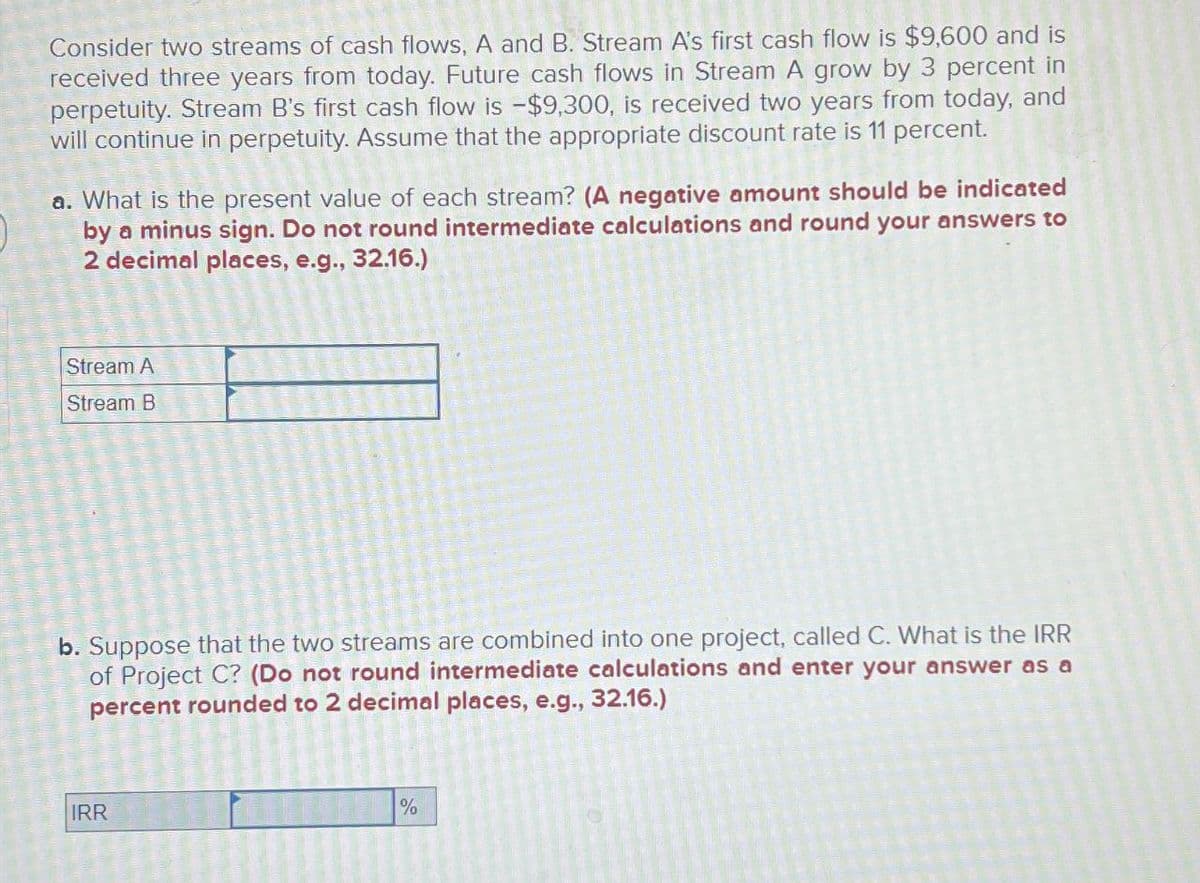

Consider two streams of cash flows, A and B. Stream A's first cash flow is $9,600 and is received three years from today. Future cash flows in Stream A grow by 3 percent in perpetuity. Stream B's first cash flow is -$9,300, is received two years from today, and will continue in perpetuity. Assume that the appropriate discount rate is 11 percent. a. What is the present value of each stream? (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Stream A Stream B b. Suppose that the two streams are combined into one project, called C. What is the IRR of Project C? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %

Consider two streams of cash flows, A and B. Stream A's first cash flow is $9,600 and is received three years from today. Future cash flows in Stream A grow by 3 percent in perpetuity. Stream B's first cash flow is -$9,300, is received two years from today, and will continue in perpetuity. Assume that the appropriate discount rate is 11 percent. a. What is the present value of each stream? (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Stream A Stream B b. Suppose that the two streams are combined into one project, called C. What is the IRR of Project C? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 11E

Related questions

Question

None

Transcribed Image Text:Consider two streams of cash flows, A and B. Stream A's first cash flow is $9,600 and is

received three years from today. Future cash flows in Stream A grow by 3 percent in

perpetuity. Stream B's first cash flow is -$9,300, is received two years from today, and

will continue in perpetuity. Assume that the appropriate discount rate is 11 percent.

a. What is the present value of each stream? (A negative amount should be indicated

by a minus sign. Do not round intermediate calculations and round your answers to

2 decimal places, e.g., 32.16.)

Stream A

Stream B

b. Suppose that the two streams are combined into one project, called C. What is the IRR

of Project C? (Do not round intermediate calculations and enter your answer as a

percent rounded to 2 decimal places, e.g., 32.16.)

IRR

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College