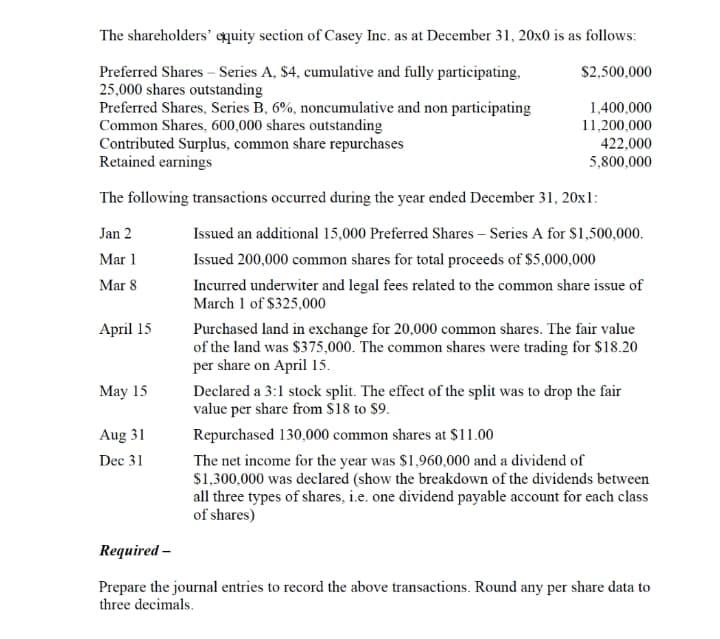

The shareholders' equity section of Casey Inc. as at December 31, 20x0 is as follows: Preferred Shares - Series A, $4, cumulative and fully participating, 25,000 shares outstanding Preferred Shares, Series B, 6%, noncumulative and non participating Common Shares, 600,000 shares outstanding Contributed Surplus, common share repurchases Retained earnings $2,500,000 1,400,000 11,200,000 422,000 5,800,000 The following transactions occurred during the year ended December 31, 20x1: Jan 2 Issued an additional 15,000 Preferred Shares - Series A for $1,500,000. Mar 1 Issued 200,000 common shares for total proceeds of $5,000,000 Incurred underwiter and legal fees related to the common share issue of March 1 of $325,000 Mar 8 Purchased land in exchange for 20,000 common shares. The fair value of the land was $375,000. The common shares were trading for $18.20 per share on April 15. April 15 Declared a 3:1 stock split. The effect of the split was to drop the fair value per share from $18 to $9. May 15 Aug 31 Repurchased 130,000 common shares at $11.00 The net income for the year was $1,960,000 and a dividend of $1,300,000 was declared (show the breakdown of the dividends between all three types of shares, i.e. one dividend payable account for each class of shares) Dec 31 Required – Prepare the journal entries to record the above transactions. Round any per share data to three decimals.

The shareholders' equity section of Casey Inc. as at December 31, 20x0 is as follows: Preferred Shares - Series A, $4, cumulative and fully participating, 25,000 shares outstanding Preferred Shares, Series B, 6%, noncumulative and non participating Common Shares, 600,000 shares outstanding Contributed Surplus, common share repurchases Retained earnings $2,500,000 1,400,000 11,200,000 422,000 5,800,000 The following transactions occurred during the year ended December 31, 20x1: Jan 2 Issued an additional 15,000 Preferred Shares - Series A for $1,500,000. Mar 1 Issued 200,000 common shares for total proceeds of $5,000,000 Incurred underwiter and legal fees related to the common share issue of March 1 of $325,000 Mar 8 Purchased land in exchange for 20,000 common shares. The fair value of the land was $375,000. The common shares were trading for $18.20 per share on April 15. April 15 Declared a 3:1 stock split. The effect of the split was to drop the fair value per share from $18 to $9. May 15 Aug 31 Repurchased 130,000 common shares at $11.00 The net income for the year was $1,960,000 and a dividend of $1,300,000 was declared (show the breakdown of the dividends between all three types of shares, i.e. one dividend payable account for each class of shares) Dec 31 Required – Prepare the journal entries to record the above transactions. Round any per share data to three decimals.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 9SPB: CASH DIVIDENDS, STOCK DIVIDEND, AND STOCK SPLIT During the year ended December 31, 20--, Baggio...

Related questions

Question

Transcribed Image Text:The shareholders' equity section of Casey Inc. as at December 31, 20x0 is as follows:

Preferred Shares – Series A, $4, cumulative and fully participating,

25,000 shares outstanding

Preferred Shares, Series B, 6%, noncumulative and non participating

Common Shares, 600,000 shares outstanding

Contributed Surplus, common share repurchases

Retained earnings

S2,500,000

1,400,000

11,200,000

422,000

5,800,000

The following transactions occurred during the year ended December 31, 20x1:

Jan 2

Issued an additional 15,000 Preferred Shares – Series A for S1,500,000.

Mar 1

Issued 200,000 common shares for total proceeds of $5,000,000

Mar 8

Incurred underwiter and legal fees related to the common share issue of

March 1 of $325,000

Purchased land in exchange for 20,000 common shares. The fair value

of the land was $375,000. The common shares were trading for $18.20

per share on April 15.

April 15

Declared a 3:1 stock split. The effect of the split was to drop the fair

value per share from $18 to $9.

May 15

Aug 31

Repurchased 130,000 common shares at $11.00

The net income for the year was $1,960,000 and a dividend of

$1,300,000 was declared (show the breakdown of the dividends between

all three types of shares, i.e. one dividend payable account for each class

of shares)

Dec 31

Required –

Prepare the journal entries to record the above transactions. Round any per share data to

three decimals.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning