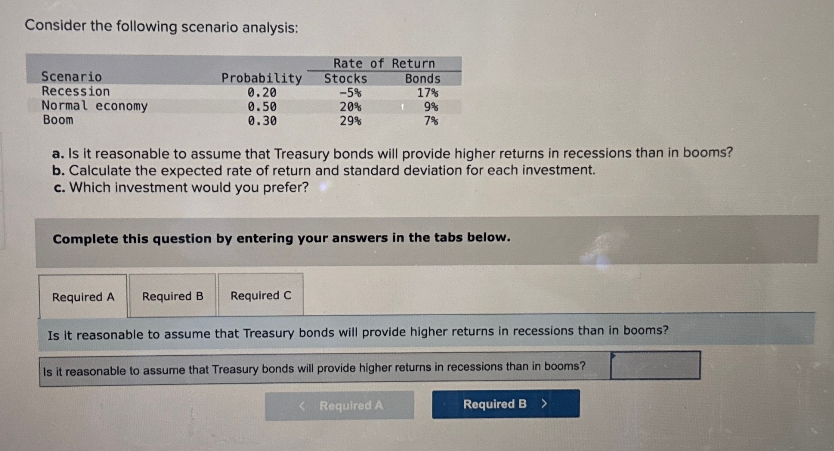

Consider the following scenario analysis: Rate of Return Scenario Recession Normal economy Boom Probability Stocks 0.20 -5% Bonds 17% 0.50 20% 1 9% 0.30 29% 7% a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? < Required A Required B >

Consider the following scenario analysis: Rate of Return Scenario Recession Normal economy Boom Probability Stocks 0.20 -5% Bonds 17% 0.50 20% 1 9% 0.30 29% 7% a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? < Required A Required B >

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 14P

Related questions

Question

Am. 135.

Transcribed Image Text:Consider the following scenario analysis:

Rate of Return

Scenario

Recession

Normal economy

Boom

Probability

Stocks

0.20

-5%

Bonds

17%

0.50

20%

1 9%

0.30

29%

7%

a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms?

b. Calculate the expected rate of return and standard deviation for each investment.

c. Which investment would you prefer?

Complete this question by entering your answers in the tabs below.

Required A Required B

Required C

Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms?

Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms?

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning