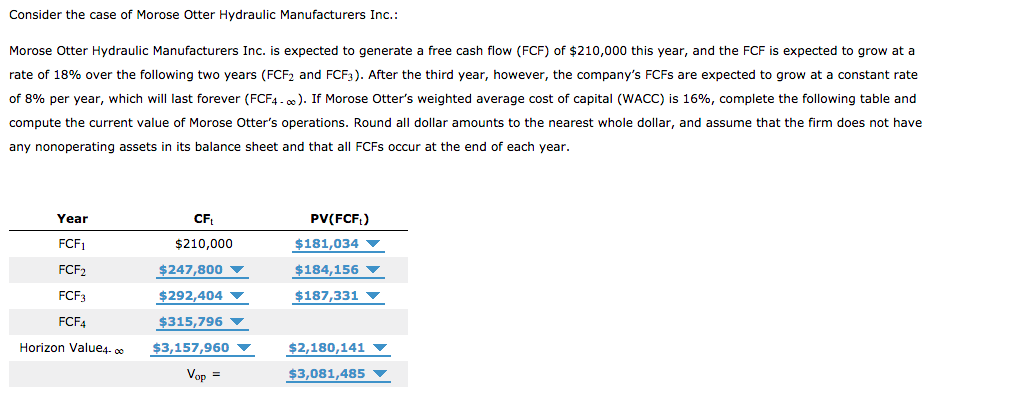

Consider the case of Morose Otter Hydraulic Manufacturers Inc.: Morose Otter Hydraulic Manufacturers Inc. is expected to generate a free cash flow (FCF) of $210,000 this year, and the FCF is expected to grow at a rate of 18% over the following two years (FCF2 and FCF3). After the third year, however, the company's FCFS are expected to grow at a constant rate of 8% per year, which will last forever (FCF4 - ). If Morose Otter's weighted average cost of capital (WACC) is 16%, complete the following table and compute the current value of Morose Otter's operations. Round all dollar amounts to the nearest whole dollar, and assume that the firm does not have any nonoperating assets in its balance sheet and that all FCFS occur at the end of each year. Year CF PV(FCF,) FCF1 $181,034 V $184,156 ▼ $210,000 FCF2 $247,800 $292,404 V $315,796 ▼ $3,157,960 v FCF3 $187,331 FCF4 Horizon Value4- 00 $2,180,141 ▼ $3,081,485 ▼ Vop

Consider the case of Morose Otter Hydraulic Manufacturers Inc.: Morose Otter Hydraulic Manufacturers Inc. is expected to generate a free cash flow (FCF) of $210,000 this year, and the FCF is expected to grow at a rate of 18% over the following two years (FCF2 and FCF3). After the third year, however, the company's FCFS are expected to grow at a constant rate of 8% per year, which will last forever (FCF4 - ). If Morose Otter's weighted average cost of capital (WACC) is 16%, complete the following table and compute the current value of Morose Otter's operations. Round all dollar amounts to the nearest whole dollar, and assume that the firm does not have any nonoperating assets in its balance sheet and that all FCFS occur at the end of each year. Year CF PV(FCF,) FCF1 $181,034 V $184,156 ▼ $210,000 FCF2 $247,800 $292,404 V $315,796 ▼ $3,157,960 v FCF3 $187,331 FCF4 Horizon Value4- 00 $2,180,141 ▼ $3,081,485 ▼ Vop

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Consider the case of Morose Otter Hydraulic Manufacturers Inc.:

Morose Otter Hydraulic Manufacturers Inc. is expected to generate a free cash flow (FCF) of $210,000 this year, and the FCF is expected to grow at a

rate of 18% over the following two years (FCF2 and FCF3). After the third year, however, the company's FCFS are expected to grow at a constant rate

of 8% per year, which will last forever (FCF4 - ). If Morose Otter's weighted average cost of capital (WACC) is 16%, complete the following table and

compute the current value of Morose Otter's operations. Round all dollar amounts to the nearest whole dollar, and assume that the firm does not have

any nonoperating assets in its balance sheet and that all FCFS occur at the end of each year.

Year

CF

PV(FCF,)

FCF1

$181,034 V

$184,156 ▼

$210,000

FCF2

$247,800

$292,404 V

$315,796 ▼

$3,157,960 v

FCF3

$187,331

FCF4

Horizon Value4- 00

$2,180,141 ▼

$3,081,485 ▼

Vop

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College