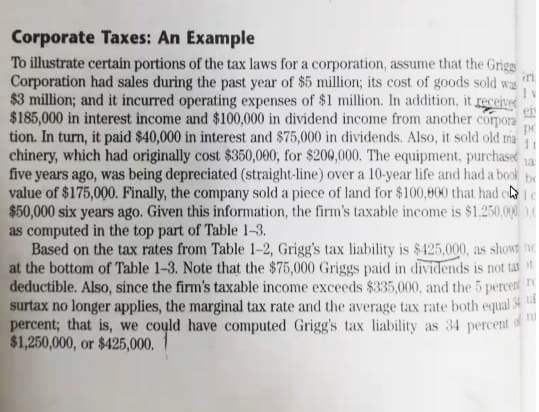

Corporate Taxes: An Example To illustrate certain portions of the tax laws for a corporation, assume that the Grigs Corporation had sales during the past year of $5 million; its cost of goods sold was $3 million; and it incurred operating expenses of $1 million. In addition, it received $185,000 in interest income and $100,000 in dividend income from another copora tion. In turn, it paid $40,000 in interest and $75,000 in dividends. Also, it sold old ma chinery, which had originally cost $350,00, for $20,000. The equipment, purchased five years ago, was being depreciated (straight-line) over a 10-year life and had a book value of $175,000. Finally, the company sold a piece of land for $100,800 that had o $50,000 six years ago. Given this information, the firm's taxable income is $1.250.000 as computed in the top part of Table 1-3, Based on the tax rates from Table 1-2, Grigg's tax liability is $425,000, as show at the bottom of Table 1-3. Note that the $75,000 Griggs paid in dividends is not tat deductible. Also, since the firm's taxable income exceeds $335,000, and the 5 percet surtax no longer applies, the marginal tax rate and the average tax rate both equal S percent; that is, we could have computed Grigg's tax liability as 34 percent $1,250,000, or $425,000. 1

Corporate Taxes: An Example To illustrate certain portions of the tax laws for a corporation, assume that the Grigs Corporation had sales during the past year of $5 million; its cost of goods sold was $3 million; and it incurred operating expenses of $1 million. In addition, it received $185,000 in interest income and $100,000 in dividend income from another copora tion. In turn, it paid $40,000 in interest and $75,000 in dividends. Also, it sold old ma chinery, which had originally cost $350,00, for $20,000. The equipment, purchased five years ago, was being depreciated (straight-line) over a 10-year life and had a book value of $175,000. Finally, the company sold a piece of land for $100,800 that had o $50,000 six years ago. Given this information, the firm's taxable income is $1.250.000 as computed in the top part of Table 1-3, Based on the tax rates from Table 1-2, Grigg's tax liability is $425,000, as show at the bottom of Table 1-3. Note that the $75,000 Griggs paid in dividends is not tat deductible. Also, since the firm's taxable income exceeds $335,000, and the 5 percet surtax no longer applies, the marginal tax rate and the average tax rate both equal S percent; that is, we could have computed Grigg's tax liability as 34 percent $1,250,000, or $425,000. 1

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter6: Accounting For Financial Management

Section: Chapter Questions

Problem 7P

Related questions

Question

Make an income statement.

Transcribed Image Text:Corporate Taxes: An Example

To illustrate certain portions of the tax laws for a corporation, assume that the Grigs

Corporation had sales during the past year of $5 million; its cost of goods sold was

$3 million; and it incurred operating expenses of $1 million. In addition, it received

$185,000 in interest income and $100,000 in dividend income from another corpora

tion. In turn, it paid $40,000 in interest and $75,000 in dividends. Also, it sold old ma

chinery, which had originally cost $350,00, for $200,000. The equipment, purchased

five years ago, was being depreciated (straight-line) over a 10-year life and had a book

value of $175,000. Finally, the company sold a piece of land for $100,800 that had cie

$50,000 six years ago. Given this information, the firm's taxable income is $1.250,000 4

as computed in the top part of Table 1-3.

Based on the tax rates from Table 1-2, Grigg's tax liability is $425,000, as showt he

at the bottom of Table 1-3. Note that the $75,000 Griggs paid in dividends is not t

deductible. Also, since the firm's taxable income exceeds $335,000, and the 5 percent

surtax no longer applies, the marginal tax rate and the average tax rate both equal S4

percent; that is, we could have computed Grigg's tax liability as 34 percent

$1,250,000, or $425,000,

in

11

1a

be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT