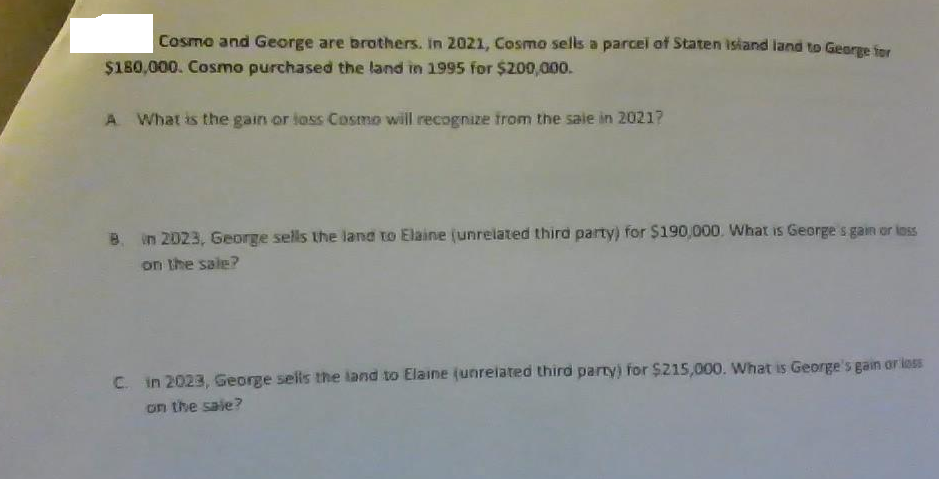

Cosmo and George are brothers. In 2021, Cosmo sells a parcei of Staten isiand land to George fer $180,000. Cosmo purchased the land in 1995 for $200,000. A What is the gain or loss Cosmo will recognize from the sale in 2021? B. in 2023, George sells the land to Elaine (unrelated third party) for $190,000. What is George s gain or loss on the sale? C. in 2023, George sells the land to Elaine (unrelated third party) for $215,000. What is George's gain ar less on the sale?

Cosmo and George are brothers. In 2021, Cosmo sells a parcei of Staten isiand land to George fer $180,000. Cosmo purchased the land in 1995 for $200,000. A What is the gain or loss Cosmo will recognize from the sale in 2021? B. in 2023, George sells the land to Elaine (unrelated third party) for $190,000. What is George s gain or loss on the sale? C. in 2023, George sells the land to Elaine (unrelated third party) for $215,000. What is George's gain ar less on the sale?

Chapter13: Property Transact Ions: Determination Of Gain Or Loss, Basis Considerations, And Nontaxable Exchanges

Section: Chapter Questions

Problem 64P

Related questions

Question

urgent one hour left please urgent

Transcribed Image Text:Cosmo and George are brothers. in 2021, Cosmo sells a parcel of Staten isiand land to George fer

$180,000. Cosmo purchased the land in 1995 for $200,000.

A What is the gain or loss Cosmo will recognize from the saie in 20217

B. in 2023, George sells the land to Elaine (unrelated third party) for $190,000. What is George s gain or loss

on the sale?

C. in 2023, George sells the land to Elaine (unrelated third party) for $215,000. What is George's gain or less

on the sale?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT