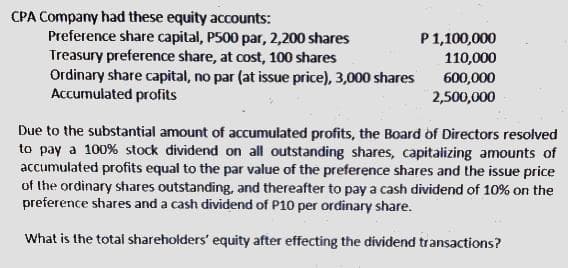

CPA Company had these equity accounts: Preference share capital, PS00 par, 2,200 shares Treasury preference share, at cost, 100 shares Ordinary share capital, no par (at issue price), 3,000 shares Accumulated profits P1,100,000 110,000 600,000 2,500,000 Due to the substantial amount of accumulated profits, the Board of Directors resolved to pay a 100% stock dividend on all outstanding shares, capitalizing amounts of accumulated profits equal to the par value of the preference shares and the issue price of the ordinary shares outstanding, and thereafter to pay a cash dividend of 10% on the preference shares and a cash dividend of P10 per ordinary share. What is the total shareholders' equity after effecting the dividend transactions?

CPA Company had these equity accounts: Preference share capital, PS00 par, 2,200 shares Treasury preference share, at cost, 100 shares Ordinary share capital, no par (at issue price), 3,000 shares Accumulated profits P1,100,000 110,000 600,000 2,500,000 Due to the substantial amount of accumulated profits, the Board of Directors resolved to pay a 100% stock dividend on all outstanding shares, capitalizing amounts of accumulated profits equal to the par value of the preference shares and the issue price of the ordinary shares outstanding, and thereafter to pay a cash dividend of 10% on the preference shares and a cash dividend of P10 per ordinary share. What is the total shareholders' equity after effecting the dividend transactions?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 12RE: Given the following year-end information, compute Greenwood Corporations basic and diluted earnings...

Related questions

Question

100%

A) 3,810,000

B) 3,820,000

C) 3,950,000

D) 4,090,000

E) Answer not given

Transcribed Image Text:CPA Company had these equity accounts:

Preference share capital, P500 par, 2,200 shares

Treasury preference share, at cost, 100 shares

Ordinary share capital, no par (at issue price), 3,000 shares

Accumulated profits

P1,100,000

110,000

600,000

2,500,000

Due to the substantial amount of accumulated profits, the Board of Directors resolved

to pay a 100% stock dividend on all outstanding shares, capitalizing amounts of

accumulated profits equal to the par value of the preference shares and the issue price

of the ordinary shares outstanding, and thereafter to pay a cash dividend of 10% on the

preference shares and a cash dividend of P10 per ordinary share.

What is the total shareholders' equity after effecting the dividend transactions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning