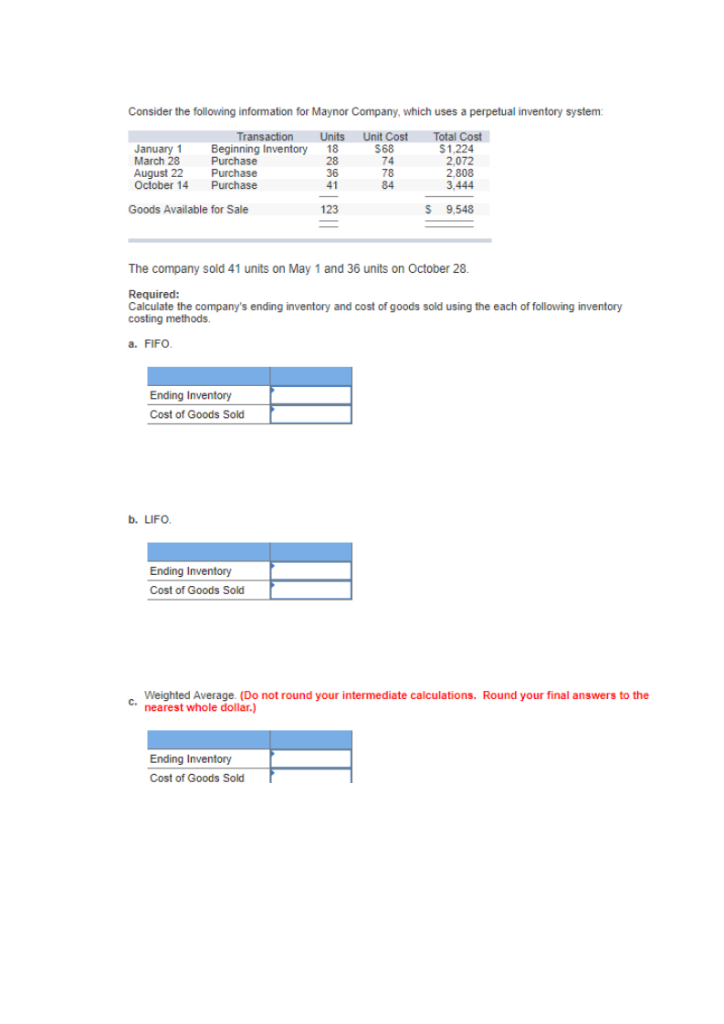

Consider the following information for Maynor Company, which uses a perpetual inventory system: Units Unit Cost Total Cost Transaction Beginning Inventory Purchase $68 January 1 March 28 $1,224 74 2,072 August 22 Purchase 78 2,808 October 14 Purchase 84 3,444 Goods Available for Sale $ 9,548 Ending Inventory Cost of Goods Sold b. LIFO. Ending Inventory Cost of Goods Sold 0885|2|| 18 The company sold 41 units on May 1 and 36 units on October 28. Required: Calculate the company's ending inventory and cost of goods sold using the each of following inventory costing methods. a. FIFO. Ending Inventory Cost of Goods Sold 36 41 123 Weighted Average. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar.)

Consider the following information for Maynor Company, which uses a perpetual inventory system: Units Unit Cost Total Cost Transaction Beginning Inventory Purchase $68 January 1 March 28 $1,224 74 2,072 August 22 Purchase 78 2,808 October 14 Purchase 84 3,444 Goods Available for Sale $ 9,548 Ending Inventory Cost of Goods Sold b. LIFO. Ending Inventory Cost of Goods Sold 0885|2|| 18 The company sold 41 units on May 1 and 36 units on October 28. Required: Calculate the company's ending inventory and cost of goods sold using the each of following inventory costing methods. a. FIFO. Ending Inventory Cost of Goods Sold 36 41 123 Weighted Average. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Consider the following information for Maynor Company, which uses a perpetual inventory system:

Transaction

Units Unit Cost

Total Cost

Beginning Inventory

18

$1,224

Purchase

28

2,072

Purchase

36

Purchase

41

Goods Available for Sale

123

January 1

March 28

August 22

October 14

Ending Inventory

Cost of Goods Sold

b. LIFO.

The company sold 41 units on May 1 and 36 units on October 28.

Required:

Calculate the company's ending inventory and cost of goods sold using the each of following inventory

costing methods.

a. FIFO.

Ending Inventory

Cost of Goods Sold

$68

74

78

84

2,808

3.444

Ending Inventory

Cost of Goods Sold

$ 9,548

Weighted Average. (Do not round your intermediate calculations. Round your final answers to the

C. nearest whole dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define FIFO, LIFO and Weighted Average Method

VIEWStep 2: Calculation of Cost of goods sold and ending inventory using FIFO Method

VIEWStep 3: Calculation of Cost of goods sold and ending inventory using LIFO Method

VIEWStep 4: Calculation of Cost of goods sold and ending inventory using Weighted Average Method

VIEWSolution

VIEWStep by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub