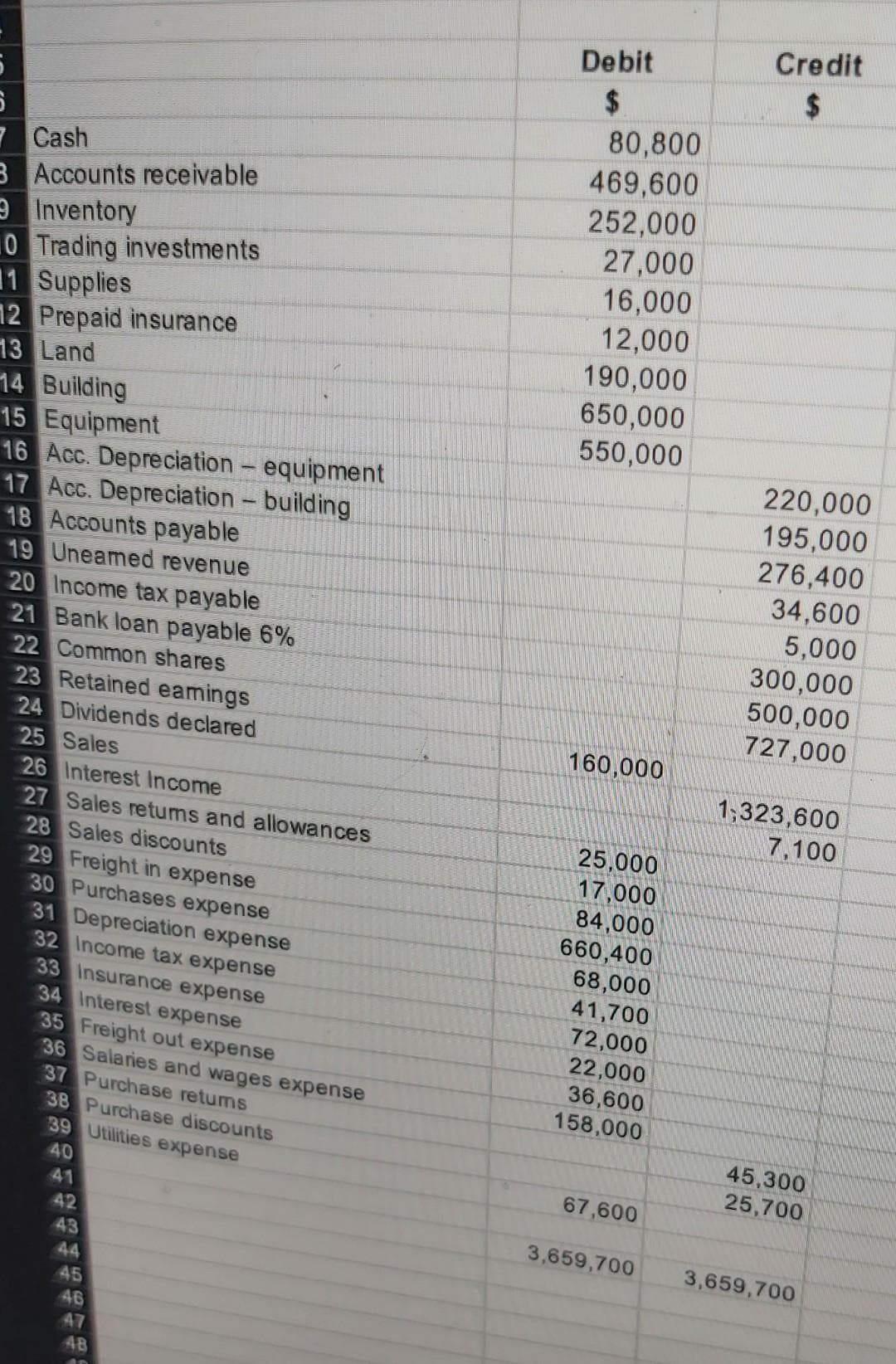

Credit Debit 2$ 2$ 80,800 469,600 252,000 27,000 16,000 12,000 190,000 650,000 550,000 Cash Accounts receivable Inventory Trading investments Supplies Prepaid insurance Land Building 5 Equipment S Acc. Depreciation - equipment Acc. Depreciation - building B Accounts payable 9 Uneamed revenue 0 Income tax payable 1 Bank loan payable 6% 22 Common shares 23 Retained eamings 24 Dividends declared 25 Sales 26 Interest Income 27 Sales retums and allowances 28 Sales discounts 29 Freight in expense 30 Purchases expense 31 Depreciation expense 32 Income tax expense 33 Insurance expense 34 Interest expense 35 Freight out expense 36 Salaries and wages expense 37 Purchase retums 38 Purchase discounts 39 Utilities expense 220,000 195,000 276,400 34,600 5,000 300,000 500,000 727,000 160,000 1,323,600 7,100 25,000 17,000 84,000 660,400 68,000 41,700 72,000 22,000 36,600 158,000 45,300 25,700 40 67,600 41 42 3,659,700 43 3,659,700 44 45 46 47

Credit Debit 2$ 2$ 80,800 469,600 252,000 27,000 16,000 12,000 190,000 650,000 550,000 Cash Accounts receivable Inventory Trading investments Supplies Prepaid insurance Land Building 5 Equipment S Acc. Depreciation - equipment Acc. Depreciation - building B Accounts payable 9 Uneamed revenue 0 Income tax payable 1 Bank loan payable 6% 22 Common shares 23 Retained eamings 24 Dividends declared 25 Sales 26 Interest Income 27 Sales retums and allowances 28 Sales discounts 29 Freight in expense 30 Purchases expense 31 Depreciation expense 32 Income tax expense 33 Insurance expense 34 Interest expense 35 Freight out expense 36 Salaries and wages expense 37 Purchase retums 38 Purchase discounts 39 Utilities expense 220,000 195,000 276,400 34,600 5,000 300,000 500,000 727,000 160,000 1,323,600 7,100 25,000 17,000 84,000 660,400 68,000 41,700 72,000 22,000 36,600 158,000 45,300 25,700 40 67,600 41 42 3,659,700 43 3,659,700 44 45 46 47

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

100%

prepare statement of changes

Net income is 118,400

Transcribed Image Text:Credit

Debit

2.

2$

80,800

469,600

252,000

27,000

16,000

12,000

190,000

650,000

550,000

7Cash

B Accounts receivable

e Inventory

0 Trading investments

11 Supplies

12 Prepaid insurance

13 Land

14 Building

15 Equipment

16 Acc. Depreciation - equipment

17 Acc. Depreciation - building

18 Accounts payable

19 Uneamed revenue

20 Income tax payable

21 Bank loan payable 6%

22 Common shares

23 Retained eamings

24 Dividends declared

25 Sales

26 Interest Income

27 Sales retums and allowances

28 Sales discounts

29 Freight in expense

30 Purchases expense

31 Depreciation expense

32 Income tax expense

33 Insurance expense

34 Interest expense

35 Freight out expense

36 Salaries and wages expense

37 Purchase retums

38 Purchase discounts

39 Utilities expense

220,000

195,000

276,400

34,600

5,000

300,000

500,000

727,000

160,000

1,323,600

7,100

25,000

17,000

84,000

660,400

68,000

41,700

72,000

22,000

36,600

158,000

45,300

25,700

40

67,600

41

42

3,659,700

43

3,659,700

44

45

46

47

4B

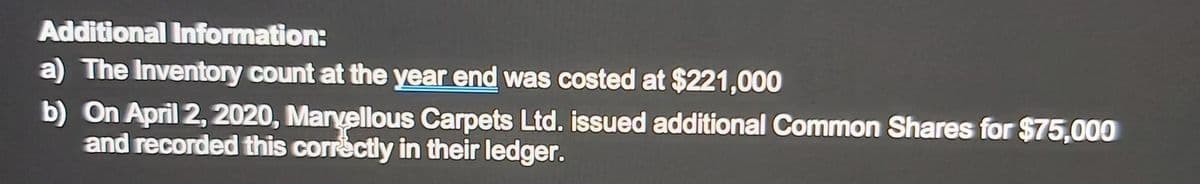

Transcribed Image Text:Additional Information:

a) The Inventory count at the year end was costed at $221,000

b) On April 2, 2020, Manyellous Carpets Ltd. issued additional Common Shares for $75,000

and recorded this correctly in their ledger.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning