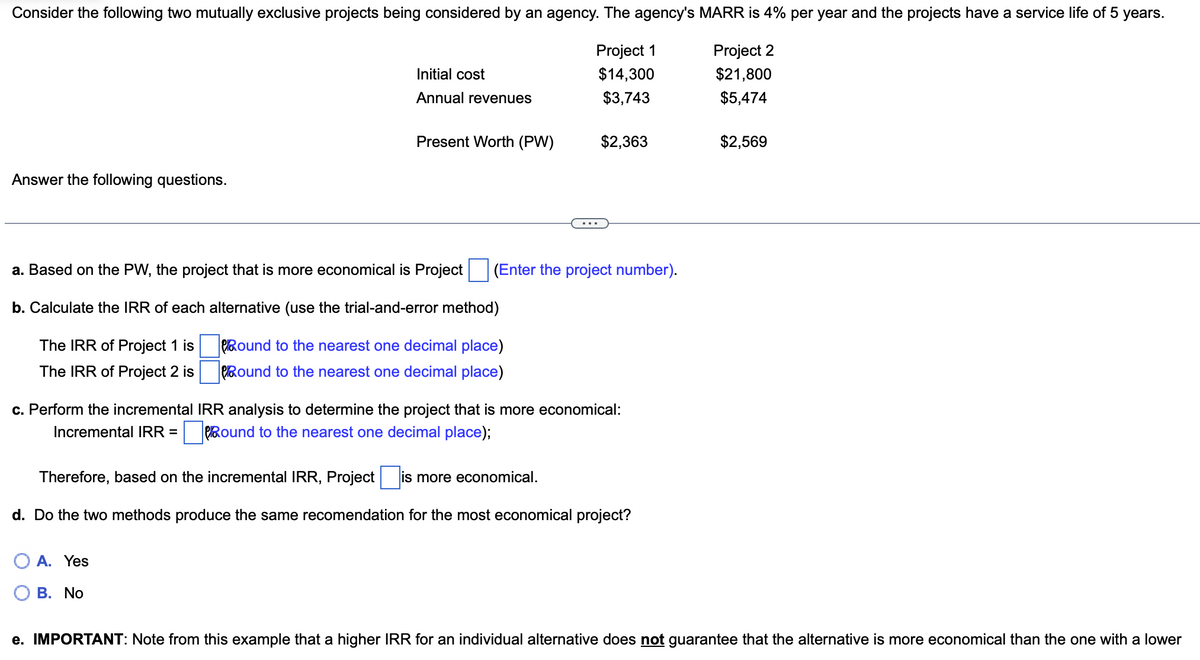

Consider the following two mutually exclusive projects being considered by an agency. The agency's MARR is 4% per year and the projects have a service life of 5 years. Project Project 2 $14,300 $21,800 $3,743 $5,474 Answer the following questions. Initial cost Annual revenues Present Worth (PW) $2,363 a. Based on the PW, the project that is more economical is Project (Enter the project number). b. Calculate the IRR of each alternative (use the trial-and-error method) The IRR of Project 1 is Round to the nearest one decimal place) The IRR of Project 2 is Round to the nearest one decimal place) O A. Yes OB. No c. Perform the incremental IRR analysis to determine the project that is more economical: Incremental IRR=Round to the nearest one decimal place); Therefore, based on the incremental IRR, Project is more economical. d. Do the two methods produce the same recomendation for the most economical project? $2,569 e. IMPORTANT: Note from this example that a higher IRR for an individual alternative does not guarantee that the alternative is more economical than the one with a low

Consider the following two mutually exclusive projects being considered by an agency. The agency's MARR is 4% per year and the projects have a service life of 5 years. Project Project 2 $14,300 $21,800 $3,743 $5,474 Answer the following questions. Initial cost Annual revenues Present Worth (PW) $2,363 a. Based on the PW, the project that is more economical is Project (Enter the project number). b. Calculate the IRR of each alternative (use the trial-and-error method) The IRR of Project 1 is Round to the nearest one decimal place) The IRR of Project 2 is Round to the nearest one decimal place) O A. Yes OB. No c. Perform the incremental IRR analysis to determine the project that is more economical: Incremental IRR=Round to the nearest one decimal place); Therefore, based on the incremental IRR, Project is more economical. d. Do the two methods produce the same recomendation for the most economical project? $2,569 e. IMPORTANT: Note from this example that a higher IRR for an individual alternative does not guarantee that the alternative is more economical than the one with a low

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 2CMA: Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of...

Related questions

Question

e. IMPORTANT Note that from this example that a higher

Transcribed Image Text:Consider the following two mutually exclusive projects being considered by an agency. The agency's MARR is 4% per year and the projects have a service life of 5 years.

Project 1

Project 2

$14,300

$21,800

$3,743

$5,474

Answer the following questions.

Initial cost

Annual revenues

Present Worth (PW)

a. Based on the PW, the project that is more economical is Project (Enter the project number).

b. Calculate the IRR of each alternative (use the trial-and-error method)

The IRR of Project 1 is

Round to the nearest one decimal place)

The IRR of Project 2 is

Round to the nearest one decimal place)

A. Yes

$2,363

c. Perform the incremental IRR analysis to determine the project that is more economical:

Incremental IRR=Round to the nearest one decimal place);

B. No

Therefore, based on the incremental IRR, Project is

is more economical.

d. Do the two methods produce the same recomendation for the most economical project?

$2,569

e. IMPORTANT: Note from this example that a higher IRR for an individual alternative does not guarantee that the alternative is more economical than the one with a lower

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning