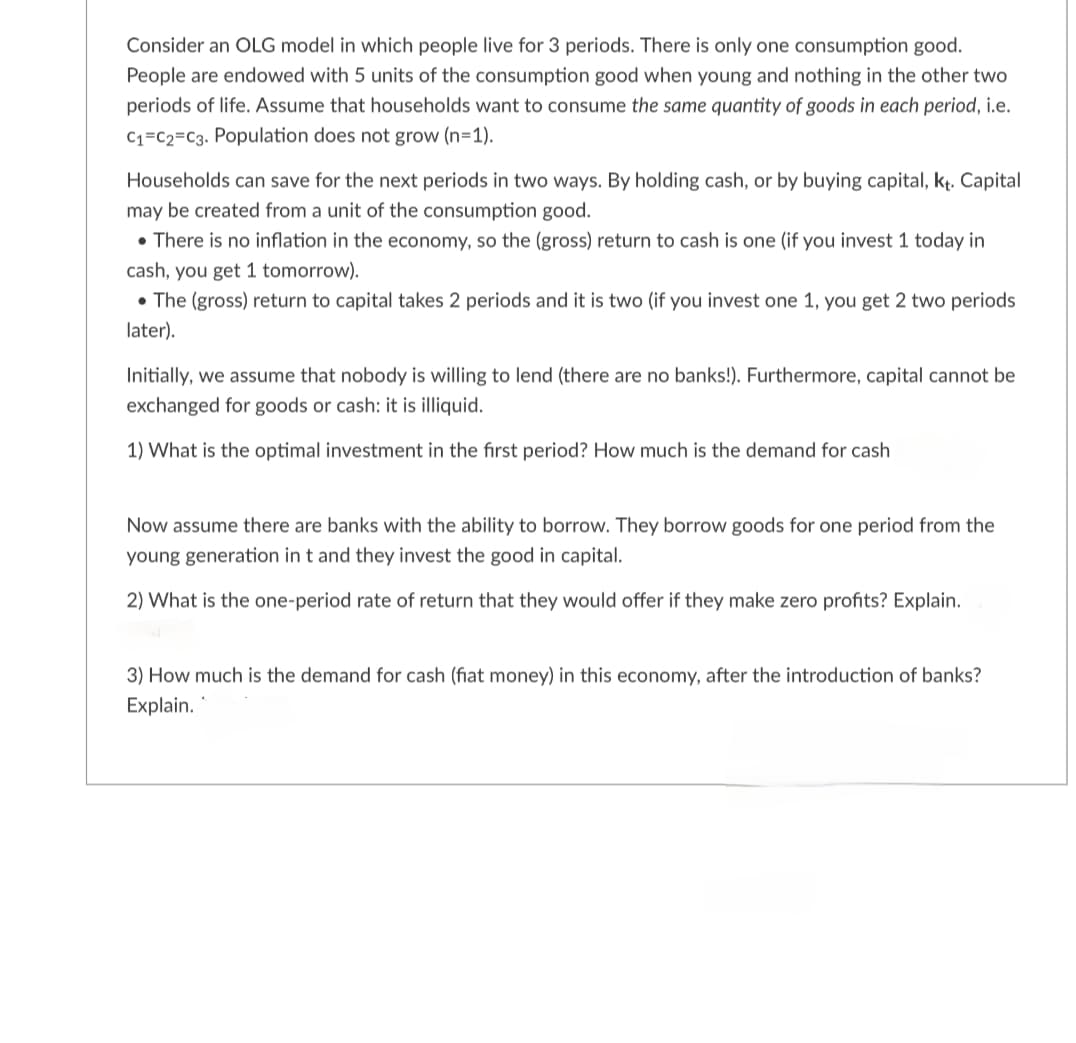

Consider an OLG model in which people live for 3 periods. There is only one consumption good. People are endowed with 5 units of the consumption good when young and nothing in the other two periods of life. Assume that households want to consume the same quantity of goods in each period, i.e. C1 C2 C3. Population does not grow (n=1). Households can save for the next periods in two ways. By holding cash, or by buying capital, kt. Capital may be created from a unit of the consumption good. There is no inflation in the economy, so the (gross) return to cash is one (if you invest 1 today in cash, you get 1 tomorrow). The (gross) return to capital takes 2 periods and it is two (if you invest one 1, you get 2 two periods later). Initially, we assume that nobody is willing to lend (there are no banks!). Furthermore, capital cannot be exchanged for goods or cash: it is illiquid. 1) What is the optimal investment in the first period? How much is the demand for cash Now assume there are banks with the ability to borrow. They borrow goods for one period from the young generation in t and they invest the good in capital. 2) What is the one-period rate of return that they would offer if they make zero profits? Explain. 3) How much is the demand for cash (fiat money) in this economy, after the introduction of banks? Explain.

Consider an OLG model in which people live for 3 periods. There is only one consumption good. People are endowed with 5 units of the consumption good when young and nothing in the other two periods of life. Assume that households want to consume the same quantity of goods in each period, i.e. C1 C2 C3. Population does not grow (n=1). Households can save for the next periods in two ways. By holding cash, or by buying capital, kt. Capital may be created from a unit of the consumption good. There is no inflation in the economy, so the (gross) return to cash is one (if you invest 1 today in cash, you get 1 tomorrow). The (gross) return to capital takes 2 periods and it is two (if you invest one 1, you get 2 two periods later). Initially, we assume that nobody is willing to lend (there are no banks!). Furthermore, capital cannot be exchanged for goods or cash: it is illiquid. 1) What is the optimal investment in the first period? How much is the demand for cash Now assume there are banks with the ability to borrow. They borrow goods for one period from the young generation in t and they invest the good in capital. 2) What is the one-period rate of return that they would offer if they make zero profits? Explain. 3) How much is the demand for cash (fiat money) in this economy, after the introduction of banks? Explain.

Chapter15: Monetary Policy

Section: Chapter Questions

Problem 1QP

Related questions

Question

Transcribed Image Text:Consider an OLG model in which people live for 3 periods. There is only one consumption good.

People are endowed with 5 units of the consumption good when young and nothing in the other two

periods of life. Assume that households want to consume the same quantity of goods in each period, i.e.

C1 C2 C3. Population does not grow (n=1).

Households can save for the next periods in two ways. By holding cash, or by buying capital, kt. Capital

may be created from a unit of the consumption good.

There is no inflation in the economy, so the (gross) return to cash is one (if you invest 1 today in

cash, you get 1 tomorrow).

The (gross) return to capital takes 2 periods and it is two (if you invest one 1, you get 2 two periods

later).

Initially, we assume that nobody is willing to lend (there are no banks!). Furthermore, capital cannot be

exchanged for goods or cash: it is illiquid.

1) What is the optimal investment in the first period? How much is the demand for cash

Now assume there are banks with the ability to borrow. They borrow goods for one period from the

young generation in t and they invest the good in capital.

2) What is the one-period rate of return that they would offer if they make zero profits? Explain.

3) How much is the demand for cash (fiat money) in this economy, after the introduction of banks?

Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning