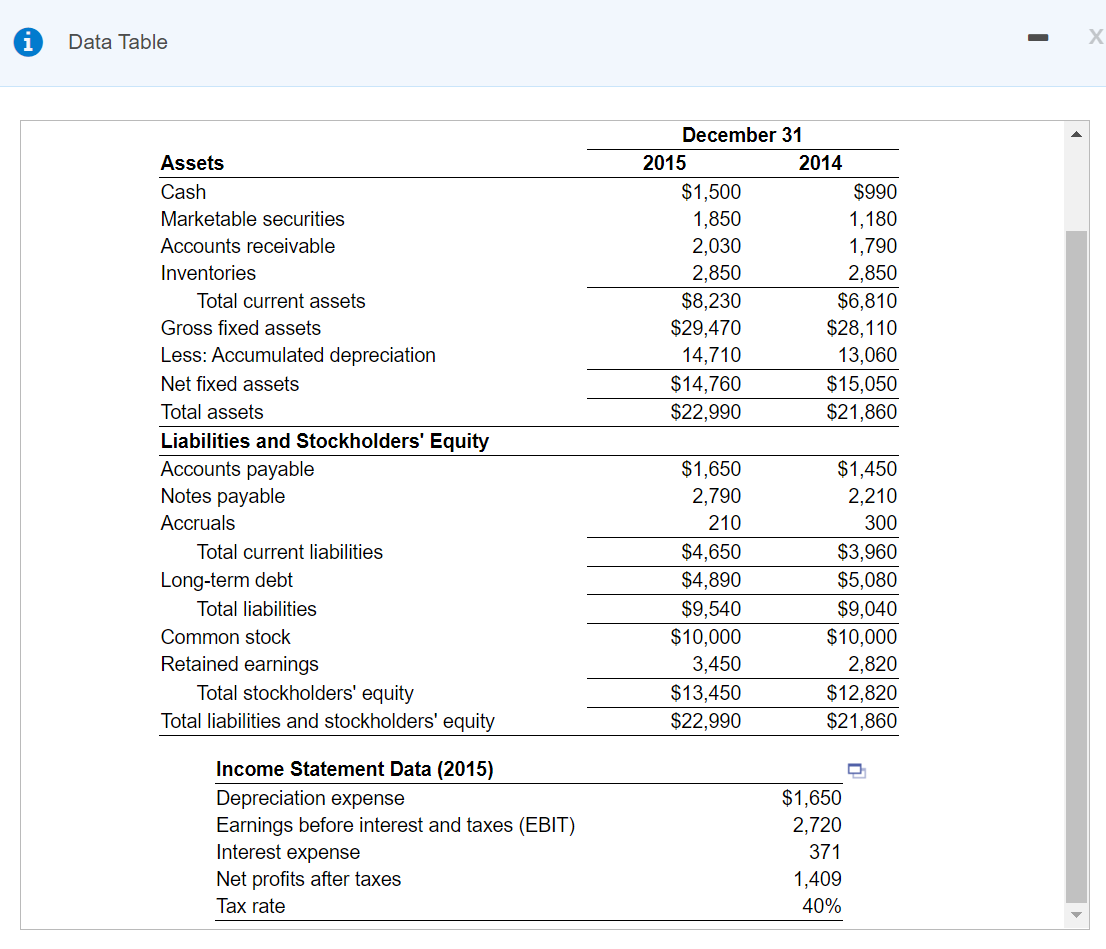

Consider the balance sheets and selected data from the income statement of Keith Corporation that follow (attached) a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2015. b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2015. c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2015. d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c).

Consider the balance sheets and selected data from the income statement of Keith Corporation that follow (attached) a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2015. b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2015. c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2015. d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c).

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 15.19EX

Related questions

Question

Consider the balance sheets and selected data from the income statement of Keith Corporation that follow (attached)

a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2015.

b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2015.

c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2015.

d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c).

Transcribed Image Text:Data Table

December 31

Assets

2015

2014

Cash

$1,500

$990

1,180

1,790

Marketable securities

1,850

2,030

Accounts receivable

Inventories

2,850

2,850

$8,230

$29,470

Total current assets

$6,810

$28,110

13,060

Gross fixed assets

Less: Accumulated depreciation

14,710

Net fixed assets

$14,760

$22,990

$15,050

Total assets

$21,860

Liabilities and Stockholders' Equity

Accounts payable

Notes payable

$1,450

2,210

$1,650

2,790

Accruals

210

300

$4,650

$3,960

$5,080

Total current liabilities

Long-term debt

$4,890

$9,540

$10,000

3,450

Total liabilities

$9,040

Common stock

$10,000

Retained earnings

2,820

Total stockholders' equity

Total liabilities and stockholders' equity

$13,450

$12,820

$22,990

$21,860

Income Statement Data (2015)

Depreciation expense

Earnings before interest and taxes (EBIT)

Interest expense

$1,650

2,720

371

Net profits after taxes

1,409

Tax rate

40%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning