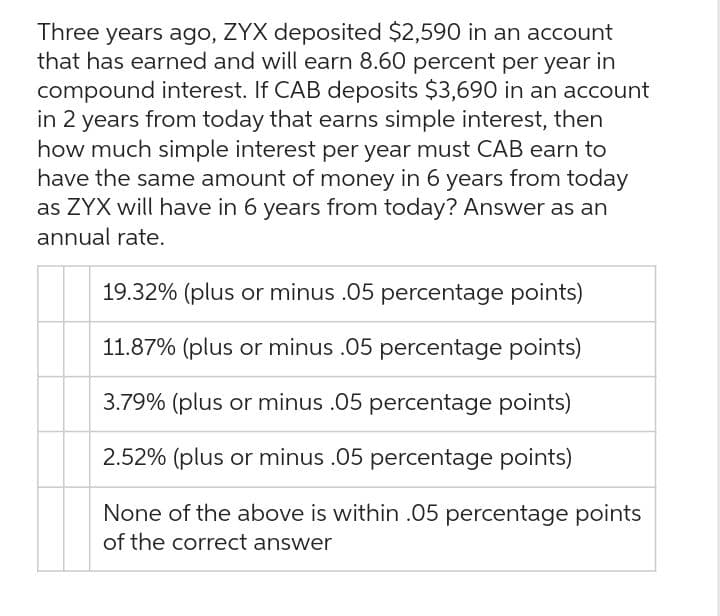

Three years ago, ZYX deposited $2,590 in an account that has earned and will earn 8.60 percent per year in compound interest. If CAB deposits $3,690 in an account in 2 years from today that earns simple interest, then how much simple interest per year must CAB earn to have the same amount of money in 6 years from today as ZYX will have in 6 years from today? Answer as an annual rate. 19.32% (plus or minus .05 percentage points) 11.87% (plus or minus .05 percentage points) 3.79% (plus or minus .05 percentage points) 2.52% (plus or minus .05 percentage points) None of the above is within .05 percentage points of the correct answer

Three years ago, ZYX deposited $2,590 in an account that has earned and will earn 8.60 percent per year in compound interest. If CAB deposits $3,690 in an account in 2 years from today that earns simple interest, then how much simple interest per year must CAB earn to have the same amount of money in 6 years from today as ZYX will have in 6 years from today? Answer as an annual rate. 19.32% (plus or minus .05 percentage points) 11.87% (plus or minus .05 percentage points) 3.79% (plus or minus .05 percentage points) 2.52% (plus or minus .05 percentage points) None of the above is within .05 percentage points of the correct answer

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 8E

Related questions

Question

Transcribed Image Text:Three years ago, ZYX deposited $2,590 in an account

that has earned and will earn 8.60 percent per year in

compound interest. If CAB deposits $3,690 in an account

in 2 years from today that earns simple interest, then

how much simple interest per year must CAB earn to

have the same amount of money in 6 years from today

as ZYX will have in 6 years from today? Answer as an

annual rate.

19.32% (plus or minus .05 percentage points)

11.87% (plus or minus .05 percentage points)

3.79% (plus or minus .05 percentage points)

2.52% (plus or minus .05 percentage points)

None of the above is within .05 percentage points

of the correct answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning