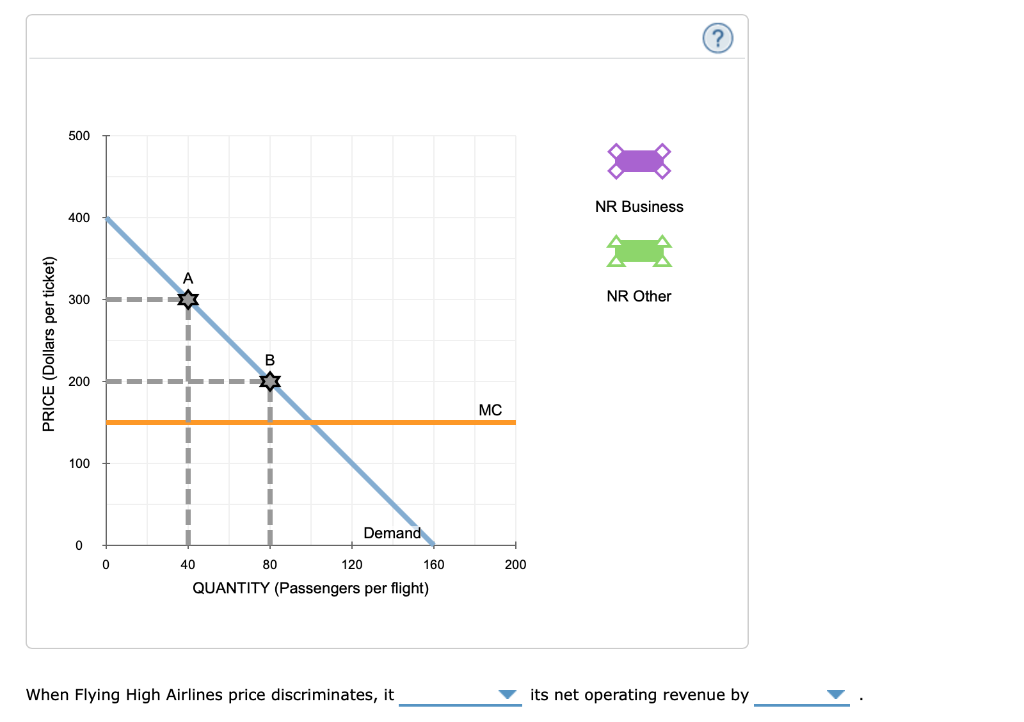

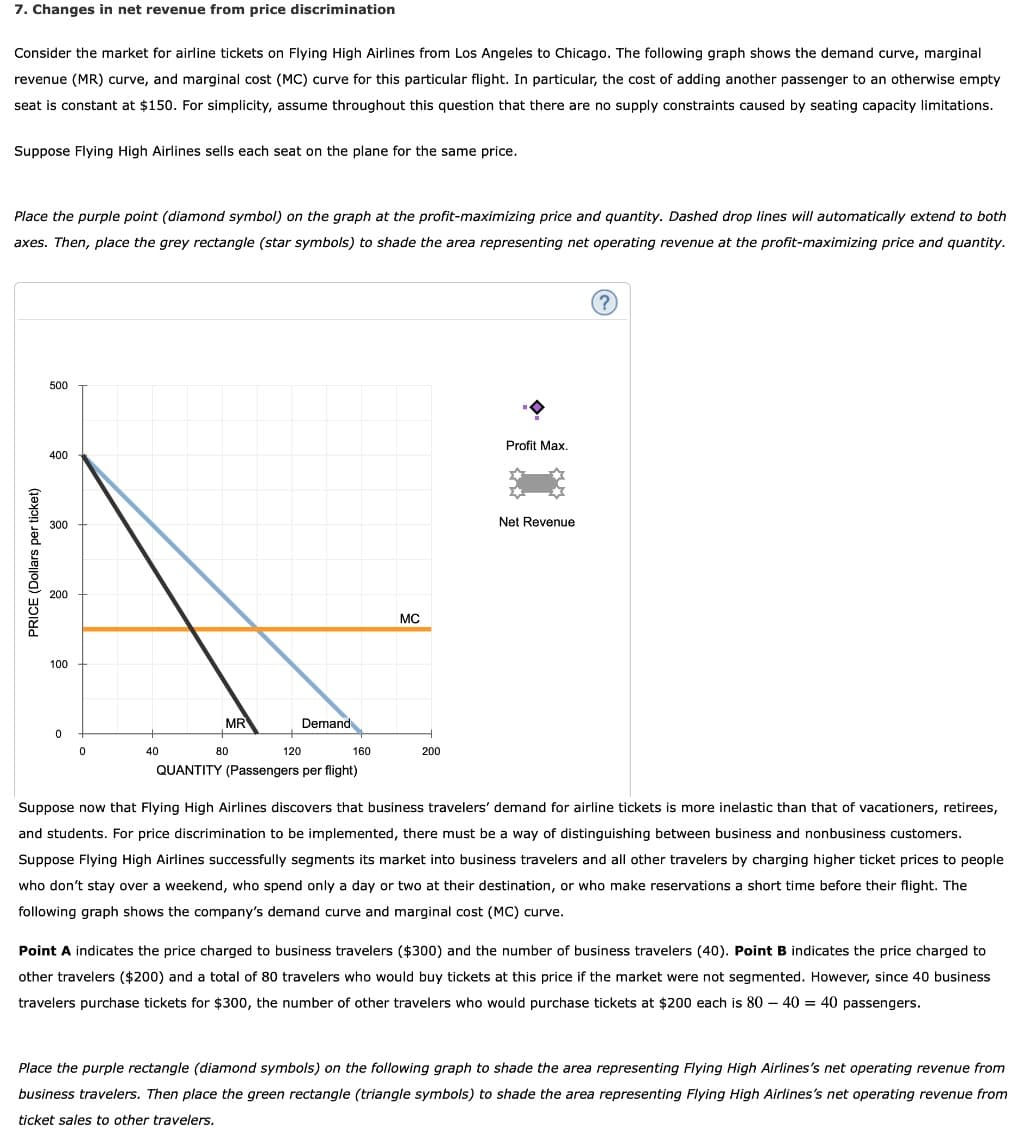

Consider the market for airline tickets on Flying High Airlines from Los Angeles to Chicago. The following graph shows the demand curve, marginal revenue (MR) curve, and marginal cost (MC) curve for this particular flight. In particular, the cost of adding another passenger to an otherwise empty seat is constant at $150. For simplicity, assume throughout this question that there are no supply constraints caused by seating capacity limitations. Suppose Flying High Airlines sells each seat on the plane for the same price. Place the purple point (diamond symbol) on the graph at the profit-maximizing price and quantity. Dashed drop lines will automatically extend to both axes. Then, place the grey rectangle (star symbols) to shade the area representing net operating revenue at the profit-maximizing price and quantity. PRICE (Dollars per ticket) 500 400 300 200 100 0 0 MR 40 160 QUANTITY (Passengers per flight) 80 Demand 120 MC 200 Profit Max. Net Revenue (?) Suppose now that Flying High Airlines discovers that business travelers' demand for airline tickets is more inelastic than that of vacationers, retirees, and students. For price discrimination to be implemented, there must be a way of distinguishing between business and nonbusiness customers. Suppose Flying High Airlines successfully segments its market into business travelers and all other travelers by charging higher ticket prices to people who don't stay over a weekend, who spend only a day or two at their destination, or who make reservations a short time before their flight. The following graph shows the company's demand curve and marginal cost (MC) curve. Point A indicates the price charged to business travelers ($300) and the number of business travelers (40). Point B indicates the price charged to other travelers ($200) and a total of 80 travelers who would buy tickets at this price if the market were not segmented. However, since 40 business. travelers purchase tickets for $300, the number of other travelers who would purchase tickets at $200 each is 80 - 40 = 40 passengers. Place the purple rectangle (diamond symbols) on the following graph to shade the area representing Flying High Airlines's net operating revenue from business travelers. Then place the green rectangle (triangle symbols) to shade the area representing Flying High Airlines's net operating revenue from ticket sales to other travelers.

Consider the market for airline tickets on Flying High Airlines from Los Angeles to Chicago. The following graph shows the demand curve, marginal revenue (MR) curve, and marginal cost (MC) curve for this particular flight. In particular, the cost of adding another passenger to an otherwise empty seat is constant at $150. For simplicity, assume throughout this question that there are no supply constraints caused by seating capacity limitations. Suppose Flying High Airlines sells each seat on the plane for the same price. Place the purple point (diamond symbol) on the graph at the profit-maximizing price and quantity. Dashed drop lines will automatically extend to both axes. Then, place the grey rectangle (star symbols) to shade the area representing net operating revenue at the profit-maximizing price and quantity. PRICE (Dollars per ticket) 500 400 300 200 100 0 0 MR 40 160 QUANTITY (Passengers per flight) 80 Demand 120 MC 200 Profit Max. Net Revenue (?) Suppose now that Flying High Airlines discovers that business travelers' demand for airline tickets is more inelastic than that of vacationers, retirees, and students. For price discrimination to be implemented, there must be a way of distinguishing between business and nonbusiness customers. Suppose Flying High Airlines successfully segments its market into business travelers and all other travelers by charging higher ticket prices to people who don't stay over a weekend, who spend only a day or two at their destination, or who make reservations a short time before their flight. The following graph shows the company's demand curve and marginal cost (MC) curve. Point A indicates the price charged to business travelers ($300) and the number of business travelers (40). Point B indicates the price charged to other travelers ($200) and a total of 80 travelers who would buy tickets at this price if the market were not segmented. However, since 40 business. travelers purchase tickets for $300, the number of other travelers who would purchase tickets at $200 each is 80 - 40 = 40 passengers. Place the purple rectangle (diamond symbols) on the following graph to shade the area representing Flying High Airlines's net operating revenue from business travelers. Then place the green rectangle (triangle symbols) to shade the area representing Flying High Airlines's net operating revenue from ticket sales to other travelers.

Chapter6: Consumer Choice And Demand

Section: Chapter Questions

Problem 3.7P

Related questions

Question

first options: increases or decreases

second options: $8,000 $2,000 $6,000

Note:-

Do not provide handwritten solution. Maintain accuracy and quality in your answer.

Take care of plagiarism.

Answer completely.

You will get up vote for sure.

Transcribed Image Text:PRICE (Dollars per ticket)

500

400

300

200

100

0

0

▬▬

A

|

I

40

B

Σ

||

1

80

120

Demand

160

QUANTITY (Passengers per flight)

When Flying High Airlines price discriminates, it

MC

200

NR Business

NR Other

?

its net operating revenue by

Transcribed Image Text:7. Changes in net revenue from price discrimination

Consider the market for airline tickets on Flying High Airlines from Los Angeles to Chicago. The following graph shows the demand curve, marginal

revenue (MR) curve, and marginal cost (MC) curve for this particular flight. In particular, the cost of adding another passenger to an otherwise empty

seat is constant at $150. For simplicity, assume throughout this question that there are no supply constraints caused by seating capacity limitations.

Suppose Flying High Airlines sells each seat on the plane for the same price.

Place the purple point (diamond symbol) on the graph at the profit-maximizing price and quantity. Dashed drop lines will automatically extend to both

axes. Then, place the grey rectangle (star symbols) to shade the area representing net operating revenue at the profit-maximizing price and quantity.

PRICE (Dollars per ticket)

500

400

300

200

100

0

0

MR

40

160

QUANTITY (Passengers per flight)

80

Demand

120

MC

200

Profit Max.

Net Revenue

?

Suppose now that Flying High Airlines discovers that business travelers' demand for airline tickets is more inelastic than that of vacationers, retirees,

and students. For price discrimination to be implemented, there must be a way of distinguishing between business and nonbusiness customers.

Suppose Flying High Airlines successfully segments its market into business travelers and all other travelers by charging higher ticket prices to people

who don't stay over a weekend, who spend only a day or two at their destination, or who make reservations a short time before their flight. The

following graph shows the company's demand curve and marginal cost (MC) curve.

Point A indicates the price charged to business travelers ($300) and the number of business travelers (40). Point B indicates the price charged to

other travelers ($200) and a total of 80 travelers who would buy tickets at this price if the market were not segmented. However, since 40 business

travelers purchase tickets for $300, the number of other travelers who would purchase tickets at $200 each is 80 - 40 = 40 passengers.

Place the purple rectangle (diamond symbols) on the following graph to shade the area representing Flying High Airlines's net operating revenue from

business travelers. Then place the green rectangle (triangle symbols) to shade the area representing Flying High Airlines's net operating revenue from

ticket sales to other travelers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax