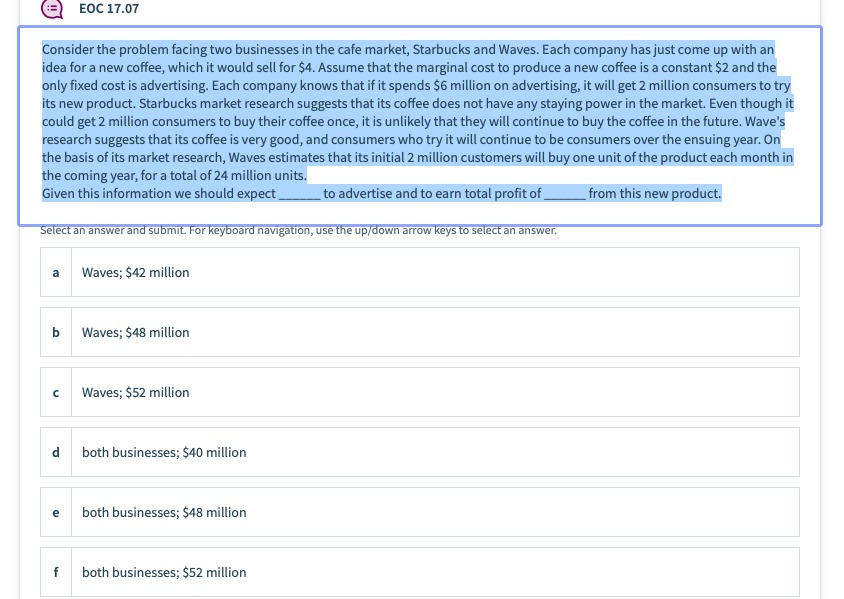

Consider the problem facing two businesses in the cafe market, Starbucks and Waves. Each company has just come up with an idea for a new coffee, which it would sell for $4. Assume that the marginal cost to produce a new coffee is a constant $2 and the only fixed cost is advertising. Each company knows that if it spends $6 million on advertising, it will get 2 million consumers to tr its new product. Starbucks market research suggests that its coffee does not have any staying power in the market. Even though could get 2 million consumers to buy their coffee once, it is unlikely that they will continue to buy the coffee in the future. Wave's research suggests that its coffee is very good, and consumers who try it will continue to be consumers over the ensuing year. On the basis of its market research, Waves estimates that its initial 2 million customers will buy one unit of the product each month i the coming year, for a total of 24 million units. Given this information we should expect, to advertise and to earn total profit of . from this new product.

Consider the problem facing two businesses in the cafe market, Starbucks and Waves. Each company has just come up with an idea for a new coffee, which it would sell for $4. Assume that the marginal cost to produce a new coffee is a constant $2 and the only fixed cost is advertising. Each company knows that if it spends $6 million on advertising, it will get 2 million consumers to tr its new product. Starbucks market research suggests that its coffee does not have any staying power in the market. Even though could get 2 million consumers to buy their coffee once, it is unlikely that they will continue to buy the coffee in the future. Wave's research suggests that its coffee is very good, and consumers who try it will continue to be consumers over the ensuing year. On the basis of its market research, Waves estimates that its initial 2 million customers will buy one unit of the product each month i the coming year, for a total of 24 million units. Given this information we should expect, to advertise and to earn total profit of . from this new product.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter21: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.4CP: Break-even analysis Somerset Inc. has finished a new video game, Snowboard Challenge. Management is...

Related questions

Question

Transcribed Image Text:ЕOC 17.07

Consider the problem facing two businesses in the cafe market, Starbucks and Waves. Each company has just come up with an

idea for a new coffee, which it would sell for $4. Assume that the marginal cost to produce a new coffee is a constant $2 and the

only fixed cost is advertising. Each company knows that if it spends $6 million on advertising, it will get 2 million consumers to try

its new product. Starbucks market research suggests that its coffee does not have any staying power in the market. Even though it

could get 2 million consumers to buy their coffee once, it is unlikely that they will continue to buy the coffee in the future. Wave's

research suggests that its coffee is very good, and consumers who try it will continue to be consumers over the ensuing year. On

the basis of its market research, Waves estimates that its initial 2 million customers will buy one unit of the product each month in

the coming year, for a total of 24 million units.

Given this information we should expect

to advertise and to earn total profit of

from this new product.

Select an answer and submit. For keyboard

gation, use the up/down arrow keys to select an answer.

Waves; $42 million

a

Waves; $48 million

Waves; $52 million

both businesses; $40 million

e

both businesses; $48 million

f

both businesses; $52 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning