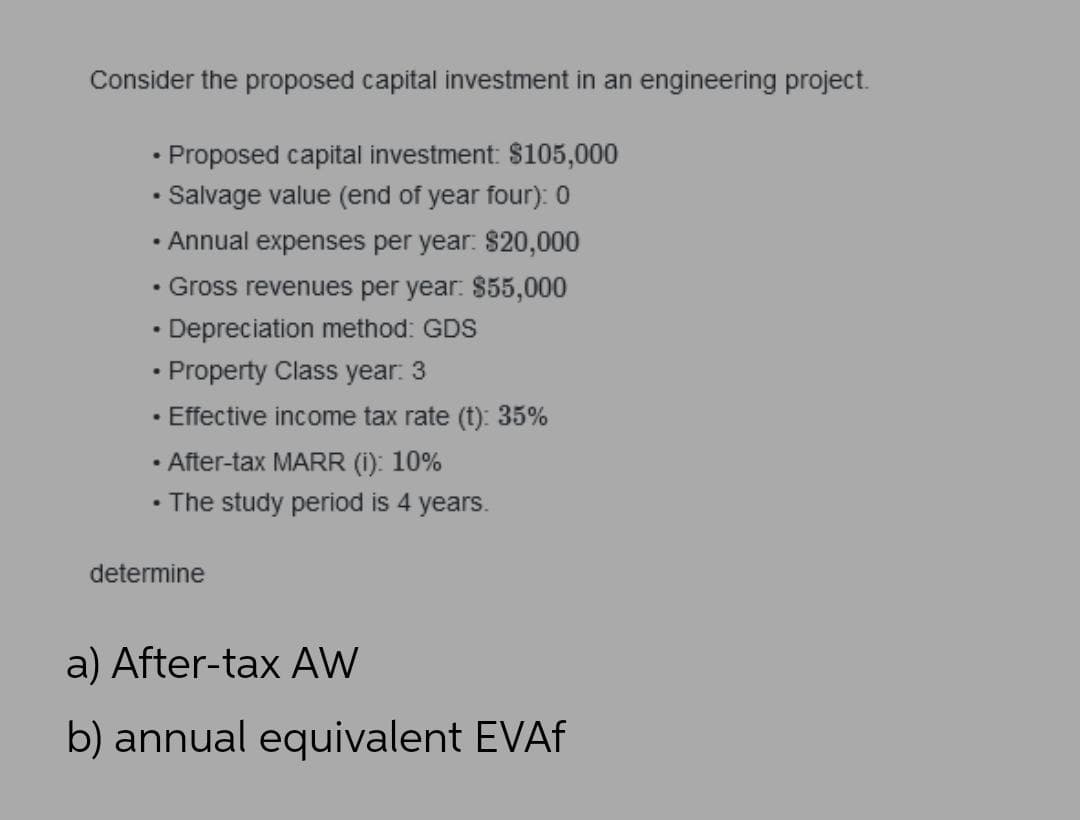

Consider the proposed capital investment in an engineering project. • Proposed capital investment: $105,000 • Salvage value (end of year four): 0 • Annual expenses per year: $20,000 Gross revenues per year: S55,000 Depreciation method: GDS • Property Class year. 3 • Effective income tax rate (t): 35% • After-tax MARR (i): 10% • The study period is 4 years. determine a) After-tax AW b) annual equivalent EVAF

Q: In the Malthusian growth model, what happens in the steady state if total factor productivity goes ...

A: The Malthusian Theory of Population is based on the exponential growth of population and arithmetic ...

Q: The price of a good increased from AED 5000 to AED 7000 and accordingly the quantity sales of that g...

A:

Q: Who are involuntary unemployed? A) Individuals who are willing to work at the market wage but they ...

A: Unemployment, the state of one who is equipped for working, effectively looking for work, however in...

Q: PB=1 PB=2 PB=3 PB=4 PA=1 4, 4 8, 2 10, 1 0,0 PA=2 2, 8 6, 6 12, 4 12, 2 PA=3 1, 10 4, 12 8, 8 16, 5 ...

A: Answer -

Q: A small open economy is described by the following equations: C = 50+0.75(Y-T), I = 200 -20r, NX = 2...

A: IS–LM model, or Hicks–Hansen model, is a two-dimensional macroeconomic tool that shows the relations...

Q: Suppose an individual in the Grossman model is trying to decide what to have for dinner. His options...

A: 1) The given Utillity function is: U = 3Z+H The utility for every meal For Steak and eggs U = 3(7) -...

Q: 3. Problem Solving. Given the demand equation for chocolate bars Q = 1,600 – 300P and the supply equ...

A: Note:- Since we can only answer upto three subparts, we'll answer first three. Please repost the que...

Q: 6. Limitations of GDP Although GDP is a reasonably good measure of a nation's output, it does not ne...

A: Meaning of Macroeconomics: The term macroeconomics refers to the situation of economic and scarcit...

Q: the first three years, it will prov of profit each year. For the n hual profit will be P35,000. For ...

A: Given that, Investment is P250000 first, three-year profit is P20000. next four-year profit is P3500...

Q: What do you understand by demand and what would you say is its main purpose?

A: Demand refers to the ability and willingness along with the desire to buy a good. Demand and supply ...

Q: Imagine that you are considering starting your own business. Please share what you think would be so...

A: The potential advantages that an individual, investor, or organization foregoes by choosing one opti...

Q: ention two possible situations when dealing with exports and imports.

A: The process that involves the transfer of goods from one person to another being done in exchange fo...

Q: Economists differ in their views of the role of the government in promoting economic growth. At the ...

A: Economists have different views on the role of the government in the economy. Some economists argue ...

Q: LEIS company is planning to borrow P10.5M for a company expansion and is not sure what the interest ...

A: # When Interest Rate = 10% Annual Worth of loan Cost = -10.5(10%)(1-(1+10%)-5 = -10.5*0.26 = -2...

Q: In the demand curve, there is a mid-point. Determine the value of: i. Elasticity of demand in the m...

A: Elasticity at mid point = 1 Elasticity of demand above the mid point is greater than 1

Q: Find the lower bound of the confidence interval, rounding the result to four decimal places. p(1 – p...

A: Given Sample proportion p=0.57 Sample size =1007 We have to find 95% confidence interval for the pr...

Q: A small open economy is described by the following equations: C = 50+0.75(Y-T), I = 200 -20r, NX = 2...

A: LM curve shows the direct relationship between interest rate and output. It means as the interest ra...

Q: Consider the following total cost function: TC = 1500 + 300Q -3602 + 203 What is the quantity that m...

A: In order to find the quantity at which Marginal Cost is minimised, we will first find the MC functio...

Q: Capital Investment Decision:Accounting Rate-of-Return Method Boink Corporation manufactures metal ha...

A: Cost is the expenditure that is incurred in the production of goods and services. It means the raw m...

Q: 3. Assume equations 1 and 2 below were estimated from the data gathered that will represent the dema...

A: Note:- Since we can only answer up to three subparts, we'll answer first three. Please repost the qu...

Q: Consider a project which involves the investment of P100,000 now and P100,000 at the end of one year...

A: Gh

Q: Labor Input to Produce Chairs and Tables Spain 1 Morocco 3 Chair Table 10 5

A: TRUE It can be concluded from the given schedule that Spain has a comparative advantage in the produ...

Q: explain in a simple way, what is demand?

A: Demand is an economic term that means a consumer's willingness to purchase goods and services and ea...

Q: 2. Ann has started working and is saving to buy a house, which requires a down-payment of d. She has...

A: This is essentially an expenditure minimizing exercise for Ann. To be able to save the down payment ...

Q: Iwo firms produce a homogenous product. Let p denote the product's price. The output I of firm 1 is ...

A: The equilibrium price(P) and quantity(Q) can be estimated by using the following steps: First: Find ...

Q: A 40% increase in price led the quantity supplied of bicycles in a competitive market to increase fr...

A: Elasticity of supply measures the responsiveness of quantity supplied with respect to change in pric...

Q: Consider a geometric series of cash flows that begins at time 5 with a cash flow of $5,000. Cash flo...

A: Given:- Cash flow time 5 = $ 5000 Annual growth in cash flow = 7% Number in cash flows = 9 Future ...

Q: Determine the equilbirum price (p) and quantity (q) if P = 4/25 q + 50 %3D and q= 100p + 6500/7

A: At equilibrium, demand and supply for goods are equal at certain price and quantity are called equil...

Q: The multiplier for the economy in the above diagram: a. is 3 b. is 4.8 C. is 4 d is 5.2

A: The measure that depicts the final value of goods and services being produced in a year during an ec...

Q: An investment of x pesos is made at the end of each year for three years, at an interest rate of 9% ...

A: The formula for Future Value: FV = Present Value(1 + r)n Where r is the rate of interestn is the tim...

Q: all problems in economics are about scarcity, that is, about how to use given resources for satisfyi...

A: All problems in economics are about scarcity, that is about how to use given resources for satisfyin...

Q: Given a utility function of 2 goods X and Y: U (X,Y) = X +Y1, MRSXY as the consumer substitutes X fo...

A:

Q: $10- $10 efer to Figure (Graph A). With $5 $5 B 20 40 60 80 100 10 20 30 40 Quantity Quantity Graph ...

A: Total revenue in financial aspects alludes to the total receipts from deals of a given amount of lab...

Q: Suppose the market for apples is perfectly competitive. The short-run average total cost and margina...

A: (1) A perfectly competitive firm produces at P=MC in short run. The market price for apples is $26 ...

Q: Mirtha owns an online jewelry store that specializes in earrings. In March, she sells 50 pairs of ea...

A: Total Cost refers to the sum total of all the costs incurred on the production and selling of the go...

Q: 5. There are n firms in a competitive industry. The market demand function is given by p = 10 – Q. A...

A: Market Demand function : p = 10 - Q Where , Q = Market quantity with n firms So , Q = nq Cost ...

Q: Hi! We this for our Microeconomics course. We are tasked to analyze the following. Please help me wi...

A: The supply curve shows the positive relationship between the price and quantity supplied. The demand...

Q: Martin has a brother and can take a selfish action, which pays him $10 and his brother $0, or an alt...

A: Nash equilibrium is that point of a steady state from which no players wants to deviate . Martin has...

Q: What are two guidelines the manager should keeo in mind with measuring the maginal cost correctly?

A:

Q: Two processes can be used for producing a new engine. Process A will have a first cost of P750,000, ...

A: Future Worth is calculated by compounding the cash flows to end life of the project at a given inter...

Q: Use the exact internal rate of return method to determine which of the four independent projects sho...

A: *Answer:

Q: Use the diagram below to answer the following questions. Assume an initial market price of $4. a. Id...

A: Demand Curve: - demand curve is the graphical way of showing the relationship between the quantity d...

Q: Figure 6 Response to a Business Cycle Expansion Price of Bonds, B Step 1. A business cycle expansion...

A: If there is an excess of the supply of the bond in the market, it would make the more supply then th...

Q: About the measurement of the GDP O A The profits of a firm are higher than the value added of the fi...

A: Option A is false because Value-added includes profit so this is not true. Option C is also incorrec...

Q: Suppose the equilibrium price for good quality used cars is $20,000. And the equilibrium price for p...

A: Adverse selection occurs when one party to a contract has more information than the other. Here the ...

Q: Suppose two firms compete as Cournot Oligopolists. The profit functions of these two firms are π_...

A: Game Theory refers to the study of decision making which uses various mathematical models along with...

Q: Identify the term being referred to: A long term loan obtained from a bank and is secured by fixed ...

A: Bank offers various kind of loan . In terms of time span there are two Loan short run and long run .

Q: Explain briefly the three basic questions that every country must ask themselves about their economi...

A: Quantity of enterprise depends on certain factors which results into its success. It would increase ...

Q: You deposit P10 000 into a 9% account today . At the end of two years , you will deposit P30 000 . I...

A: Deposit today = 10000 Interest rate = 9 %

Q: • The large increase in the supply of central bank money between 2008 and 2015 was absorbed by house...

A: Introduction Why bank reserves increases during 2008-15: This has began to rise after the financial ...

Step by step

Solved in 2 steps with 4 images

- Chibitatat Corporation provided the following data for calendar year ending on December 31, 2020. Philippines (php) Abroad (php) Gross Income 4,000,000 2,000,000 Deductions 2,500,000 600,000 Income Tax Paid 150,000 If the corporation is a domestic corporation and it opts to claim the tax paid abroad as deductions from gross income, its income tax payable is:Given: Before -Tax Cash Flow (BT-CF) for Kal Tech Systems in 2012 for an equipment that will be depreciated using the SL method with salvage value of $10,000. Year 0 1 2 3 4 5 BT-CF -$120,000 32,000 32,000 32,000 32,000 32,000 Market value - $36,000 What is the after-tax return if the company is in the 34% income tax bracket? The incremental tax rate is 34%. Also, it is known that the before-tax return is 16.65% Group of answer choices 9.65% 11.29% 10.16% 10.99%The effective combined tax rate in a firm is 28%. An outlay of $2 million for certain new assets is under consideration. Over the next 9 years, these assets will be responsible for annual receipts of $650,000 and annual disbursements (other than for income taxes) of $225,000. After this time, they will be used only for stand-by purposes with no future excess of receipts over disbursements.(a) What is the prospective rate of return before income taxes?(b) What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 9 years?(c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation?

- The effective combined tax rate in a firm is 28%. An outlay of $2 million for certain new assets is under consideration. Over the next 9 years, these assets will be responsible for annual receipts of $650,000 and annual disbursements (other than for income taxes) of $225,000. After this time, they will be used only for stand-by purposes with no future excess of receipts over disbursements. (a) What is the prospective rate of return before income taxes? (b) What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 9 years? (c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation? please solve it step by stepquipment associated with manufacturing small railcars had a first cost of $170,000 with an expected salvage value of $30,000 at the end of its 5-year life. The revenue was $630,000 in year 2, with operating expenses of $98,000. If the company’s effective tax rate was 36%, what would be the difference in taxes paid in year 2 if the depreciation method were straight line instead of Modified Accelerated Cost Recovery System (MACRS)? The MACRS depreciation rate for year 2 is 32%. The difference in taxes paid is determined to be $ .An engineer who made an annual return of 8% after taxes on a stock investment was told by his accountant that this is equivalent to a 12% per year before-tax return. What percentage of taxable income is the accountant assuming will be taken by taxes?

- An engineering firm purchased 25 years ago a mini power plant for Php 5.0 M. Other expenses including repairs amounted to Php 500,000. The mini power plant is up to next 25 years only and for the plant to operate. The salcage value is Php 500,000. Determine the depreciation charge during the 20TH and 40TH year. Also determine the book value at the end of 25th and 45th years if interest is 12% using a) Sum of the Years Digit method, b) Sinking Fund method and c) Double Declining Balance method . Pls show complete handwritten solutionA company with a 34% marginal income tax rate is considering the purchase of a $75,000 piece of equipment that is classified as 3-year property in the MACRS depreciation schedule. The equipment will provide the following estimated benefits in Year 1-5. Year Before-Tax Cash Flow 0 −$75,000 1 $10,000 2 $25,000 3 $50,000 4 $15,000 If the company purchases the equipment, how much income tax will it owe in Year 3? Group of answer choices $13,223 $17,000 $25,500 No income tax is owedDuring one year a business had gross income of $3.2 million, operating expenses of $2.7 million excluding interest on loans, depreciation of $0.2 million, and no natural resource depletion. The company had one loan outstanding during the year. During the year, four quarterly payments of $55,000 ($40,000 of principal + $15,000 of interest) were made on the loan. What is the company's taxable income for the year? Group of answer choices $240,000 $245,000 $285,000 $300,000

- A corporate expects to receive $36,144 each year for 15 years if a particular project is undertaken. There will be an initial investment of $100,705. The expenses associated with the project are expected to be $7,740 per year. Assume straight-line depreciation, a 15-year useful life, and no salvage value. Use a combined state and federal 48% marginal tax rate, MARR of 8%, determine the project's after-tax net present worth.An asset with a first cost of $9000 is depreciated using 5-year MACRS recovery. The CFBT is estimated at $10,000 for the first 4 years and $5000 thereafter as long as the asset is retained. The effective tax rate is 40%, and money is worth 10% per year. In present worth dollars, how much of the cash flow generated by the asset over its recovery period is lost to taxes?A factory has decided to purchase some new equipment for P600, 000. The equipment will be kept for 10 years before being sold. The estimated salvage value for depreciation purposes is to be P45,000. Using straight line method, what is the annual depreciation on the equipment? a. P55, 500 b. P50,000 c. P51,500 d. P52, 500