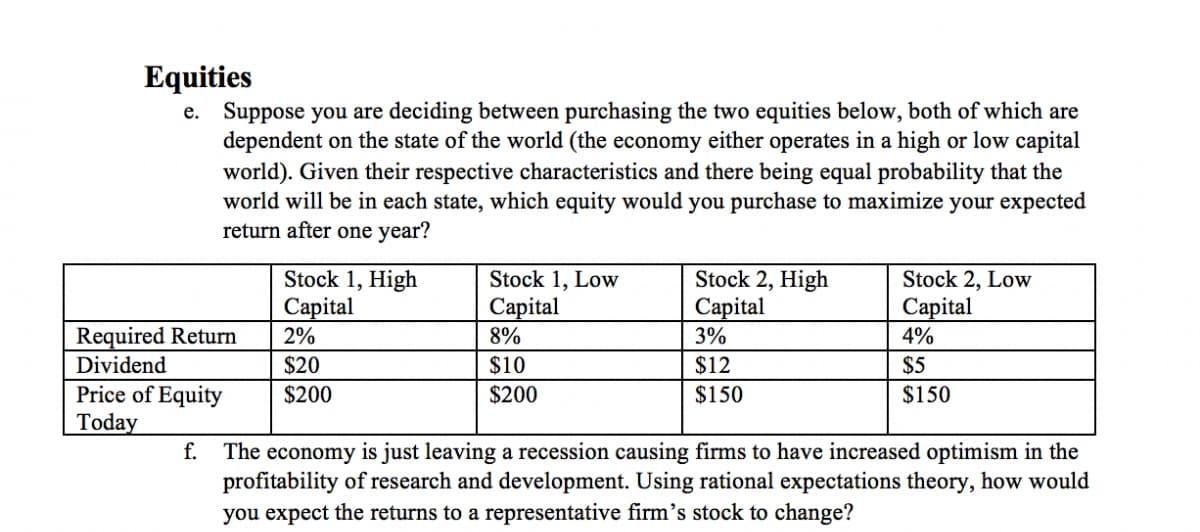

Equities e. Suppose you are deciding between purchasing the two equities below, both of which are dependent on the state of the world (the economy either operates in a high or low capital world). Given their respective characteristics and there being equal probability that the world will be in each state, which equity would you purchase to maximize your expected return after one year? Stock 1, High Capital 2% Stock 1, Low Сapital 8% Stock 2, High Сapital Stock 2, Low Сapital 4% Required Return 3% Dividend $20 $10 $12 $5 Price of Equity Today $200 $200 $150 $150 f. The economy is just leaving a recession causing firms to have increased optimism in the profitability of research and development. Using rational expectations theory, how would you expect the returns to a representative firm's stock to change?

Equities e. Suppose you are deciding between purchasing the two equities below, both of which are dependent on the state of the world (the economy either operates in a high or low capital world). Given their respective characteristics and there being equal probability that the world will be in each state, which equity would you purchase to maximize your expected return after one year? Stock 1, High Capital 2% Stock 1, Low Сapital 8% Stock 2, High Сapital Stock 2, Low Сapital 4% Required Return 3% Dividend $20 $10 $12 $5 Price of Equity Today $200 $200 $150 $150 f. The economy is just leaving a recession causing firms to have increased optimism in the profitability of research and development. Using rational expectations theory, how would you expect the returns to a representative firm's stock to change?

Chapter31: Capital Markets

Section: Chapter Questions

Problem 2E

Related questions

Question

5

Transcribed Image Text:Equities

e. Suppose you are deciding between purchasing the two equities below, both of which are

dependent on the state of the world (the economy either operates in a high or low capital

world). Given their respective characteristics and there being equal probability that the

world will be in each state, which equity would you purchase to maximize your expected

return after one year?

Stock 1, High

Саpital

2%

Stock 1, Low

Сapital

8%

Stock 2, High

Саpital

3%

Stock 2, Low

Capital

4%

Required Return

Dividend

$20

$10

$12

$5

Price of Equity

Today

$200

$200

$150

$150

f.

The economy is just leaving a recession causing firms to have increased optimism in the

profitability of research and development. Using rational expectations theory, how would

you expect the returns to a representative firm's stock to change?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you