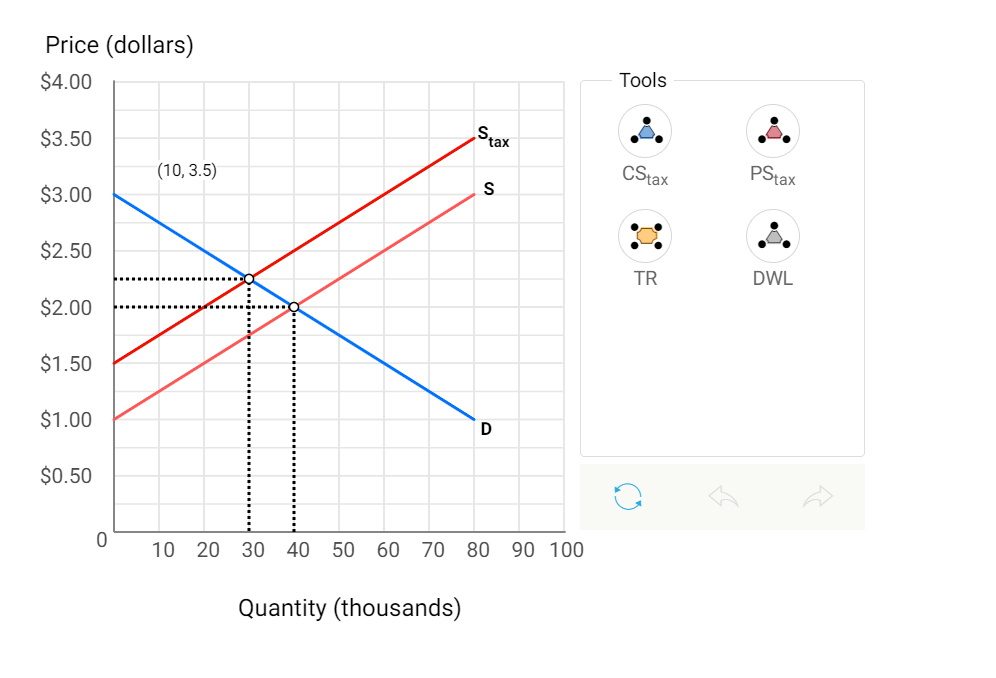

Suppose a tax is levied in the market for soda. Consider a $0.50 excise tax on producers for each soda sold. The graph illustrates the demand and supply curves for soda both before and after the tax is levied. Use the graph below to answer the remaining parts of this question. SEE GRAPH d. What is the consumer surplus generated after the imposition of the tax? Shade in this area on the graph. Instructions: Use the tool provided “CStax” to illustrate this area on the graph. Consumer surplus after the imposition of the tax is $ _____ thousand. e. What is the producer surplus generated after the imposition of the tax? Shade in this area on the graph. Instructions: Use the tool provided “PStax” to illustrate this area on the graph. Producer surplus after the imposition of the tax is $ _____ thousand. f. What is the total revenue

Suppose a tax is levied in the market for soda. Consider a $0.50 excise tax on producers for each soda sold. The graph illustrates the demand and supply

SEE GRAPH

d. What is the

Instructions: Use the tool provided “CStax” to illustrate this area on the graph.

Consumer surplus after the imposition of the tax is $ _____ thousand.

e. What is the

Instructions: Use the tool provided “PStax” to illustrate this area on the graph.

Producer surplus after the imposition of the tax is $ _____ thousand.

f. What is the total revenue generated from the tax? Shade in this area on the graph.

Instructions: Use the tool provided “TR” to illustrate this area on the graph.

Tax revenue from the tax after the imposition of the tax is $_____ thousand.

g. What is the total economic surplus generated after the imposition of the tax?

Total economic surplus after the imposition of the tax is $ _____ thousand.

h. What is the

Instructions: Use the tool provided “DWL” to illustrate this area on the graph.

The deadweight loss after the imposition of the tax is $_____ thousand.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images