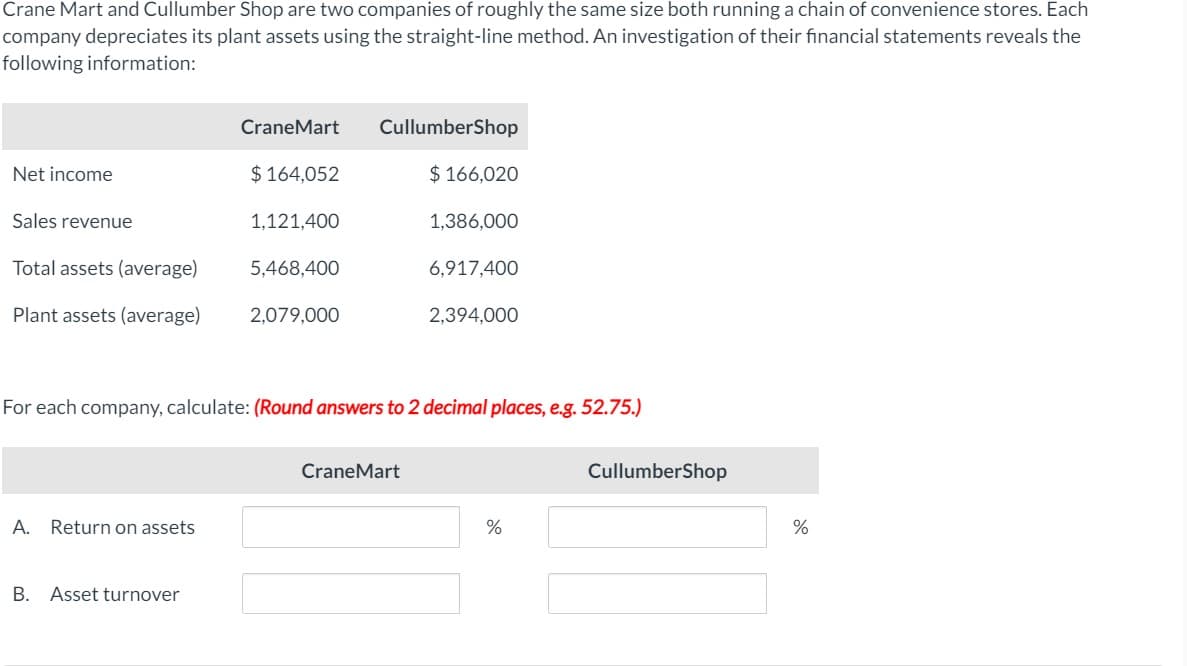

Crane Mart and Cullumber Shop are two companies of roughly the same size both running a chain of convenience stores. Each company depreciates its plant assets using the straight-line method. An investigation of their financial statements reveals the following information: CraneMart CullumberShop Net income $ 164,052 $ 166,020 Sales revenue 1,121,400 1,386,000 Total assets (average) 5,468,400 6,917,400 Plant assets (average) 2,079,000 2,394,000 For each company, calculate: (Round answers to 2 decimal places, e.g. 52.75.) CraneMart CullumberShop A. Return on assets B. Asset turnover

Crane Mart and Cullumber Shop are two companies of roughly the same size both running a chain of convenience stores. Each company depreciates its plant assets using the straight-line method. An investigation of their financial statements reveals the following information: CraneMart CullumberShop Net income $ 164,052 $ 166,020 Sales revenue 1,121,400 1,386,000 Total assets (average) 5,468,400 6,917,400 Plant assets (average) 2,079,000 2,394,000 For each company, calculate: (Round answers to 2 decimal places, e.g. 52.75.) CraneMart CullumberShop A. Return on assets B. Asset turnover

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 12PB: Farm Fresh Agriculture Company purchased Sunny Side Egg Distribution for $400,000 cash when Sunny...

Related questions

Question

Transcribed Image Text:Crane Mart and Cullumber Shop are two companies of roughly the same size both running a chain of convenience stores. Each

company depreciates its plant assets using the straight-line method. An investigation of their financial statements reveals the

following information:

CraneMart

CullumberShop

Net income

$ 164,052

$ 166,020

Sales revenue

1,121,400

1,386,000

Total assets (average)

5,468,400

6,917,400

Plant assets (average)

2,079,000

2,394,000

For each company, calculate: (Round answers to 2 decimal places, e.g. 52.75.)

CraneMart

CullumberShop

A.

Return on assets

B. Asset turnover

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College