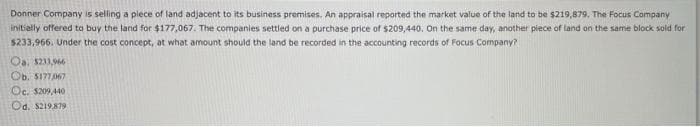

Donner Company is selling a piece of land adjacent to its business premises. An appraisal reported the market value of the land to be $219,879. The Focus Company initially offered to buy the land for $177,067. The companies settled on a purchase price of $209,440. On the same day, another piece of land on the same block sold for $233,966. Under the cost concept, at what amount should the land be recorded in the accounting records of Focus Company? Oa. $211,966 Ob. $177,067 Oc. $209,440 Od. $219,879

Donner Company is selling a piece of land adjacent to its business premises. An appraisal reported the market value of the land to be $219,879. The Focus Company initially offered to buy the land for $177,067. The companies settled on a purchase price of $209,440. On the same day, another piece of land on the same block sold for $233,966. Under the cost concept, at what amount should the land be recorded in the accounting records of Focus Company? Oa. $211,966 Ob. $177,067 Oc. $209,440 Od. $219,879

Chapter6: Business Expenses

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:Donner Company is selling a piece of land adjacent to its business premises. An appraisal reported the market value of the land to be $219,879. The Focus Company

initially offered to buy the land for $177,067. The companies settled on a purchase price of $209,440. On the same day, another piece of land on the same block sold for

$233,966. Under the cost concept, at what amount should the land be recorded in the accounting records of Focus Company?

Oa. $211,966

Ob. $177,067

Oc. $209,440

Od. $219,879

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning