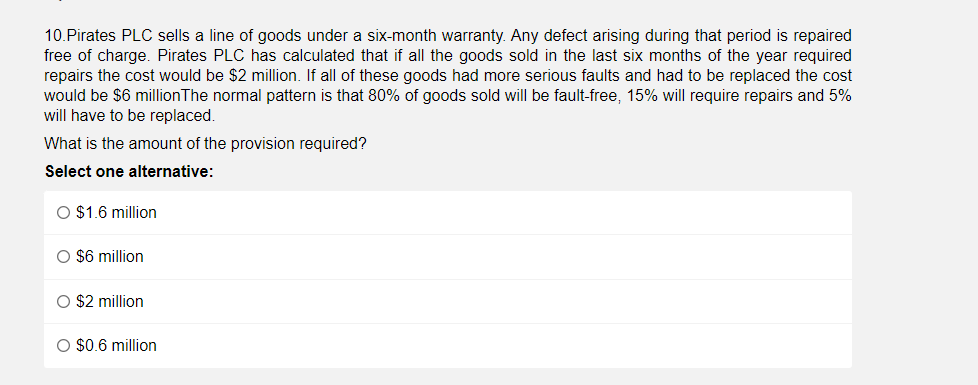

10.Pirates PLC sells a line of goods under a six-month warranty. Any defect arising during that period is repaired free of charge. Pirates PLC has calculated that if all the goods sold in the last six months of the year required repairs the cost would be $2 million. If all of these goods had more serious faults and had to be replaced the cost would be $6 millionThe normal pattern is that 80% of goods sold will be fault-free, 15% will require repairs and 5% will have to be replaced. What is the amount of the provision required? Select one alternative: O $1.6 million O $6 million O $2 million O $0.6 million

10.Pirates PLC sells a line of goods under a six-month warranty. Any defect arising during that period is repaired free of charge. Pirates PLC has calculated that if all the goods sold in the last six months of the year required repairs the cost would be $2 million. If all of these goods had more serious faults and had to be replaced the cost would be $6 millionThe normal pattern is that 80% of goods sold will be fault-free, 15% will require repairs and 5% will have to be replaced. What is the amount of the provision required? Select one alternative: O $1.6 million O $6 million O $2 million O $0.6 million

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 33P

Related questions

Question

Transcribed Image Text:10.Pirates PLC sells a line of goods under a six-month warranty. Any defect arising during that period is repaired

free of charge. Pirates PLC has calculated that if all the goods sold in the last six months of the year required

repairs the cost would be $2 million. If all of these goods had more serious faults and had to be replaced the cost

would be $6 millionThe normal pattern is that 80% of goods sold will be fault-free, 15% will require repairs and 5%

will have to be replaced.

What is the amount of the provision required?

Select one alternative:

O $1.6 million

O $6 million

O $2 million

O $0.6 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning