Q: 1. Discuss: Firms often involve themselves in projects that do not result directly in profits. For e...

A: Direct profit is defined as the amount of money earned from sales after deducting direct costs. This...

Q: d. At what discount rate would you be indifferent between these two projects? (Do not round intermed...

A: Since, specifically Part D is asked, so the following solution also relates to Part D only. Solution...

Q: draw the cash flow tnx.

A: The present value is the total value of the future payment series you must have now. For example, if...

Q: Company ABS’s Cash Conversion Cycle has 241.46 days while Company CBN has 194 days of CCC. Which com...

A: Cash conversion cycle (CCC) refers to the time period ( number of days) between the payment for raw ...

Q: 6.7 Determine the rate of return per year for the cash flows shown below. Use (a) tabulated factors,...

A: Given Years =1,2,3, and 4 Cash flow in $ = -80000, 9000, 70000, 30000 We are required to prepare a r...

Q: 1. Malinao Bakery forecast sales 2100 loaves of bread for the month of January. The owner would like...

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve ...

Q: Supposing we the contract entered in is at the price of $285. We would like to evaluate our position...

A: Here, Spot price = $285. Time of contract = 4 months Forward price = $293.15. To Find: Gain or loss ...

Q: 7. With an initial investment of $1000, I will add $100/month for the first year, and $200/month for...

A: An investment is dedicating an asset for the purpose of earning a return on it. When an investor inv...

Q: An asphalt road requires no repairs until the end of 2 years. At the end of 3rd year, P90,000 will b...

A: Here, Here, From Year 1 to Year 2, Repair cost is P0 From Year 3 to Year 7, Repair Cost is P90,000 ...

Q: Seth Fitch owns a small retail ice cream parlor. He is considering expanding the business and has id...

A: Payback period is the period up to which initial cost of the investment is recovered. It is calculat...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: NPV is the difference between present value of all cash inflows and initial investment NPV =PV of al...

Q: Please explain the reasoning behind this formula. Expected inflation rate=10Year T bill rate−10 Yea...

A: Inflation is the steady loss of a currency's buying value. The rate at which an economy's purchasing...

Q: A stock does not currently pay required return is 6%. What is the value of the stock?

A: Stock price is defined as the maximum price that an investor is ready to pay for a stock. It is calc...

Q: Your parents can take out a federal Direct Plus loan to pay for the total remaining cost of your und...

A: Given: Simple interest rate = 6.84% Years =10 graduation on June 1st Loan taken date = 1st September...

Q: All else equal, according to the expectations hypothesis, if the slope of the term structure increas...

A: The expectations theory is designed to assist investors in making decisions based on future interest...

Q: A building cost P8.5 million and the salvage value is P50,000 after 23 years. The annual maintenance...

A: The present worth analysis is an analysis where all the present values are calculated. All the disco...

Q: or an investor who plans to purchase a bond that matures in one year, the primary concern should be ...

A: Step 1You obtain the face amount of the bond and any interests that have accumulated since the last ...

Q: 1. You wish to have $10,000 in an account 10 years from now. How much money must be deposited in the...

A: Future value (FV) = $10,000 Interest rate (r) = 8% Period (n) = 10 Years

Q: Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year ...

A: Honor Code: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answ...

Q: Quantitative Problem 2: You and your wife are making plans for retirement. You plan on living 25 yea...

A: While calculating, the amount required in the retirement account, we are required to calculate the f...

Q: )A stock currently trades at $37. The continuously compounded risk-free rate of interest is 5%, and ...

A: The European call option refers to that option that gives the holder the right to buy a stock at a p...

Q: ared borrowed Charging 3.6 070 cONpornded Monthly interest.

A: Loans are paid by equal monthly payments that carry the payment of principal amount and payment of i...

Q: Below is the Income Statement of Company A for 2020-2021 in KWD. 2021 2020 Sales Revenue 1,000,000 1...

A: Solution:- Common size percentage means the ratio of items of income statement to a common base, gen...

Q: Dark Creek Corporation's CEO is selecting between two mutually exclusive projects. The company is ob...

A: Here, Pay off in Bad Economy in High Volatility is $2,900 Payoff in Good Economy in High Volatility ...

Q: The balance on Taylor's credit card is $2000. It has an interest rate of 12.5%. She wants to compare...

A: Interest refers to the amount paid by the borrower to bank on the amount borrowed at a fixed or fluc...

Q: Melinda opened a savings account for her daughter on ? day she depositing $1,000: Each year on her b...

A: Annual deposit (A) = $1000 Number of deposits (n) = 22 r = 9.5%

Q: How can we reduce this risk in financial reporting process? "Are redundant and out-of-date informat...

A: Financial reporting is a typical accounting approach that uses financial statements to convey a comp...

Q: Harper Electronics is considering investing in manufacturing equipment expected to cost $250,000. Th...

A: Capital Budgeting methods: Managers use several capital budgeting methods while evaluating investmen...

Q: Task 5. Compute the present value of the following annuity investments: 1. P5,000 quarterly investme...

A: Part 1 Quarterly Investment = P 5,000 Interest rate = 6% Time Period = 5 Years Part 2 Annual Investm...

Q: Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows: Ye...

A: a) NPV=? When r =8% Year Cashflow ($) PVIF @8% PV= Cashflows*PVIF 0 -37000000 1 -37000000 1 5...

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return...

A: Capital structure decisions refer to the arrangement and combination of sources of funds required to...

Q: A$14,500 bond that has a coupon rate of 5.80% payable semi-annually and maturity of 5 years was purc...

A: Par value (FV) = $14500 Coupon rate = 5.80% Semi annual coupon amount (C) = 14500*0.0580/2 = $420.50...

Q: Suppose that you have good credit and can get a 30-year mortage for $100,000 at 5%. What is your mon...

A: A mortgage is a loan made usually for a property in which the collateral is the property itself.

Q: Your firm has a credit rating of A. You notice that the credit spread for five-year maturity A debt...

A: Given: Particulars Amount Credit spread 0.83% Years(NPER) 5 Coupon rate 6.10% Treasury no...

Q: You may be familiar with the 1950's cartoon called Popeye the Sailor Man. One of the characters, nam...

A: In a transactional economy, money is an economic unit that acts as a widely recognised medium of exc...

Q: Mrs. Go make deposits that forms a geometric gradient that increases at 6% per month for 1 year. She...

A: Deposit per month is P500 Growth rate of deposits is 6% Interest rate is 12% compounded monthly To...

Q: Rolling Company bonds have a coupon rate of 6.00 percent, 24 years to maturity, and a current price ...

A: Par value = $1000 Coupon rate = 6% Coupon amount = 1000*0.06 = $60 Years to maturity = 24 Years Pric...

Q: Explain briefly what cross hedging implies. What is the significar

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: Your company is considering a project for which you oversee the analysis. The company has spent $100...

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first...

Q: Studies concluded that college graduation is a very good investment. Suppose a college graduate make...

A: Expected value of college graduation can be found using the earnings average and percentage given. S...

Q: In the Middle Ages, goldsmiths took in customers’ deposits (gold coins) and issued receipts that fun...

A: Customers find goldsmiths to be extremely convenient when conducting a large number of gold transact...

Q: If Average assets and capital are 900,000 and 540,000, respectively, with a net income of 47,520, wh...

A: Return on equity is a type of financial ratio of a company. Return on equity is a performance measur...

Q: P8-1 Expected Return Given these three economic states, their likelihoods, ane potential returns, co...

A: Expected return is average return considering the different probabilities of different returns.

Q: what is the stock market, and why is it important?

A: Stock Market: Stock markets are platforms where the sellers & buyers meet for the exchange of e...

Q: Anle Corporation has a current stock price of $19.49 and is expected to pay a dividend of $1.25 in o...

A: Equity cost of capital = (Expected stock price after dividend + Dividend - Current stock price) / Cu...

Q: With a 50% debt ratio and 2,000,000 worth of capital, the company posted dividends amounting to one ...

A: Here, Debt ratio = 50% Capital = 2,000,000 Dividend = 1/5th of retained earnings Retained earnings ...

Q: You work for a logistics company, which considers to invest in a computerized system to improve effi...

A: Here, Initial cost = $90,000 Additional expenses = $25,000 Savings in operating cost = $65,000 Addit...

Q: Suppose DAVID wants to have P10,000,000 to retire 45 years from now, how much would she have to inve...

A: Amount needed at the retirement (X) = P 10000000 n = 45 years r = 15%

Q: Consider a portfolo consisting of the following three stocks: E The volatility of the market portfol...

A: Beta is used as a measure of systematic risk in the CAPM model. It provides a direct relation betwee...

Q: Southern Timber Company expects to have an EBIT of $10 million in the coming year, and its EBIT is e...

A: According to M&M Model the value of levered firm will be sum of value of unlevered firm plus tax...

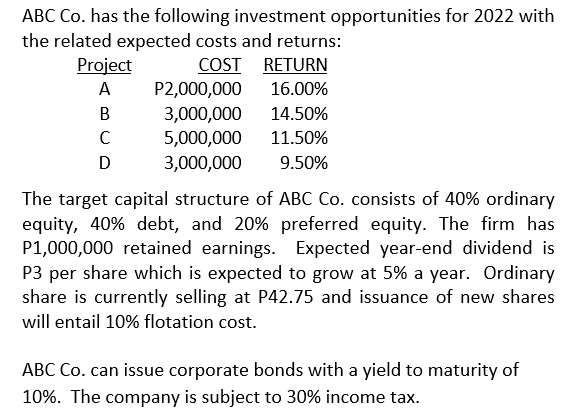

How large can the cost of

7.75%

8.90%

10.46%

11.54%

Step by step

Solved in 2 steps with 3 images

- GoldPure is considering the following independent, average-risk investment projects: Project Size of Project Project IRR Project V P1.0 million 12.0% Project W 1.2 million 11.5 Project X 1.2 million 11.0 Project Y 1.2 million 10.5 Project Z 1.0 million 10.0 The company has a target capital structure that consists of 50 percent debt and 50 percent equity. Its after-tax cost of debt is 8 percent, its cost of equity is estimated to be 16.5 percent, and its net income is P2.5 million. If the company follows a residual dividend policy, what will be its plowback ratio? Answers: a. 32% b. 100% c. 12% d. 54% e. 68% f. 66% g. 0A firm whose cost of capital is 10% is considering two mutuallyexclusive projects A and B, the cash flows of which are as below: YearProject AProject B7050.00080.000162,50096.170Suggest which project should be taken up using (i) net present8 GoldPure is considering the following independent, average-risk investment projects:Project Size of Project Project IRRProject V P1.0 million 12.0%Project W 1.2 million 11.5Project X 1.2 million 11.0Project Y 1.2 million 10.5Project Z 1.0 million 10.0The company has a target capital structure that consists of 50 percent debt and 50 percent equity. Its after-tax cost of debt is 8 percent, its cost of equity is estimated to be 16.5 percent, and its net income is P2.5 million. If the company follows a residual dividend policy, what will be its plowback ratio? Group of answer choices 0 54% 68% 100% 32% 12% 66%

- A company is considering a long term investment that requires a $45.000 investment today, andthen in 4 years promises a payout of $55.500 with prob. 0.4 and a payout of $66.000 with prob0.6. If the opportunity cost of capital for the compay is 8%, what is the expected net presentvalue?a) 425b) 433c) 441d) 449Better plc is comparing two mutually exclusive projects, whose details are given below.The company’s cost of capital is 12 per cent.Project A Project B£m £mYear 0 (150) (152)Year 1 40 80Year 2 50 80Year 3 60 50Year 4 60 40Year 5 80 30(a). Using the net present value method, which project should be accepted?(b). Using the internal rate of return method, which project should be accepted?(c). If the cost of capital increases to 20 per cent in year 5, would your advice change? Hello.i have the solution you send me but i am trying to understand where did you get the calculations for in the worknotes tabel. I still cant calculate the IRR.i really dont understand how to do it. Can you help me please by using the numbers in the tabel so i can understand what is that you are adding or taking away please? I know how to calculate the NPV but not the IRRBetter plc is comparing two mutually exclusive projects, whose details are given below.The company’s cost of capital is 12 per cent.Project A Project B£m £mYear 0 (150) (152)Year 1 40 80Year 2 50 80Year 3 60 50Year 4 60 40Year 5 80 30(a). Using the net present value method, which project should be accepted?(b). Using the internal rate of return method, which project should be accepted?(c). If the cost of capital increases to 20 per cent in year 5, would your advice change? Hello.i have the solution you send me but i am trying to understand where did you get the calculations for in the worknotes tabel. I did my own calculation but i dont get the same answer. Could you show mw the calculation but not in excel please, i need the calculation by formula manually

- Better plc is comparing two mutually exclusive projects, whose details are given below.The company’s cost of capital is 12 per cent.Project A Project B£m £mYear 0 (150) (152)Year 1 40 80Year 2 50 80Year 3 60 50Year 4 60 40Year 5 80 30(a). Using the net present value method, which project should be accepted?(b). Using the internal rate of return method, which project should be accepted?(c). If the cost of capital increases to 20 per cent in year 5, would your advice change? Hello.i have the solution you send me but i am trying to understand where did you get the calculations for in the worknotes tabel. I still cant calculate the IRR.i really dont understand how to do it. Can you help me please by using the numbers in the tabel so i can understand what is that you are adding or taking away please? I know how to calculate the NPV but not the IRR. I have went over and over this IRR but i still dont understand how you calculate it using the pv and the npv.i dont wanna use excel.Better plc is comparing two mutually exclusive projects, whose details are given below.The company’s cost of capital is 12 per cent.Project A Project B£m £mYear 0 (150) (152)Year 1 40 80Year 2 50 80Year 3 60 50Year 4 60 40Year 5 80 30(a). Using the net present value method, which project should be accepted?(b). Using the internal rate of return method, which project should be accepted?(c). If the cost of capital increases to 20 per cent in year 5, would your advice change? Hello.i have the solution you send me but i am trying to understand where did you get the calculations for in the worknotes tabel. I did my own calculation but i dont get the same answer. For example for year 2 for project A you have 39.8597 How did you get to that without using the formula in excel. I need to write down the actual numbers. I got 22.3214 some im not sure how you got to that number. Can you help me please? Thank youDyrdek Enterprises has equity with a market value of $11.8 million and the market value of debt is $4.05million. The company is evaluating a new project thathas more risk than the firm. As a result, the companywill apply a risk adjustment factor of 2.1 percent. Thenew project will cost $2.40 million today and provideannual cash flows of $626, 000 for the next 6 years. Thecompany's cost of equity is 11.47 percent and thepretax cost of debt is 4.98 percent. The tax rate is 21percent. What is the project's NPV?

- JenBritt Incorporated projects FCF of $285 million in 2020 and $520 million in 2021. FCF is expected to grow at a constant rate of 4% in 2022 and thereafter. The weighted average cost of capital is 9%. What is the current (i.e., beginning of 2020) value of operations? Do not round intermediate calculations. Enter your answer in millions WITHOUT comma or separator. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to two decimal places.In an effort to increase its customer base, a company set the project MARR at exactly the WACC. If equity capital costs 8% per year and debt capital costs 12.5% for the project, what is the equity-debt percentage mix of capital required to make the WACC = 10%?In an effort to increase its customer base, a company set the project MARR at exactly the WACC. If equity capital costs 9% per year and debt capital costs 11% for the project, what is the equity-debt percentage mix of capital required to make the WACC = 10%? The mix is __ % equity and __ % debt capital.