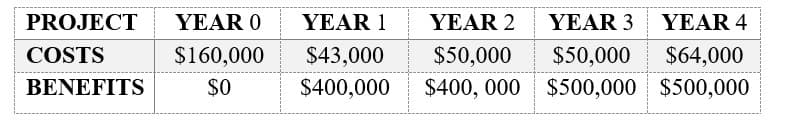

Consider the following information about a project: Calculate the NPV assuming 10% discount rate Determine in which year will be the payback Calculate (ROI)?

Q: Exercise 5-11 (Algo) Deferred annuities [LO5-8] Lincoln Company purchased merchandise from Grandvill...

A: Note payable is a form of due or liability for the business, on which regular interest payments need...

Q: 4. If you pawned your jewelry at Php 50,000 for 75 days at 8% per annum simple interest.How much wil...

A: We know, in simple interest method Future value = Principal amount + Interest earned where interest ...

Q: depreciated on a straight-line basis. The before taxes cash flows expected to be generated by the pr...

A: The process through which a company evaluates possible big projects or investments is known as capit...

Q: A certain type of machine loses 10% of its value each year. The machine cost P2,000 originally. Make...

A: Machine cost = P2,000 Depreciation rate = 10%

Q: 1. Compute the average beta for the five firms in the acrospace/defense industry. 2. Now, compute th...

A: Investment appraisal involve appraising a new project or investment a company is going to undertake....

Q: Gina has an opportunity to save $260 per month at an APR of 6.35% in a 401K plan through work. She p...

A: Investment means engaging your funds to generate income for the future. There are various purposes f...

Q: When using the binomial model, you can't make decisions about investment using only the risk-neutral...

A: Risk-neutral probabilities are used to try to find an asset's or financial instrument's objective fa...

Q: 1. At the beginning of each quarter, P36,000 is deposited into savings account that pays 6% compound...

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any sp...

Q: An annuity-due has 27 payments of $300 per period. The effective rate of interest per period is 6% f...

A: Annuity means continuous payments at regular intervals. Interest is given on annuity or such deposit...

Q: Ten bonds are purchased for $8.856.11 and are kept for 5 years. The bond coupon rate is 9% per year,...

A:

Q: FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six...

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first...

Q: Which of the following is the correct calculation of project Delta's IRR?

A: Internal Rate of Return (IRR): It is the rate of return at which a project's net present value becom...

Q: Suppose you borrow $20,000 at the start of 2022 to buy a car. Your loan is for 4 years at an effecti...

A: a. Calculate the monthly payments as follows: Therefore, the monthly payment is $469.70.

Q: Ten bonds are purchased for $9,083.25 and are kept for 5 years. The bond coupon rate is 5% per year,...

A: Ten bonds purchase price (P0) = $9083.25 Let the face value = F Total coupon for ten bonds (C) = 10 ...

Q: Data: Cost of new equipment Expected life of equipment in years Salvage Value Life Production Annual...

A: Note: This post has several subparts. The first three viz. the cost to produce cash flows over the ...

Q: Johnson Products earned $4.20 per share last year and paid a dividend of $1.55 per share. If ROE was...

A:

Q: rimary e

A: Introduction : In simple words, financial ratio refers to the study of different ratios of a firm to...

Q: Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the fo...

A: Let L1 = Long term 1 year rate L2 = Long term 2 year rate L3 = Long term 3 year rate L4 = Long term ...

Q: “Sum of money is worth more now than the same sum of money in the future”. Critically evaluate the m...

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only on...

Q: t Value for the question listed below, while the issue price is correct, I need help understanding h...

A: The price of bond is sum of present value of coupon payments and sum of present value of par value o...

Q: most recent dividend paid by Dangote cement Zambia shares is K4 per share. The company has adopted a...

A: Constant growth model is used to determine the intrinsic value of stock. In this it is assumed that ...

Q: The present worth for the DDM method is $ The present worth for the LS method is $ Ehe (Click to sel...

A: Present Worth: It represents the present value of the annual cash flow stream and is computed by di...

Q: You have $300,000 saved for retirement. Your account earns 5% interest. How much will you be able to...

A: Interest rate is 5% Present Value is $300,000 Time period is 20 years To Find: Monthly Withdrawls

Q: Greg wants to have $25,000 in three years. He has $10,000 today to invest. The bank is offering thre...

A: The interest will be compounded quarterly. The interest will be sufficient enough that the investmen...

Q: 2. What is the present value of an annuity of P150,000 payable at the end of each 6-month period for...

A: Note: This post has multiple questions. The first cannot be solved since the number of years/period...

Q: Pete's Boats has beginning long-term debt of $180 and ending long-term debt of $310. The beginning a...

A: Cash flow to creditors is the total amount of profit paid the debt holders of the company. The cash ...

Q: Consta negati during FRE

A: The Federal Reserve Board creates an index based on the average yield of numerous Treasury securitie...

Q: what is the PV of his investment if he lives for the next 20 years.

A: Present Worth: It is the present value of the future annual cash flows stream and is calculated by ...

Q: perpetual rate of 3 percent beginning in four years. If you require a return of 15 percent on the st...

A: H Model (Dividend Discount Model): The H model considers that the incomes and dividends of the compa...

Q: Risk return exercise : D2L Assessment #7 DePaul, Inc. You are searching for a stock to add to your c...

A: Given:

Q: Level 1 3 Salary $50,000 $54,000 $60,000 s promoted to salary level 3, receive ost-of-living increas...

A: Apart from Salary employee is also getting cost of living compensation based on salary level and if ...

Q: Assume we are now in mid- or late February 2022. After conducting your own analysis, you have made a...

A: Behavioral finance is finance that helps in understanding the behavior and mindset of investors in t...

Q: I- Discounting of note receivable with recourse A P1,800,000, 6-month, 10% note...

A: Discounting of Note is selling the note received from the customer to the bank before the maturity o...

Q: John Mayer Inc. purchases a house for $500,000. On January 1, He makes a 20 percent down-payment and...

A:

Q: Could I Industries just paid a dividend of $1.40 per share. The dividends are expected to grow at a ...

A:

Q: 9. Money is mvested at 10.5% nommal annual rate. Interested is compounded monthly. How much will $15...

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only on...

Q: A company hires an employee with a family of 3 for a salary of $160,000 over 3 other candidates. If ...

A: Recruiting costs are the costs that are incurred by the company in hiring and training new employees...

Q: Which of the following statements are correct regarding the purpose and characteristics of a nuncupa...

A: Answer - 1. A nuncupative will requires at least one witness. - A nuncupative will, also known as a...

Q: Mr. Abella owes Mr. Divinagracia the following obligations. (1) P100 due at the end of 10 years.(2) ...

A: First obligation (X1) = P 100 in 10 years Second obligation (X2) = P 200 in 5 years + Interest at 5%...

Q: Calculate the yield to maturity (YTM) a 10-year bond of semi-annually paid coupon rate 6% if you pur...

A: Given, Purchase price of the bond is $900. Coupon rate is 6% compounded semi annually

Q: Sophie Gowna, 47 years old, works for an Ontario company with a Bi-weekly pay cycle. She earns $19 p...

A: Net taxable earnings can be calculated by taking the gross earning adding the taxable allowances the...

Q: On an annual renewable lease, the semi-annual lease payment on office space is $5,300 payable at the...

A: Here we have to find the present value of the semi-annual lease payments which is an annuity. Also t...

Q: An increase in Accounts Receivables is : a A negative item for calculating Operating Cash Flow b ...

A: Accounts receivables is that amount of the total sales which customers still owe to the firm.

Q: compute the following ratios using the Balance Sheet (Current Year) and Income Statement provided in...

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: 9. Money is mvested at 10.5% nommal annual rate. Interested is compounded monthly. How mi $1500 depo...

A: Note : As per the guidelines, only first question will be answered. Kindly post the remaining parts ...

Q: In the 2006 Stern Review, Professor Nicholas Stern used the discount rate of 1.4% (1.3% due to techn...

A: Option B : Nordhaus’s estimation of the discount rate is more correct than Stern’s. This statement i...

Q: The pressure of corporate debt repayment has increased year by year, and the total profit has also i...

A: There are two types of financing for every organisation, namely, equity financing and debt financing...

Q: A man borrowed P3 000 to be paid after 18 months with interest at 12% compounded semi-annually and P...

A: Here, First borrowed amount payable in 18 months at 12% interest rate compounded semi annually is P3...

Q: YYYYMM Return(Stk1) Return(Stk2) Return(Market) Return(T-bill) 201701 7.75% 3.00% 6.18% 0.20% 201702...

A: The Capital Asset Pricing Model (CAPM) is a mathematical model that explains the relationship betwee...

Q: Wingler Communications Corporation (WCC) produces airpods that sell for $28.90 per set, and this yea...

A: (Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the questio...

Consider the following information about a project:

- Calculate the

NPV assuming 10% discount rate - Determine in which year will be the payback

- Calculate (

ROI )?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Question Content Area A project is estimated to cost $273,840 and provide annual net cash inflows of $60,000 for 7 years. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 6 4.917 4.355 4.111 7 5.582 4.868 4.564 8 6.210 5.335 4.968 9 6.802 5.759 5.328 10 7.360 6.145 5.650 Determine the internal rate of return for this project by using the above present value of an annuity table.fill in the blank 1 of 1%A company is considering two projects. Project I Project II Initial investment $200,000 $200,000 Cash inflow Year 1 50,000 60,000 Cash inflow Year 2 50,000 60,000 Cash inflow Year 3 50,000 80,000 Cash inflow Year 4 50,000 10,000 Cash inflow Year 5 50,000 50000 What is the payback period for Project II?Project A has the following information: Year 0 1 2 3 4 5 Initial investment outlay 125,000 Cash inflows 75,000 80,000 95,000 95,000 86,250 Personnel expenses 22,500 22,500 22,500 22,500 22,500 Material expesnes 15,000 20,000 22,500 22,500 22,500 Maintenance expenses 2,500 2,500 5,000 8,750 10,000 Other cash outflows 3,750 3,750 3,750 5,000 5,625 Liquidation value 12,500 Project B has the following information: Year 0 1 2 3 4 5 Initial investment outlay 225,000 Cash inflows 155,000 140,000 108,750 93,750 125,000 Personnel expenses 27,500 27,500 27,500 27,500 27,500 Material expenses 25,000 22,500 22,500 22,500 24,000 Maintenance expesnses 8,750 11,250 17,500 15,000 14,000 Other cash outflows 6,250 3,750 3,750 3,750 4,000 Liquidation value 15,000 The Discount Rate is 8%Assess the relative profitability of the two options using the following methods:(i) The Annuity Method(ii) The Net…

- I wish for a detailed answer. thank you A project is estimated to cost $248,400 and provide annual net cash inflows of $50,000 for 8 years. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 6 4.917 4.355 4.111 7 5.582 4.868 4.564 8 6.210 5.335 4.968 9 6.802 5.759 5.328 10 7.360 6.145 5.650 Determine the internal rate of return for this project, using the above present value of an annuity table.fill in the blank 1 %6) Year Project A Project B Difference 0 -75000 -75000 0 1 26300 24000 2300 2 29500 26900 2600 3 45300 51300 -6000 Crossover rate 14.60% Hi I need help with the following question! Thank you! Are you going to accept project A or project B? Why?A4 9a We find the following information on NPNG (No-Pain-No-Gain) Inc.: A4 9a EBIT = $2,000,000Depreciation = $250,000Change in net working capital = $100,000Net capital spending = $300,000 These numbers are projected to increase at the following supernormal rates for the next three years, and 5% after the third year for the foreseeable future: EBIT: 20%Depreciation: 10%Change in net working capital: 15%Net capital spending: 10% The firm’s tax rate is 35%, and it has 1,000,000 outstanding shares and $8,000,000 in debt. We have estimated the WACC to be 15%. a. Calculate the EBIT, Depreciation, Changes in NWC, and net capital spending for the next four years.

- Question 2 Sunshine Corporation is reviewing an investment proposal. The initial cost of the investment isR52 500. The estimated cash flows and net profit for each year are presented in the schedulebelow. All cash flows are assumed to take place at the end of the year. year Net cash flows Net profit R20 000 R2 500 R17 500 R3 500 R15 000 R4 500 R12 500 R5 500 R10 000 R6 500 The cost of capital is 12%. Required:Calculate the following:1. Payback Period 2. Net Present value 3. Accounting rate of returnconsider project D. calculate the payback period project c0 c1 c2 c3 D -372,000 200,000 140,000 72,000How do you calculate the NPV and IRR Project 1 Year Cashflows Discount Rate 10% 0 $ (750,000.00) 1 $ 250,000.00 2 $ 300,000.00 3 $ 350,000.00 4 $ 200,000.00 5 $ 100,000.00 Project 2 Year Cashflows Discount Rate 10% 0 $ (1,000,000.00) 1 $ 200,000.00 2 $ 300,000.00 3 $ 400,000.00 4 $ 500,000.00 5 $ 700,000.00

- Question 16 The following information relates to three possible capital expenditure projects. Because of capital rationing only one project can be accepted. Project: A B C . Initial cost R100 000 R115 000 R90 000 Expected life 5 years 5 years 4 years Scrap value R5 000 R7 500 R4 000 Cash-inflows R R R End year 1 40 000 50 000 27 500 2 35 000 35 000 32 500…Question 15 The following information relates to three possible capital expenditure projects. Because of capital rationing only one project can be accepted. Project: A B C . Initial cost R100 000 R115 000 R90 000 Expected life 5 years 5 years 4 years Scrap value R5 000 R7 500 R4 000 Cash-inflows R R R End year 1 40 000 50 000 27 500 2 35 000 35 000 32 500…Question 21 The following information relates to three possible capital expenditure projects. Because of capital rationing only one project can be accepted. Project: A B C . Initial cost R100 000 R115 000 R90 000 Expected life 5 years 5 years 4 years Scrap value R5 000 R7 500 R4 000 Cash-inflows R R R End year 1 40 000 50 000 27 500 2 35 000 35 000 32 500…