Consider the following version of the short run monetary model: (UK) MD/P = exp(-0.50*i)*Y MS = M i=i_(US) + e^e-e where M 1100, Y 1,956, P-1, i (US) 0.04 and e^e 1.1. The UK money supply is unexpectedly increased from M-1100 to M-1,197 in period 0. It is then returned to its original value of 1100 from period 1 onwards, and investors know this. By how much will the Pound depreciate in period 0?

Consider the following version of the short run monetary model: (UK) MD/P = exp(-0.50*i)*Y MS = M i=i_(US) + e^e-e where M 1100, Y 1,956, P-1, i (US) 0.04 and e^e 1.1. The UK money supply is unexpectedly increased from M-1100 to M-1,197 in period 0. It is then returned to its original value of 1100 from period 1 onwards, and investors know this. By how much will the Pound depreciate in period 0?

Macroeconomics: Principles and Policy (MindTap Course List)

13th Edition

ISBN:9781305280601

Author:William J. Baumol, Alan S. Blinder

Publisher:William J. Baumol, Alan S. Blinder

Chapter15: The Debate Over Monetary And Fiscal Policy

Section: Chapter Questions

Problem 2TY

Related questions

Question

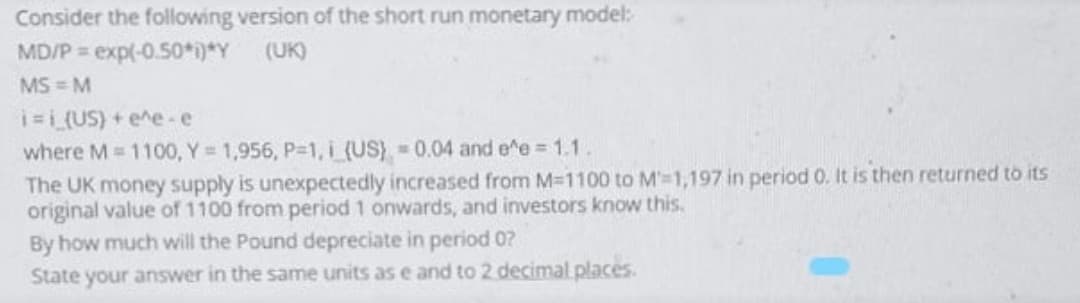

Transcribed Image Text:Consider the following version of the short run monetary model:

MD/P exp(-0.50*i)*Y (UK)

MS = M

i=L(US) + e^e-e

where M 1100, Y 1,956, P-1, i (US) 0.04 and e^e 1.1.

The UK money supply is unexpectedly increased from M-1100 to M-1,197 in period 0. It is then returned to its

original value of 1100 from period 1 onwards, and investors know this.

By how much will the Pound depreciate in period 0?

State your answer in the same units as e and to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning