Critz Company was started on January 1, Year 1. During the month of January. Critz earned $7,500 of revenue and incurred $4,800 of expenses. During the remainder of Year 1, Critz eamed $86,000 and incurred $51,000 of expenses. Critz closes its books on December 31 of each year. Requlred a. Determine the balance in the Retained Earnings account as of January 31, Year 1. b. Determine the balance in the Revenue and Expense accounts as of January 31, Year 1. c. Determine the balance in the Retained Earnings account as of December 31, Year 1, before closing. d. Determine the balances in the Revenue end Exn

Critz Company was started on January 1, Year 1. During the month of January. Critz earned $7,500 of revenue and incurred $4,800 of expenses. During the remainder of Year 1, Critz eamed $86,000 and incurred $51,000 of expenses. Critz closes its books on December 31 of each year. Requlred a. Determine the balance in the Retained Earnings account as of January 31, Year 1. b. Determine the balance in the Revenue and Expense accounts as of January 31, Year 1. c. Determine the balance in the Retained Earnings account as of December 31, Year 1, before closing. d. Determine the balances in the Revenue end Exn

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 1PB

Related questions

Question

Please help me wih this question? Inhave attached it’s bothering parts

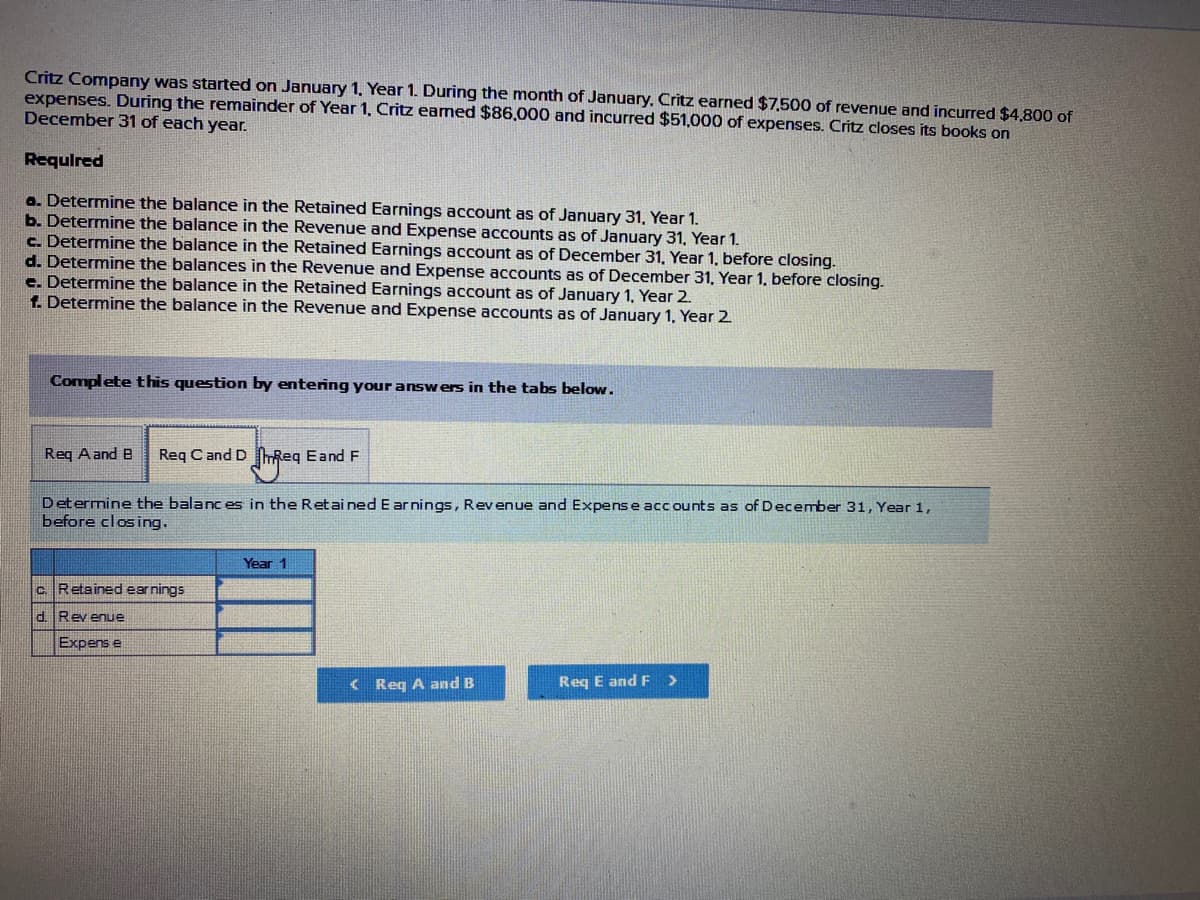

Transcribed Image Text:Critz Company was started on January 1, Year 1. During the month of January, Critz earned $7,500 of revenue and incurred $4,800 of

expenses. During the remainder of Year 1, Critz eamed $86,000 and incurred $51,000 of expenses. Critz closes its books on

December 31 of each year.

Required

a. Determine the balance in the Retained Earnings account as of January 31, Year 1.

b. Determine the balance in the Revenue and Expense accounts as of January 31, Year 1.

c. Determine the balance in the Retained Earnings account as of December 31, Year 1, before closing.

d. Determine the balances in the Revenue and Expense accounts as of December 31, Year 1, before closing.

e. Determine the balance in the Retained Earnings account as of January 1. Year 2.

f. Determine the balance in the Revenue and Expense accounts as of January 1, Year 2

Complete this question by entering your answers in the tabs below.

Req A and B

Req C and D Req Eand F

Determine the balanc es in the Retai ned E ar nings, Revenue and Expense acc ounts as of December 31, Year 1,

before closing.

Year 1

c Retained earnings

d. Rev enue

Expens e

( Reg A and B

Req E and F

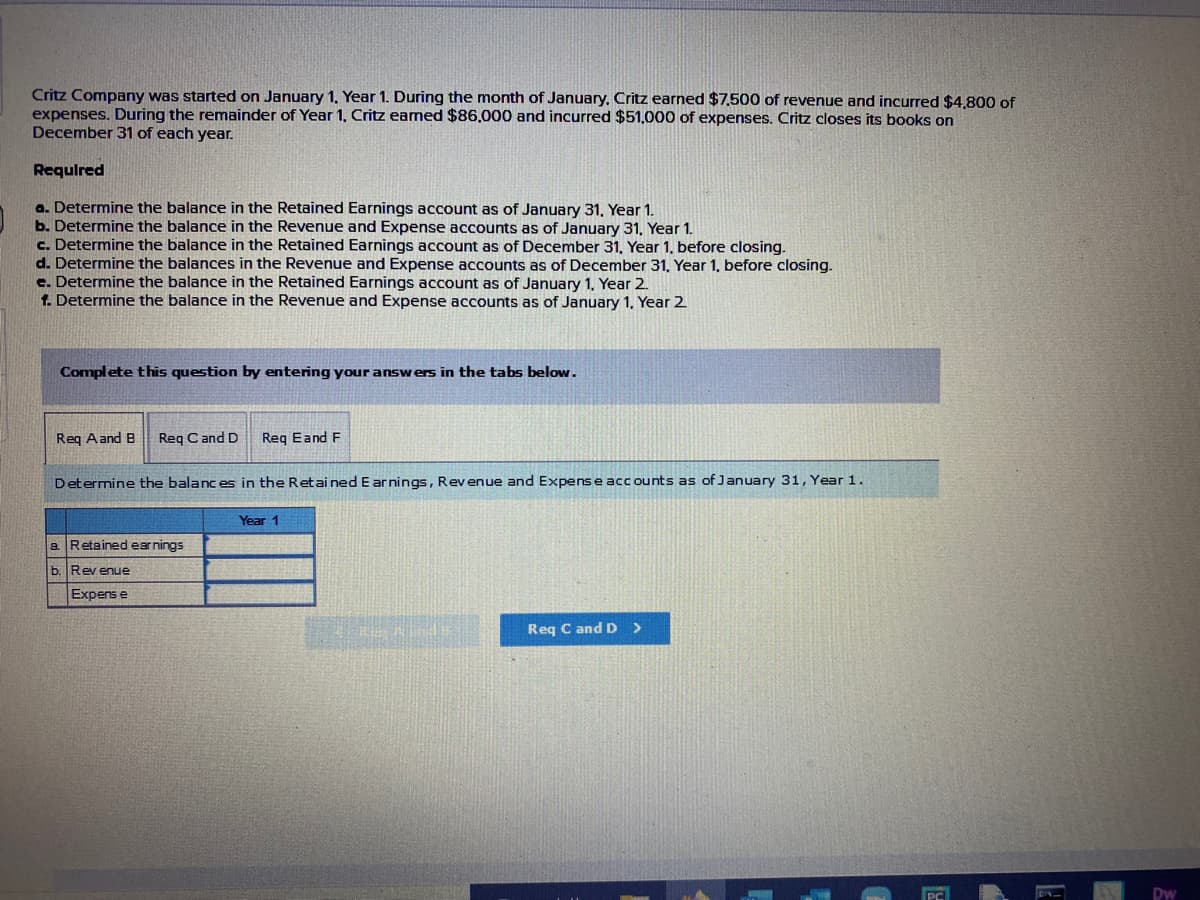

Transcribed Image Text:Critz Company was started on January 1. Year 1. During the month of January. Critz earned $7,500 of revenue and incurred $4,800 of

expenses. During the remainder of Year 1. Critz eamed $86,000 and incurred $51,000 of expenses. Critz closes its books on

December 31 of each year.

Requlred

a. Determine the balance in the Retained Earnings account as of January 31, Year 1.

b. Determine the balance in the Revenue and Expense accounts as of January 31, Year 1.

c. Determine the balance in the Retained Earnings account as of December 31, Year 1, before closing.

d. Determine the balances in the Revenue and Expense accounts as of December 31, Year 1, before closing.

e. Determine the balance in the Retained Earnings account as of January 1. Year 2.

f. Determine the balance in the Revenue and Expense accounts as of January 1, Year 2

Complete this question by entering your answers in the tabs below.

Reg Aand B

Req Cand D

Req Eand F

Determine the balanc es in the Retai ned E arnings, Revenue and Expens e accounts as of January 31, Year 1.

Year 1

a. Retained earnings

b. Revenue

Expens e

Req C and D >

Dw

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College