Chapter11: Managing Aggregate Demand: Fiscal Policy

Section: Chapter Questions

Problem 5DQ

Related questions

Question

9

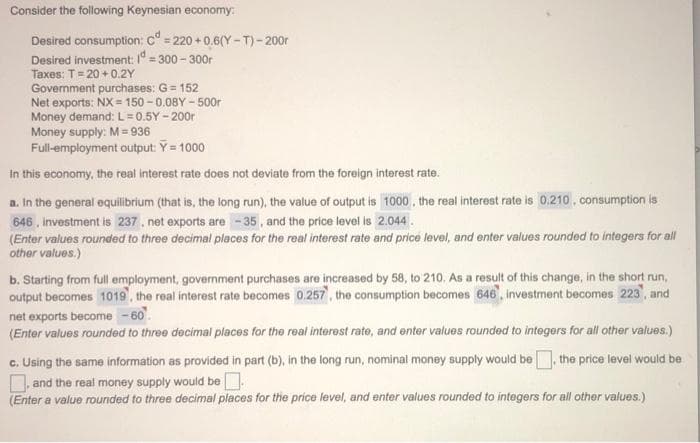

Transcribed Image Text:Consider the following Keynesian economy:

Desired consumption: c° = 220 + 0.6(Y - T)-200r

Desired investment: 1° = 300 - 300r

Taxes: T= 20 + 0.2Y

Government purchases: G= 152

Net exports: NX = 150 - 0.08Y - 500r

Money demand: L = 0.5Y - 200r

Money supply: M= 936

Full-employment output: Y = 1000

in this economy, the real interest rate does not deviate from the foreign interest rate.

a. In the general equilibrium (that is, the long run), the value of output is 1000 , the real interest rate is 0.210, consumption is

646 , investment is 237. net exports are -35, and the price level is 2.044.

(Enter values rounded to three decimal places for the real interest rate and price level, and enter values rounded to integers for all

other values.)

b. Starting from full employment, government purchases are increased by 58, to 210. As a result of this change, in the short run,

output becomes 1019, the real interest rate becomes 0.257, the consumption becomes 646, investment becomes 223, and

net exports become -60'.

(Enter values rounded to three decimal places for the real interest rato, and enter values rounded to integers for all other values.)

c. Using the same information as provided in part (b), in the long run, nominal money supply would be the price level would be

and the real money supply would be.

(Enter a value rounded to three decimal places for the price level, and enter values rounded to integers for all other values.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc