a) Calculate the following ratios for 2016 and 2015, showing detailed calculations as to how you arrive at each number. A ROE B Gross profit margin C Total asset turnover D Inventory turnover E Current ratio F Debt-to-equity G Interest coverage ratio. b) Using the financial statements and the ratios calculated above (and any other ratios you like to calculate), discuss the performance of Cobham PLC in 2016. c) Critically discuss the need for the public limited companies to prepare a Statement of Cash Flows and explain the usefulness of the information contained therein from the perspective of a financial analyst.

a) Calculate the following ratios for 2016 and 2015, showing detailed calculations as to how you arrive at each number. A ROE B Gross profit margin C Total asset turnover D Inventory turnover E Current ratio F Debt-to-equity G Interest coverage ratio. b) Using the financial statements and the ratios calculated above (and any other ratios you like to calculate), discuss the performance of Cobham PLC in 2016. c) Critically discuss the need for the public limited companies to prepare a Statement of Cash Flows and explain the usefulness of the information contained therein from the perspective of a financial analyst.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 4AP

Related questions

Question

a) Calculate the following ratios for 2016 and 2015, showing detailed calculations as to how you arrive at each number.

A ROE

B Gross profit margin

C Total asset turnover

D Inventory turnover

E

F Debt-to-equity

G Interest coverage ratio.

b) Using the financial statements and the ratios calculated above (and any other ratios you like to calculate), discuss the performance of Cobham PLC in 2016.

c) Critically discuss the need for the public limited companies to prepare a Statement of Cash Flows and explain the usefulness of the information contained therein from the perspective of a financial analyst.

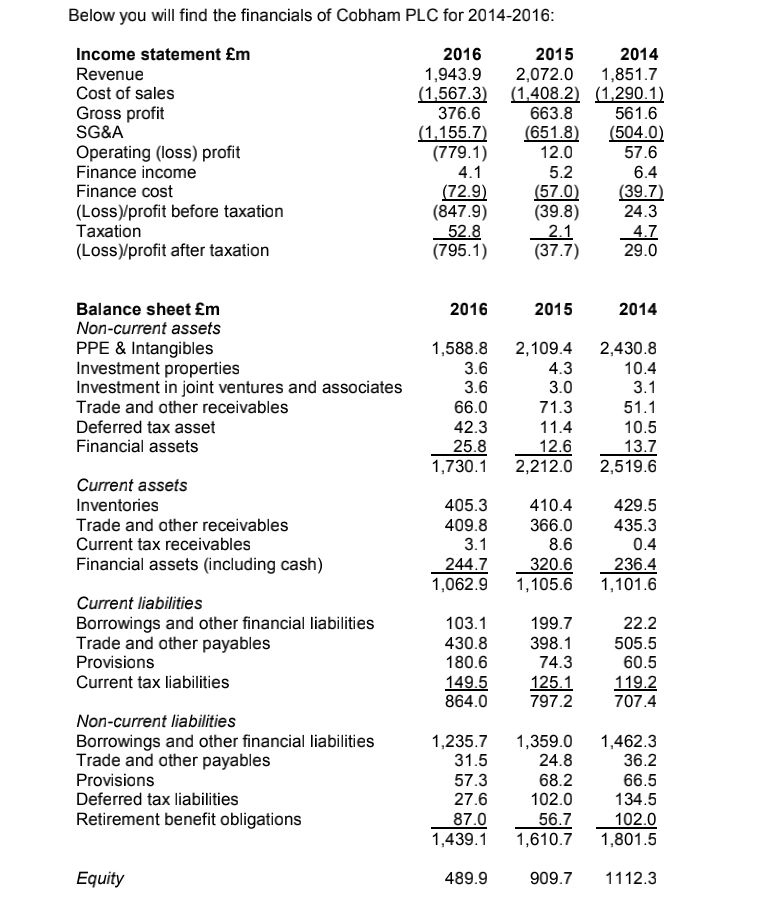

Transcribed Image Text:Below you will find the financials of Cobham PLC for 2014-2016:

Income statement £m

2016

2015

2014

Revenue

2,072.0

(1,567.3) (1,408.2) (1,290.1)

663.8

1,943.9

1,851.7

Cost of sales

Gross profit

SG&A

376.6

561.6

(1,155.7)

(779.1)

4.1

(651.8)

12.0

(504.0)

57.6

Operating (loss) profit

Finance income

5.2

6.4

(39.7)

24.3

Finance cost

(72.9)

(847.9)

52.8

(795.1)

(57.0)

(39.8)

2.1

(37.7)

(Loss)/profit before taxation

Тахation

4.7

29.0

(Loss)/profit after taxation

Balance sheet £m

Non-current assets

PPE & Intangibles

Investment properties

Investment in joint ventures and associates

Trade and other receivables

Deferred tax asset

2016

2015

2014

1,588.8

2,109.4

4.3

3.0

2,430.8

10.4

3.1

3.6

3.6

66.0

42.3

71.3

11.4

51.1

10.5

12.6

2,212.0

Financial assets

25.8

1,730.1

13.7

2,519.6

Current assets

Inventories

405.3

410.4

429.5

Trade and other receivables

409.8

366.0

435.3

Current tax receivables

3.1

8.6

0.4

Financial assets (including cash)

244.7

1,062.9

320.6

1,105.6

236.4

1,101.6

Current liabilities

Borrowings and other financial liabilities

Trade and other payables

103.1

199.7

22.2

398.1

505.5

Provisions

180.6

74.3

60.5

Current tax liabilities

149.5

864.0

125.1

797.2

119.2

707.4

Non-current liabilities

1,462.3

36.2

Borrowings and other financial liabilities

Trade and other payables

Provisions

Deferred tax liabilities

1,235.7

31.5

1,359.0

24.8

68.2

57.3

27.6

66.5

134.5

102.0

1,801.5

102.0

Retirement benefit obligations

87.0

1,439.1

56.7

1,610.7

Equity

489.9

909.7

1112.3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning