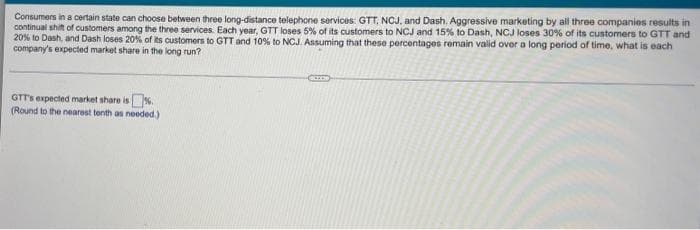

Consumers in a certain state can choose between three long-distance telephone services: GTT, NCJ. and Dash. Aggressive marketing by all three companies results in continual shit of customers among the three services. Each year, GTT loses 5% of its customers to NCJ and 15% to Dash, NCJ loses 30% of its customers to GTT and 20% to Dash, and Dash loses 20% of its customers to GTT and 10% to NCJ. Assuming that these percentages remain valid over a long period of time, what is each company's expected market share in the long run? GTTs expected market share is (Round to the nearest tenth as needed)

Q: Use the following assumptions to solve this assignment: 1. There are three countries- Argentina,…

A: Given information Total labor hours=60 hours Required input for the production of oil and bee is…

Q: Table 1 data for household consumption and income Consumption per week (US $) (Y) 55, 60, 65, 70, 75…

A: Given Data Given random sample data

Q: Explain Foreign exchange and give examples

A: Foreign exchange refers to the trading of one currency for the other currency. The trade between two…

Q: In 2016, the largest portion of federal employees were in which of the following sectors? Multiple…

A: The federal government jobs accounted for a significant portion of the employment sector in the US.

Q: Discuss the importance of Asia in global business.

A: There are the following importance of Asia in global business. The most populated market of the…

Q: radio service panel truck initially costs P100T. Its resale value at the end of the fifth year is…

A: Declining Balance Method is also called the Constant-Percentage Method or the Matheson formula.

Q: 4. The opportunity cost of changing your decision on what to major in college is highest___ a.…

A: Opportunity cost can be defined as the benefit that has been forgone of the next best alternative…

Q: 1. Two companies produce similar items for the same market. Company 1 produces q1 items and Company…

A: Given information Demand function P=90-q1-q2 TC1=1/4*q12 TC2=6q2

Q: Make the following calculations according to the table below. Good A Good B Good C Good D Quantitiy…

A: The GDP price deflator measures the changes in prices for all of the goods and services produced in…

Q: Refer to the following information about 3 hypothetical perfectly competitive firms' costs at their…

A: Answer: Given, Firm 1 Firm 2 Firm 3 Price = $150 ATC = $140 AVC = $130 Price = $150 ATC =…

Q: Total Total Total Average Average Average Product Fixed Variable Total Marginal Fixed Variable Total…

A: Total cost is the sum of fixed cost and variable cost. Fixed cost is constant throughout the…

Q: What do you think are the primary obstacles to state and local governments adopting data analysis to…

A: The economic slump, which has been marked by high unemployment and foreclosure rates, as well as…

Q: Blue berry pharmaceuticals in Bangladesh has decided to increase their yearly spending advertisement…

A: Given information, Initial expenditure on advertisement= 10 million Final expenditure on…

Q: -When you begin working in an industry if given the opportunity to choose the method by which you…

A: Below is the formula to find the future worth and present worth: Future Value = Present Value 1 +…

Q: A firm with decreasing returns to scale can expect to produce [a. more than, b. less than,…

A: Returns to scale Returns to scale is a metric for determining how efficient a production function is…

Q: 22 LS 20 18 Minimum wage 16 14 12 10 LD 100 200 300 400 500 600 700 Quantity (thousAnds of workers)…

A: The markets are the place where the buyers and the sellers of the economy meet and interact with…

Q: The production function q = K1.2 + 3L1.2 exhibits [increasing return to scale, constant return to…

A: production function, in financial matters, is a condition that communicates the connection between…

Q: Determine the value of the given gradient factor.

A: Given, (F/G, 6.025, 17)where, interest rate : 6.025and n : 17 Gradient Factor can be calculated…

Q: Analyze the Human Development Index rate of the Philippines over the years, interpret and write its…

A: Given that: Year HDI HDI Ranking 2019 0.718 107 2018 0.711 111 2017 0.706 111 2016 0.704…

Q: 22. For the three-part question that follows, provide your answer to each part in the given…

A: [a] New salary = $35,000 + 4.5%(increase in salary) = $36575 As inflation reduces the purchasing…

Q: Consider a firm that suffers diseconomies of scale. If this firm wants to produce half as…

A: "Diseconomies of scale occurs when each item produced cost more and more as a firm continue to grow…

Q: Capitalized cost of a piece of eqpt was found to be P1.5M. The rate of interest was 12% with salvage…

A: Capitalised cost = Annual Worth/i

Q: From the following data relating to the number of letters posted a port office find the seasonal…

A: In the mentioned question we have to calculate seasonal variations using the method of simple…

Q: What amount does each bidder bid in the Bayesian Nash equilibrium of a 2nd price auction? The…

A: Each advertiser offers a fixed amount per impression, which is compared to the other available bids,…

Q: When the price of good 1 decreases, the following is true (select all that applies): a) If good 1 is…

A: Goods refers to the products that meet human desires and give usefulness, such as a gratifying…

Q: Describe capital deepning

A: To produce goods and services various factors of production are required and they need to be…

Q: If the Keynesian AD shortfall is $425 billion and MPC is 0.86, calculate the size of the desired tax…

A: Marginal propensity to consume refers to the change in consumption with respect to change in income.

Q: When firm must pay lump sum tax (which is a fixed sum, independent of whether it produces any…

A: "A lump sum tax is a tax which is imposed as a fixed amount and not on the basis of output."

Q: The demand function for Wally Winka's Neverending Lollipops is given by p- (10 - x)in(x+ 7) where p…

A:

Q: A backward-bending labor supply curve occurs when: None of the above a negatively sloped labor…

A: Labor supply curve shows the relationship between the wage rate and the number of workers willing to…

Q: A machine part to be machined may be made either from an alloy of aluminum or steel. There is an…

A: Cost per unit is the cost of merchandise sold or the cost of deals, is how much cash that an…

Q: Please answer What are some of the major developments in trade over the past two decades? What are…

A: Economic development is basically the process of improving a nation's, region's, local community's,…

Q: Assume that Lucky Bank is required to hold a 10% deposits as reserves, and there is a $3000 increase…

A: The inverse of the reserve requirement, the money multiplier is the quantity by which deposits are…

Q: 3. When one country joins a free trade area with a common external tariff, it causes: O a. Trade…

A: In economics, it is very important for the firms to engage in trading activities because trading…

Q: Economic depreciation is the A) term given to a fall in a company's stock price. B) name given to…

A: Economic depreciation is the opportunity cost of the firm using capital that it owns. It is measured…

Q: 7..Comment on the following statement about perfect competition: A firm that has incurred a lot of…

A: When we consider the short-run market then there will be both fixed costs as well as variable costs…

Q: Explain the cause-effect relationship...

A: The term "cause and effect" refers to a link between two events in which one causes the other.

Q: Analyze below Cash Flow and compute for the unknown value.

A: From the given cash flow diagram we are required to find the Present value, Annual value and the…

Q: 22 LS 20 18 Minimum wage 16 14 12 10 LD 100 200 300 400 500 600 700 Quantity (thousAnds of workers)…

A: The idea of a minimum wage is slightly controversial in the domain of public policy. The imposition…

Q: (P/A, 5%,7) has a value equals to a. 5.7864 b. 0.070… c. 8.142 d. 0.8142

A: (P/A, r, n) is a present value of the annuity factor. Where, r is an interest rate n is the number…

Q: #1 What is it about the shhort run that makes it so that monetary can be effective? What do we mean…

A: In the mentioned question we have been asked what exactly effective state when it comes about…

Q: Find the equilibrium quantity and equilibrium price for the commodity whose supply and demand…

A: Answer: Given, Supply function: p=q2+20q Demand function: p=-2q2+10q+11,400 At equilibrium,Quantity…

Q: When you were born, your grandfather established a trust fund for you in the Cayman Islands. The…

A: PLEASE FIND THE ANSWER BELOW.

Q: Acertain industrial equipment has a maintenance cost of Php 2500.00 per month for the first year of…

A: The amount that should be invested initially to cover the upcoming maintenance cost should be equal…

Q: Kevin takes out a home loan for $150,000. Payments are made at the end of every month for 30 years.…

A: According to the question, Loan Amount = $150,000 Time period = 30 years Rate of Interest = 9% =…

Q: What are some of the major developments in trade over the past two decades? What are the…

A: Economic development refers to initiatives, policies, or activities that aim to enhance a…

Q: Compare the interest earned by $9,000 for six years at 7% simple interest with interest earned by…

A: Simple interest and compound interest are earned on initial amount deposited but with sufficiently…

Q: . Assume that Lucky Bank is required to hold a 10% deposits as reserves, and there is a $3000…

A: It basically refers to the maximum amount of money that commercial bank can generate by a initial…

Q: Country A's payoff If majority invest If majority does not invest Country A does not invest Country…

A: Given: Country A's payoff Country A invest Country A does not invest If majority invest 1 2…

Q: 21. If output is above the full employment level, wages will (rise, fall) and the aggregate supply…

A: The economics as a study is based upon the idea that the resources which are present with the…

Urgently need

Step by step

Solved in 2 steps with 1 images

- A clothing store and a jeweler are located side by side in a shopping mall. If the clothing store spend C dollars on advertising and the jeweler spends J dollars on advertising, then the profits of the clothing store will be (36 + J )C - 2C 2 and the profits of the jeweler will be (30 + C )J - 2J 2. The clothing store gets to choose its amount of advertising first, knowing that the jeweler will find out how much the clothing store advertised before deciding how much to spend. The amount spent by the clothing store will be Group of answer choices $17. $34. $51. $8.50. $25.50.ollowing is the payoff table for the Pittsburgh Development Corporation (PDC) Condominium Project. Amounts are in millions of dollars. State of Nature Decision Alternative Strong Demand S1 Weak Demand S2 Small complex, d1 8 7 Medium complex, d2 14 5 Large complex, d3 20 -9 Suppose PDC is optimistic about the potential for the luxury high-rise condominium complex and that this optimism leads to an initial subjective probability assessment of 0.8 that demand will be strong (S1) and a corresponding probability of 0.2 that demand will be weak (S2). Assume the decision alternative to build the large condominium complex was found to be optimal using the expected value approach. Also, a sensitivity analysis was conducted for the payoffs associated with this decision alternative. It was found that the large complex remained optimal as long as the payoff for the strong demand was greater than or equal to $17.5 million and as long as the payoff for…Youngstown-Warren Regional Airport (YNG) has had a difficult time securing passenger service from a commercial airline. a.) A few years ago, the Port Authority offered an incentive to United with guaranteed revenue equal to approximately $1.5 million, but United declined saying it was not sufficient. Suppose United anticipated that it would cost $1 million to offer flights from Youngstown, so with a guaranteed revenue of $1.5 million, their anticipated profit would equal $500,000. Given that they still chose to decline offering service from YNG, what do you know must be true? Put this in terms of implicit costs and economic profit. b.) In 2019, YNG’s only commercial carrier, Allegiant Air stopped offering service from YNG, despite the fact that it was known to be profitable. Allegiant Air’s service from YNG was known to be profitable. Why would Allegiant Air pull service from YNG even if it had been their service from YNG had been generating a profit? Note, Allegiant started…

- When a famous painting becomes available for sale, it is often known which museum or collector will be the likely winner. Yet, the auctioneer actively woos representatives of other museums that have no chance of winning to attend anyway. Suppose a piece of art has recently become available for sale and will be auctioned off to the highest bidder, with the winner paying an amount equal to the second highest bid. Assume that most collectors know that Valerie places a value of $15,000 on the art piece and that she values this art piece more than any other collector. Suppose that if no one else shows up, Valerie simply bids $15,000/2=$7,500 and wins the piece of art. The expected price paid by Valerie, with no other bidders present, is $________.. Suppose the owner of the artwork manages to recruit another bidder, Antonio, to the auction. Antonio is known to value the art piece at $12,000. The expected price paid by Valerie, given the presence of the second bidder Antonio, is $_______. .Two equal-sized newspapers have an overlap circulation of 10% (10% of the subscribers subscribe to both newspapers). Advertisers are willing to pay $8 to advertise in one newspaper but only $15 to advertise in both, because they're unwilling to pay twice to reach the same subscriber. Suppose the advertisers bargain by telling each newspaper that they're going to reach agreement with the other newspaper, whereby they pay the other newspaper $7 to advertise. According to the nonstrategic view of bargaining, each newspaper would earn _____ of the $7 in value added by reaching an agreement with the advertisers. The total gain for the two newspapers from reaching an agreement is ____. . Suppose the two newspapers merge. As such, the advertisers can no longer bargain by telling each newspaper that they're going to reach agreement with the other newspaper. Thus, the total gains for the two parties (the advertisers and the merged newspapers) from reaching an agreement with the…Two equal-sized newspapers have an overlap circulation of 10% (10% of the subscribers subscribe to both newspapers). Advertisers are willing to pay $15 to advertise in one newspaper but only $28 to advertise in both, because they're unwilling to pay twice to reach the same subscriber. Suppose the advertisers bargain by telling each newspaper that they're going to reach agreement with the other newspaper, whereby they pay the other newspaper $13 to advertise. According to the nonstrategic view of bargaining, each newspaper would earn ? of the $13 in value added by reaching an agreement with the advertisers. The total gain for the two newspapers from reaching an agreement is ? . Suppose the two newspapers merge. As such, the advertisers can no longer bargain by telling each newspaper that they're going to reach agreement with the other newspaper. Thus, the total gains for the two parties (the advertisers and the merged newspapers) from reaching an agreement with the…

- You are a developer that has just finished writing a new game and would like to publish it with this platform’s store. You do not expect to incur in any more costs developing the product. The app store typically keeps 20% of your revenue but, in order to give an incentive to sellers, the app store will only charge 15% of revenue to successful apps selling more than 60,000 units a year, and 10% to top-selling apps with more than 85,000 units sold. Assume that there are no extra (in-game) charges beyond the price to acquire the game. Using the data in the table below, at what price should you sell your game at? (Don't forget to take into account elasticity) Quantity Price Total Revenue To Store Revenue Elasticity 96261.14 $ 0.99 $ 95,298.53 10% $ 85,768.67 -0.11 85920.32 $ 1.99 $ 170,981.43 10% $ 153,883.29 -0.24 75579.50 $ 2.99 $ 225,982.70 15% $ 192,085.29 -0.41 65238.68 $ 3.99 $ 260,302.33 15% $…BPO Services is in the business of digitizing information from forms that are filled out by hand. In 2006, a big client gave BPO a distribution of the forms that it digitized in house last year, and BPO estimated how much it would cost to digitize each form. Form Type Mix of Forms Form Cost A 0.5 $3.00 B 0.5 $1.00 The expected cost of digitizing a form is . Suppose the client and BPO agree to a deal, whereby the client pays BPO to digitize forms. The price of each form processed is equal to the expected cost of the form that you calculated in the previous part of the problem. Suppose that after the agreement, the client sends only forms of type A. The expected digitization cost per form of the forms sent by the client is . This leads to an expected loss of per form for BPO. (Hint: Do not round your answers. Enter the loss as a positive number.)Consider the following 3×3 two player normal form game that is being repeated infinite number of times. The discounting factor for player 1 is δ1 and the discounting factor for player 2 is δ2. left center right up (10 ,40) (32 ,75) (65 ,58) middle (55 ,63) (21 ,45) (23 ,83) down (14 ,76) (16 ,65) (37 ,42) a. Find the total discounted utility for player 2 if player 1 decides to play middle all the time and player 2 decides to play left all the time. b. Now suppose both players are following the strategy of part (a) until player 1 decides to play up in the 6th stage. The the new NE after the 6th stage is (up,right). Find the total discounted utility for player 2 in this case. c. Using the grim trigger strategy, find the minimum value of δ2. Can you find any anomaly in your calculated value of δ2?

- Two partners start a business. Each has two possible strategies, spend full time or secretly take a second job and spend only part time on the business. Any profits that the business makes will be split equally between the two partners, regardless of whether they work full time or part time for the business. If a partner takes a second job, he will earn $20,000 from this job plus his share of profits from the business. If he spends full time on the business, his only source of income is his share of profits from this business. If both partners spend full time on the business, total profits will be $200,000. If one partner spends full time on the business and the other takes a second job, the business profits will be $80,000. If both partners take second job, the total business profits are $20,000. a) This game has no pure strategy Nash equilibria, but has a mixed strategy equilibrium. b) This game has two Nash equilibria, one in which each partner has an income of $100,000 and one in…Following is the payoff table for the Pittsburgh Development Corporation (PDC) Condominium Project. Amounts are in millions of dollars. State of Nature Decision Alternative Strong Demand S1 Weak Demand S2 Small complex, d1 8 7 Medium complex, d2 14 5 Large complex, d3 20 -9 Suppose PDC is optimistic about the potential for the luxury high-rise condominium complex and that this optimism leads to an initial subjective probability assessment of 0.8 that demand will be strong (S1) and a corresponding probability of 0.2 that demand will be weak (S2). Assume the decision alternative to build the large condominium complex was found to be optimal using the expected value approach. Also, a sensitivity analysis was conducted for the payoffs associated with this decision alternative. It was found that the large complex remained optimal as long as the payoff for the strong demand was greater than or equal to $17.5 million and as long as the payoff for…Following is the payoff table for the Pittsburgh Development Corporation (PDC) Condominium Project. Amounts are in millions of dollars. State of Nature Decision Alternative Strong Demand S1 Weak Demand S2 Small complex, d1 8 7 Medium complex, d2 14 5 Large complex, d3 20 -9 Suppose PDC is optimistic about the potential for the luxury high-rise condominium complex and that this optimism leads to an initial subjective probability assessment of 0.8 that demand will be strong (S1) and a corresponding probability of 0.2 that demand will be weak (S2). Assume the decision alternative to build the large condominium complex was found to be optimal using the expected value approach. Also, a sensitivity analysis was conducted for the payoffs associated with this decision alternative. It was found that the large complex remained optimal as long as the payoff for the strong demand was greater than or equal to $17.5 million and as long as the payoff for…