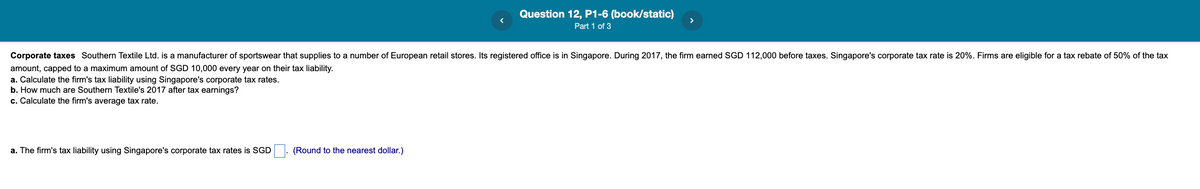

Corporate taxes Southern Textile Ltd. is a manufacturer of sportswear that supplies to a number of European retail stores. Its registered office is in Singapore. During 2017, the firm earned SGD 112,000 before taxes. Singapore's corporate tax rate is 20%. Firms are eligible for a tax rebate of 50% of the tax amount, capped to a maximum amount of SGD 10,000 every year on their tax liability. a. Calculate the firm's tax liability using Singapore's corporate tax rates. b. How much are Southern Textile's 2017 after tax earnings? c. Calculate the firm's average tax rate. a. The firm's tax liability using Singapore's corporate tax rates is SGD- (Round to the nearest dollar.)

Corporate taxes Southern Textile Ltd. is a manufacturer of sportswear that supplies to a number of European retail stores. Its registered office is in Singapore. During 2017, the firm earned SGD 112,000 before taxes. Singapore's corporate tax rate is 20%. Firms are eligible for a tax rebate of 50% of the tax amount, capped to a maximum amount of SGD 10,000 every year on their tax liability. a. Calculate the firm's tax liability using Singapore's corporate tax rates. b. How much are Southern Textile's 2017 after tax earnings? c. Calculate the firm's average tax rate. a. The firm's tax liability using Singapore's corporate tax rates is SGD- (Round to the nearest dollar.)

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 1FIC

Related questions

Question

Transcribed Image Text:Question 12, P1-6 (book/static)

Part 1 of 3

Corporate taxes Southern Textile Ltd. is a manufacturer of sportswear that supplies to a number of European retail stores. Its registered office is in Singapore. During 2017, the firm earned SGD 112,000 before taxes. Singapore's corporate tax rate is 20%. Firms are eligible for a tax rebate of 50% of the tax

amount, capped to a maximum amount of SGD 10,000 every year on their tax liability.

a. Calculate the firm's tax liability using Singapore's corporate tax rates.

b. How much are Southern Textile's 2017 after tax earnings?

c. Calculate the firm's average tax rate.

a. The firm's tax liability using Singapore's corporate tax rates is SGD

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning