COUNTING

Q: Most companies compute the materials price variance when materials are purchased. Group of choices ...

A: SOlution: True. This is because Most companies compute the materials price variance when materials a...

Q: A fixed asset with a cost of $25,556 and accumulated depreciation of $23,000 is traded for a similar...

A: Solution: Cost at which new equipment will be recorded = Fair market value of the new equipment = $5...

Q: A foreign exchange intervention with an offsetting open market operation (e.g. a purchase of US Trea...

A: Foreign Exchange intervention - It is a kind of monetary policy tool where the central bank actively...

Q: A manufacturing company prepays its insurance coverage for a three-year period. The premium for the ...

A: Product cost is the cost which is part of the manufacturing of that product and is includes in the c...

Q: 1. Under IFRS 16, which of the following statements is true? * The lessee automatically accounts the...

A: Lease is a type of contract in which the actual owner of the asset gives the right to use the asset ...

Q: The difference between actual factory overhead and budgeted factory overhead on the basis of actual ...

A: The difference between the actual expenses and the budgeted expenses for the specific units is refer...

Q: Qec Inc. bought machinery worth $120,000 on January 1st, 2014. With no residual value, it estimated ...

A: Depreciation is an accounting technique for distributing a tangible or fixed asset's cost over its u...

Q: Gently Laser Clinic purchased laser equipment for $6,516 and paid $678 down, with the remainder to b...

A: Gently Laser Clinic purchased laser equipment for $6,516 and paid $678 down, with the remainder to b...

Q: Assume that you are going to start a Business after graduation. Describe 10 transactions that the bu...

A: Ledgers - After recording transactions in the journal next step is to transfer them into ledgers. Le...

Q: 1. What is the purpose of internal controls? 2. What will happen if companies do not impose interna...

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: The owner of Zeke's Landscaping Designs just hired an office manager to handle all the office functi...

A: Internal control principles state that a single person would not be allowed the work of transaction ...

Q: Pastina Company sells various types of pasta to grocery chains as private label brands. The company'...

A: A trial balance's main function is to confirm that the entries in a firm's accounting system are mat...

Q: 7) X-on Ltd. Began 2001 with the following balances in its shareholders' equity accounts Common shar...

A: Stockholders' equity, also known as shareholders' or owners' equity, is the amount of assets that re...

Q: Under the completed-contract method, Question 16 options: a revenue, cost, and gross profit are r...

A: Under the completed-contract method, The total revenues, total costs incurred, ...

Q: A fixed asset with a cost of $30,192 and accumulated depreciation of $27,172.80 is sold for $5,132.6...

A: Fixed asset cost = $ 30,192 Accumulated depreciation = $ 27172.80 Sale amount = $ 5132.64

Q: Calculate the missing values for each unique company. (Enter your ROI and Profit Margin percentage a...

A: ROI=Investment turnover/Profit margin

Q: Bebe Co. declared dividends of Php 2 per share for their performance last year after the declaration...

A: Answer) Calculation of Dividends Yield Ratio Dividends Yield Ratio = Dividend Per Share/ Market Valu...

Q: Assume a company is considering using available space to make 10,000 units of a component part that ...

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new ques...

Q: For a finance lease, the lease obligation of the lessee would be reduced periodically by a. the l...

A: Solution: For a finance lease, the lease obligation of the lessee would be reduced periodically by...

Q: Assume a company had net income of $60,000 that included a gain on the sale of equipment of $4,000. ...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: There are different depreciation methods, which allow businesses to determine the projected loss of ...

A: Depreciation: Depreciation refers to the process of allocating the relevant cost of a fixed asset o...

Q: ration selling organic food products, and an operation that provides accounting services to small bu...

A: In business there are time when losses may occur but tax has provision to carry forward the losses.

Q: When preparing a bank reconciliation, if the adjusted book balance and the adjusted bank balance are...

A: Equal amount of Adjusted book balance and the adjusted bank balance doesn't tell the cash is used on...

Q: The Crown Company established a $1,000 petty cash fund by issuing a cheque to the custodian on Octob...

A: > >Petty Cash fund is created out of cash account to pay off certain small and petty amoun...

Q: Exercise #8 Inventory Costing Methods (ADOPTED) The following information was made available for a p...

A: The inventory can be valued at each level (after every sale and purchase) under perpetual inventory ...

Q: In connection with your audit of the financial statements of Hollis Manufacturing Corporation for th...

A: Adjusting entry is made for the adjustments that affect the financial statement of the company.

Q: Cost of Gross Goods Sold Sales Net Ending Profit Beg Inventory Purchases Inventory Net Sales returns...

A: Formula: Net sales = Sales - Sales returns

Q: Whispering Winds Corporation has the following accounts at December 31: Common Stock, $9 par, 5,450 ...

A: Stockholders' equity, also known as shareholders' or owners' equity, is a type of equity held by sto...

Q: The home improvement center (HIC) has an employment contract with the newly hired CEO. The contract ...

A: The question is based on the concept of Financial Management.

Q: Comparative Income Statement This Year Last Year Sales 7,360,000 $ 5,593,600 Cost of goods sold Gros...

A: Formula: Gross margin = Sales - cost of goods sold

Q: Which of the following lease arrangements would most likely be accounted for as a finance lease by t...

A: Finance Lease - It is type of equipment lease where the customer rents assets for useful life of ite...

Q: PinaSarap Industries provided the following inventory card: Purchase Date Units Used Balance Units P...

A: Average cost per unit = Total cost of goods available for sale / Total units available for sale =(10...

Q: 10. On January 1, 2012, Thelma Industries leased equipment to Tricia Company for a four- year period...

A: Given data, Fair Value of the Equipment =P400,000 Cost of the equipment =P300,000 Useful life =5 yea...

Q: Ricky Company is a dealer in property. On January 1, 2020, the entity entered into a finance lease w...

A: Total cost of sale = cost of the car + legal fees = P600,000 + P20,000 = P620,000

Q: Mike Ltd purchased the outstanding voting shares of Sam Ltd at the beginning of 2009 for $387,000. A...

A: Acquisition refers to the acquisition of common shares and voting rights in one company by another c...

Q: On January 1, 2020, Canada Company granted to a senior executive 10,000 share options conditional up...

A: The companies provide compensation to executive in the form stock option to retain high level execut...

Q: Value of tax shield

A: Tax Shield is the deduction in the taxable income due to deductible expenses. Normally tax shield is...

Q: The Marine Division of Pacific Corp. has average invested assets of $120,000,000. Sales revenue of $...

A: Return on investment = Operating income / Average invested assets where, Average invested assets = (...

Q: A partial aging of accounts receivable for a cleaning service is given in the accompanying table. Fi...

A: Ratio analysis means where different ratio of various years of years companies has been compared and...

Q: Instructions Determine the amounts of the labor price and the labor quantity variances for August.

A:

Q: April May June Manufacturing costs* $156,800 $195,200 $217,600 Insurance expense"* Depreciation expe...

A: Formula: Total insurance amount = Insurance expense per month x Number of months.

Q: For a finance lease, the lease obligation of the lessee would be reduced periodically by a. the le...

A: Solution: For a finance lease, the lease obligation of the lessee would be reduced periodically by "...

Q: Michelle Company leased equipment to May Corporation on July 1, 2012 for an eight-year period expiri...

A: Discount factor = present value of the equipment / Annual lease payment = P3,520,000 /P600,000 = 5....

Q: The difference between actual direct labor hours worked and standard direct labor hours allowed mult...

A: Efficiency Variance - It is the variance equals the no of direct labor hours with budgeted one minus...

Q: Question 7 Your firm pays $100,000 to acquire 100% of the Chimp Bicycles. The balance sheet of Chimp...

A: SOLUTION- GOODWILL = PURCHASE CONSIDERATION - (CASH + ACCOUNTS RECEIVABLE + INVENTORY + TRADEMARK...

Q: nvestment earns 20% compounded semiannually. After how many years will it trip

A: An investment is a purchase of an asset or item with the intent of earning income or increasing in v...

Q: c. Which of the following correctly identifies a risk facing SSC that might adversely affect sales d...

A: The question is based on the concept of Financial Accounting.

Q: Number of Direct Labor Hours Machine Hours Product Units Per Unit Per Unit Blinks 1,037 3 7 Dinks 2,...

A: Formula: Total machine hours cost = Number of units x Machine hours per unit

Q: Require a Income Statement

A: Financial statement means the trading and profit and loss account and balance sheet of the company w...

Q: c. Calculate the direct labor rate variance. (Do not round your intermediate calculations. Indicate ...

A: Solution:- c)Calculation of the direct labor rate variance as follows:- Formula Labor rate variance ...

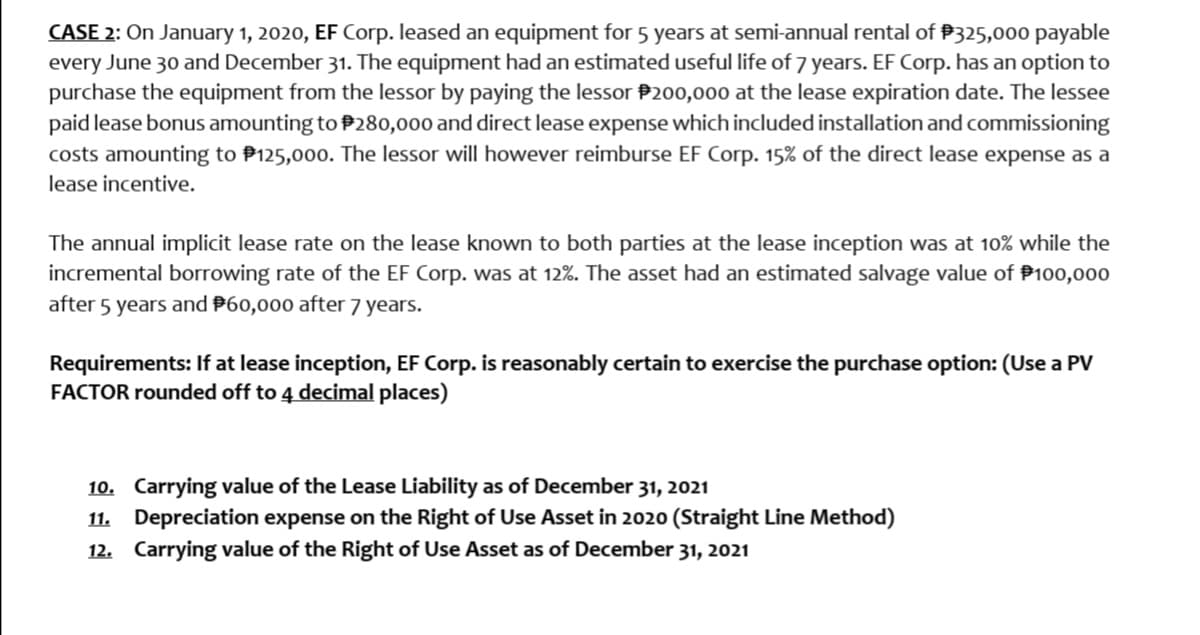

PLEASE ANSWER IN GOOD ACCOUNTING FORM. THANK YOU.

Step by step

Solved in 3 steps

- Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line methodLessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.

- Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.

- Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Owens Company leased equipment for 4 years at 50,000 a year with an option to renew the lease for 6 years at 2,000 per month or to purchase the equipment for 25,000 (a price considerably less than the expected fair value) after the initial lease term of 4 years. Why would this lease qualify as a finance lease?Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.Lease Income and Expense Reuben Company retires a machine from active use on January 2, 2019, for the express purpose of leasing it. The machine had a carrying value of 900,000 after 12 years of use and is expected to have 10 more years of economic life. The machine is depreciated on a straight-line basis. On March 2, 2019, Reuben leases the machine to Owens Company for 180,000 a year for a 5-year period ending February 28, 2024. Under the provisions of the lease, Reuben incurs total maintenance and other related costs of 20,000 for the year ended December 31, 2019. Owens pays 180,000 to Reuben on March 2, 2019. The lease was properly classified as an operating lease. Required: 1. Compute the income before income taxes derived by Reuben from this lease for the calendar year ended December 31, 2019. 2. Compute the amount of rent expense incurred by Owens from this lease for the calendar year ended December 31, 2019.