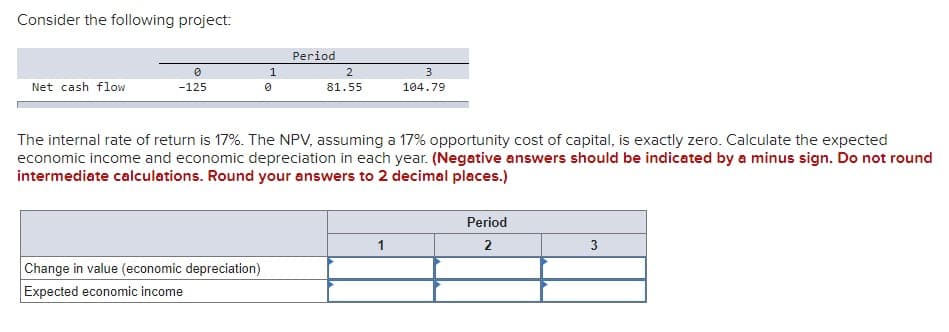

Consider the following project: Period 0 1 Net cash flow -125 0 2 81.55 3 104.79 The internal rate of return is 17%. The NPV, assuming a 17% opportunity cost of capital, is exactly zero. Calculate the expected economic income and economic depreciation in each year. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) Period 1 2 3 Change in value (economic depreciation) Expected economic income

Consider the following project: Period 0 1 Net cash flow -125 0 2 81.55 3 104.79 The internal rate of return is 17%. The NPV, assuming a 17% opportunity cost of capital, is exactly zero. Calculate the expected economic income and economic depreciation in each year. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) Period 1 2 3 Change in value (economic depreciation) Expected economic income

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 1CMA

Question

Bhupatbhai

Transcribed Image Text:Consider the following project:

Period

0

1

Net cash flow

-125

0

2

81.55

3

104.79

The internal rate of return is 17%. The NPV, assuming a 17% opportunity cost of capital, is exactly zero. Calculate the expected

economic income and economic depreciation in each year. (Negative answers should be indicated by a minus sign. Do not round

intermediate calculations. Round your answers to 2 decimal places.)

Period

1

2

3

Change in value (economic depreciation)

Expected economic income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT