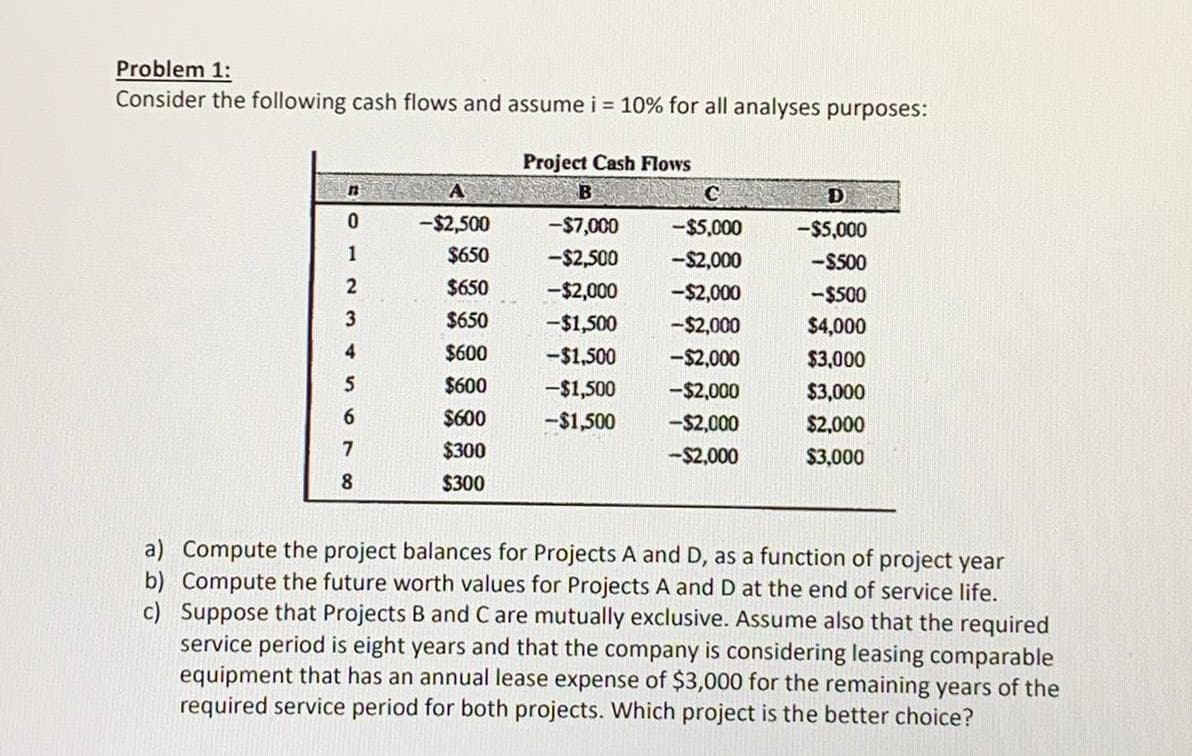

Consider the following cash flows and assume i = 10% for all analyses purposes: 12 0 1 2 3 4 5 6 7 8 A -$2,500 $650 $650 $650 $600 $600 $600 $300 $300 Project Cash Flows B -$7,000 -$2,500 -$2,000 -$1,500 -$1,500 -$1,500 -$1,500 C -$5,000 -$2,000 -$2,000 -$2,000 -$2,000 -$2,000 -$2,000 -$2,000 D -$5,000 -$500 -$500 $4,000 $3,000 $3,000 $2,000 $3,000 a) Compute the project balances for Projects A and D, as a function of project year b) Compute the future worth values for Projects A and D at the end of service life. c) Suppose that Projects B and C are mutually exclusive. Assume also that the required service period is eight years and that the company is considering leasing comparable equipment that has an annual lease expense of $3,000 for the remaining years of the required service period for both projects. Which project is the better choice?

Consider the following cash flows and assume i = 10% for all analyses purposes: 12 0 1 2 3 4 5 6 7 8 A -$2,500 $650 $650 $650 $600 $600 $600 $300 $300 Project Cash Flows B -$7,000 -$2,500 -$2,000 -$1,500 -$1,500 -$1,500 -$1,500 C -$5,000 -$2,000 -$2,000 -$2,000 -$2,000 -$2,000 -$2,000 -$2,000 D -$5,000 -$500 -$500 $4,000 $3,000 $3,000 $2,000 $3,000 a) Compute the project balances for Projects A and D, as a function of project year b) Compute the future worth values for Projects A and D at the end of service life. c) Suppose that Projects B and C are mutually exclusive. Assume also that the required service period is eight years and that the company is considering leasing comparable equipment that has an annual lease expense of $3,000 for the remaining years of the required service period for both projects. Which project is the better choice?

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 8EP

Related questions

Question

Transcribed Image Text:Problem 1:

Consider the following cash flows and assume i = 10% for all analyses purposes:

Project Cash Flows

A

D

-$2,500

-$7,000

-$5,000

-$5,000

1

$650

-$2,500

-$2,000

-$500

2

$650

-$2,000

-$2,000

-$500

$650

-$1,500

-$2,000

$4,000

4

$600

-$1,500

-$2,000

$3,000

5

$600

-$1,500

-$2,000

$3,000

$600

-$1,500

-$2,000

$2,000

7

$300

-$2,000

$3,000

8

$300

a) Compute the project balances for Projects A and D, as a function of project year

b) Compute the future worth values for Projects A and D at the end of service life.

c) Suppose that Projects B and C are mutually exclusive. Assume also that the required

service period is eight years and that the company is considering leasing comparable

equipment that has an annual lease expense of $3,000 for the remaining years of the

required service period for both projects. Which project is the better choice?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning