College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 5, Problem 5E

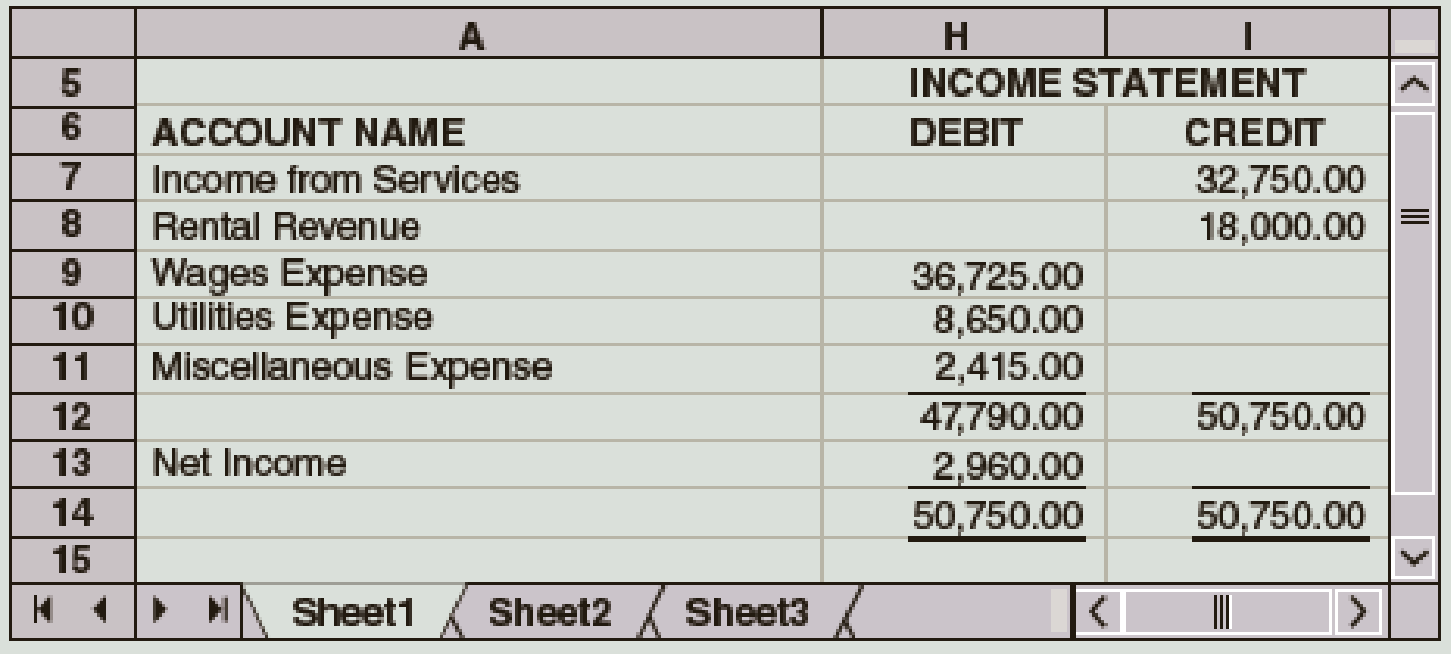

The Income Statement columns of the work sheet of Redfax Company for the fiscal year ended December 31 follow. During the year, D. Redfax withdrew $12,000. Journalize the closing entries.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Ch. 5 - What is the third step in the accounting cycle?...Ch. 5 - Which of the following accounts would be closed...Ch. 5 - If Income from Services had a 20,400 credit...Ch. 5 - Which of the following accounts would appear on a...Ch. 5 - Under the cash basis of accounting, which of the...Ch. 5 - Prob. 6QYCh. 5 - Number in order the following steps in the...Ch. 5 - List the steps in the closing procedure in the...Ch. 5 - What is the purpose of closing entries? What is a...Ch. 5 - What are real accounts? What are nominal accounts?...

Ch. 5 - What is the purpose of the Income Summary account?...Ch. 5 - What is the purpose of the post-closing trial...Ch. 5 - Write the third closing entry to transfer the net...Ch. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Classify the following accounts as real...Ch. 5 - The ledger accounts after adjusting entries for...Ch. 5 - As of December 31, the end of the current year,...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - After all revenue and expenses have been closed at...Ch. 5 - Identify whether the following accounts would be...Ch. 5 - Considering the following events, determine which...Ch. 5 - Indicate with an X whether each of the following...Ch. 5 - Prepare a statement of owners equity for The...Ch. 5 - Prob. 1PACh. 5 - The partial work sheet for Ho Consulting for May...Ch. 5 - The account balances of Bryan Company as of June...Ch. 5 - Williams Mechanic Services prepared the following...Ch. 5 - Prob. 1PBCh. 5 - The partial work sheet for Emil Consulting for...Ch. 5 - The account balances of Miss Beverlys Tutoring...Ch. 5 - Toms Catering Services prepared the following work...Ch. 5 - Rather than going directly to college, some...Ch. 5 - Prob. 2ACh. 5 - The post-closing trial balance submitted to you by...Ch. 5 - You are preparing a post-closing trial balance for...Ch. 5 - The bookkeeper has completed a work sheet and has...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - After the adjusting entries are recorded and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals of Financial Accounting

How is activity-based costing useful for pricing decisions?

Cost Accounting (15th Edition)

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

Intermediate Accounting

Interest-bearing notes payable with year-end adjustments P1 Keesha Co. borrows $200,000 cash on November 1, 201...

Financial Accounting: Information for Decisions

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Income Statement columns of the work sheet of Cederblom Company for the fiscal year ended December 31 follow. During the year, S. Cederblom withdrew 17,000. Journalize the closing entries.arrow_forwardThe Income Statement columns of the work sheet of Dunn Company for the fiscal year ended June 30 follow. During the year, K. Dunn withdrew 4,000. Journalize the closing entries.arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forward

- The following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forwardThe following partial work sheet covers the affairs of Ketcher and Company for the year ended June 30. Required 1. Journalize the six adjusting entries. 2. Journalize the closing entries. 3. Journalize the reversing entry as of July 1, for the salaries that were accrued in the June adjusting entry. Check Figure Reversing entry amount, 1,645arrow_forwardAfter all revenue and expenses have been closed at the end of the fiscal period ended December 31, Income Summary has a debit of 45,550 and a credit of 36,520. On the same date, D. Mau, Drawing has a debit balance of 12,000 and D. Mau, Capital had a beginning credit balance of 63,410. a. Journalize the entries to close the remaining temporary accounts. b. What is the new balance of D. Mau, Capital after closing the remaining temporary accounts? Show your calculations.arrow_forward

- The trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab. Merchandise Inventory at December 31, 54,845.00. c. Store supplies inventory (on hand), 488.50. d. Insurance expired, 680. e. Salaries accrued, 692. f. Depreciation of store equipment, 3,760. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardThe following partial work sheet covers the affairs of Masanto and Company for the year ended June 30. Required 1. Journalize the six adjusting entries. 2. Journalize the closing entries. 3. Journalize the reversing entry as of July 1, for the salaries that were accrued in the June adjusting entry. Check Figure Reversing entry amount, 1,240arrow_forwardWrite the third closing entry to transfer the net income or net loss to the P. Hernandez, Capital account, assuming the following: a. A net income of 3,842 during the first quarter (Jan.Mar.) b. A net loss of 1,781 during the second quarter (Apr.Jun.)arrow_forward

- The account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forwardThe trial balance of Hadden Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardAs of December 31, the end of the current year, the ledger of Harris Company contained the following account balances after adjustment. All accounts have normal balances. Journalize the closing entries.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License