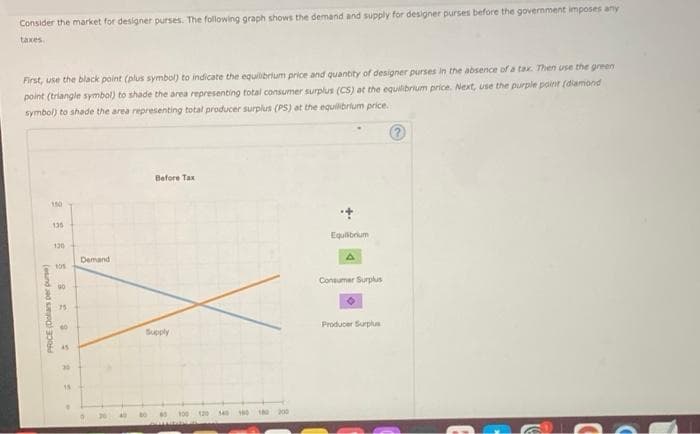

Consider the market for designer purses. The following graph shows the demand and supply for designer purses before the government imposes any taxes First, use the black point (plus symbol) to indicate the equilibrium price and quantity of designer purses in the absence of a tax. Then use the green point (triangle symbol) to shade the area representing total consumer surplus (CS) at the equilibrium price. Next, use the purple poinit (diamond symbol) to shade the area representing total producer surplus (PS) at the equilibrium price. Before Tax 150 135 Equilbrium 120 Demand 90 Consumer Surplus Producer Surplus Supply 45 20 4 s 100 120 340 100 160 200 (end ed oal 3d

Consider the market for designer purses. The following graph shows the demand and supply for designer purses before the government imposes any taxes First, use the black point (plus symbol) to indicate the equilibrium price and quantity of designer purses in the absence of a tax. Then use the green point (triangle symbol) to shade the area representing total consumer surplus (CS) at the equilibrium price. Next, use the purple poinit (diamond symbol) to shade the area representing total producer surplus (PS) at the equilibrium price. Before Tax 150 135 Equilbrium 120 Demand 90 Consumer Surplus Producer Surplus Supply 45 20 4 s 100 120 340 100 160 200 (end ed oal 3d

Chapter4: Markets In Action

Section: Chapter Questions

Problem 12SQ

Related questions

Question

Transcribed Image Text:Consider the market for designer purses. The following graph shows the demand and supply for designer purses before the government imposes any

taxes

First, use the black point (plus symbol) to indicate the equilibrium price and quantity of designer purses in the absence of a tax. Then use the green

point (triangle symbol) to shade the area representing total consumer surplus (CS) at the equilibrium price. Next, use the purple poinit (diamond

symbol) to shade the area representing total producer surplus (PS) at the equilibrium price.

Before Tax

150

135

Equilbrium

120

Demand

Consumer Surplus

90

Producer Surplus

Supply

45

20

340

00 10 200

4 s 100 120

PRICE (Delars per pue)

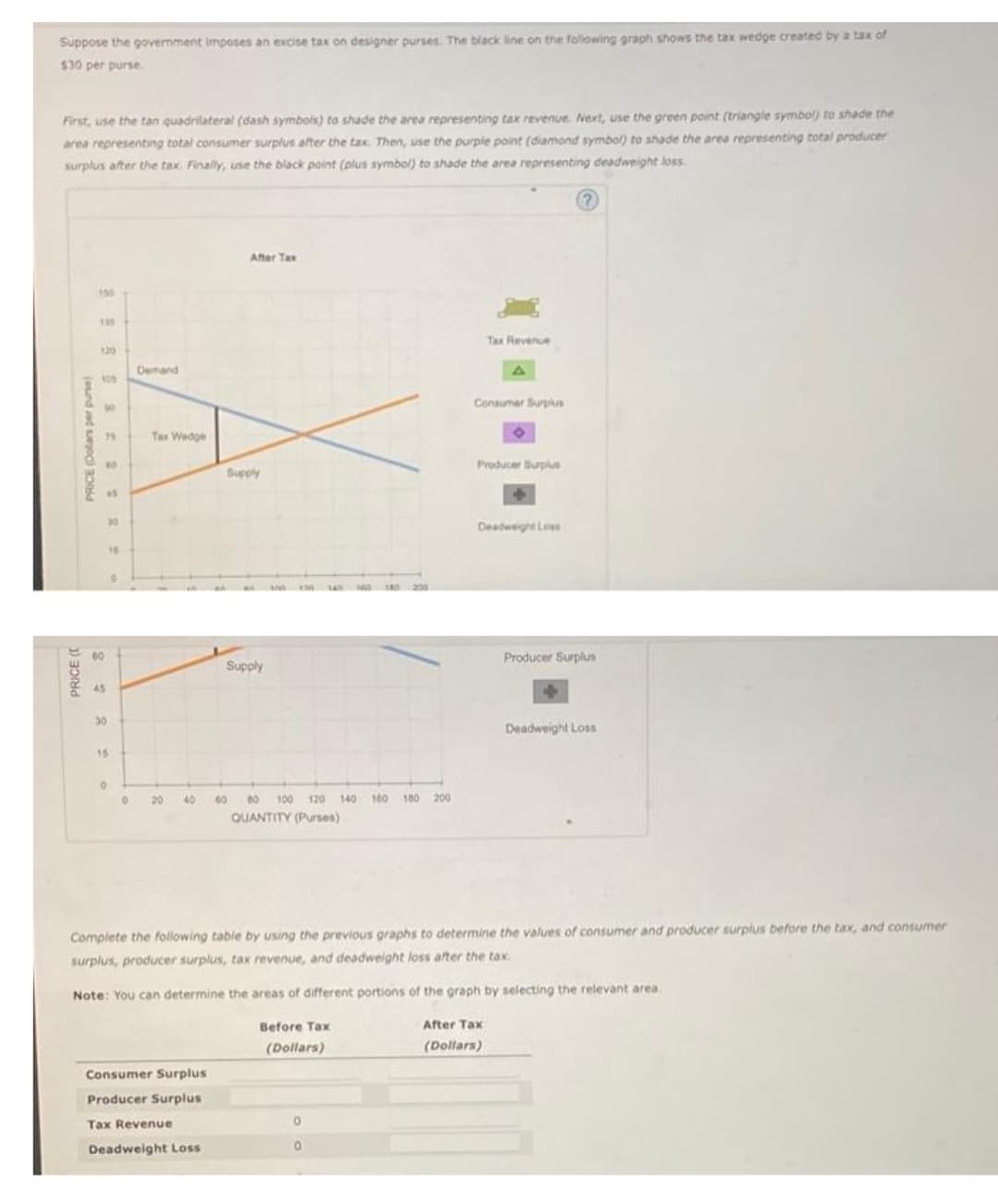

Transcribed Image Text:Suppose the govermment imposes an excise tax on designer purses. The black line on the folowing graph shows the tax wedge created by a tax of

$30 per purse

First, use the tan quadrilateral (dash symbols) to shade the area representing tax revenue. Next, use the green point (triangle symbol) to shade the

area representing total consumer surplus after the tax. Then, use the purple point (diamond symbol) to shade the area representing total producer

surplus after the tax. Finally, use the black point (plus symbol) to shade the area representing deadweight loss

2)

After Tax

150

135

Tax Revenue

120

Demand

100

Consumer Surplus

to

Tax Wedge

Producer Burplus

Supply

45

30

Deadwight Loes

200

00

Producer Surplus

Supply

45

30

Deadweight Loss

15

20

40

60

80

100

120 140 M60 100 200

QUANTITY (Purses)

Complete the following table by using the previous graphs to determine the values of consumer and producer surplus before the tax, and consumer

surplus, producer surplus, tax revenue, and deadweight loss after the tax.

Note: You can determine the areas of different portions of the graph by selecting the relevant area.

Before Tax

After Tax

(Dollars)

(Dollars)

Consumer Surplus

Producer Surplus

Tax Revenue

Deadweight Loss

PRICE (

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning