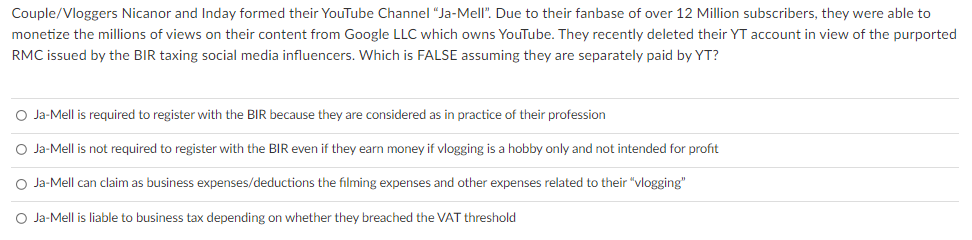

Couple/Vloggers Nicanor and Inday formed their YouTube Channel "Ja-Mell". Due to their fanbase of over 12 Million subscribers, they were able to monetize the millions of views on their content from Google LLC which owns YouTube. They recently deleted their YT account in view of the purported RMC issued by the BIR taxing social media influencers. Which is FALSE assuming they are separately paid by YT? O Ja-Mell is required to register with the BIR because they are considered as in practice of their profession O Ja-Mell is not required to register with the BIR even if they earn money if vlogging is a hobby only and not intended for profit O Ja-Mell can claim as business expenses/deductions the filming expenses and other expenses related to their "vlogging" O Ja-Mell is liable to business tax depending on whether they breached the VAT threshold

Couple/Vloggers Nicanor and Inday formed their YouTube Channel "Ja-Mell". Due to their fanbase of over 12 Million subscribers, they were able to monetize the millions of views on their content from Google LLC which owns YouTube. They recently deleted their YT account in view of the purported RMC issued by the BIR taxing social media influencers. Which is FALSE assuming they are separately paid by YT? O Ja-Mell is required to register with the BIR because they are considered as in practice of their profession O Ja-Mell is not required to register with the BIR even if they earn money if vlogging is a hobby only and not intended for profit O Ja-Mell can claim as business expenses/deductions the filming expenses and other expenses related to their "vlogging" O Ja-Mell is liable to business tax depending on whether they breached the VAT threshold

Business Its Legal Ethical & Global Environment

10th Edition

ISBN:9781305224414

Author:JENNINGS

Publisher:JENNINGS

Chapter10: Cyberlaw, Social Media, And Privacy

Section: Chapter Questions

Problem 8QAP

Related questions

Question

Transcribed Image Text:Couple/Vloggers Nicanor and Inday formed their YouTube Channel "Ja-Mell". Due to their fanbase of over 12 Million subscribers, they were able to

monetize the millions of viewws on their content from Google LLC which owns YouTube. They recently deleted their YT account in view of the purported

RMC issued by the BIR taxing social media influencers. Which is FALSE assuming they are separately paid by YT?

O Ja-Mell is required to register with the BIR because they are considered as in practice of their profession

O Ja-Mell is not required to register with the BIR even if they earn money if vlogging is a hobby only and not intended for profit

O Ja-Mell can claim as business expenses/deductions the filming expenses and other expenses related to their "vlogging"

O Ja-Mell is liable to business tax depending on whether they breached the VAT threshold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage