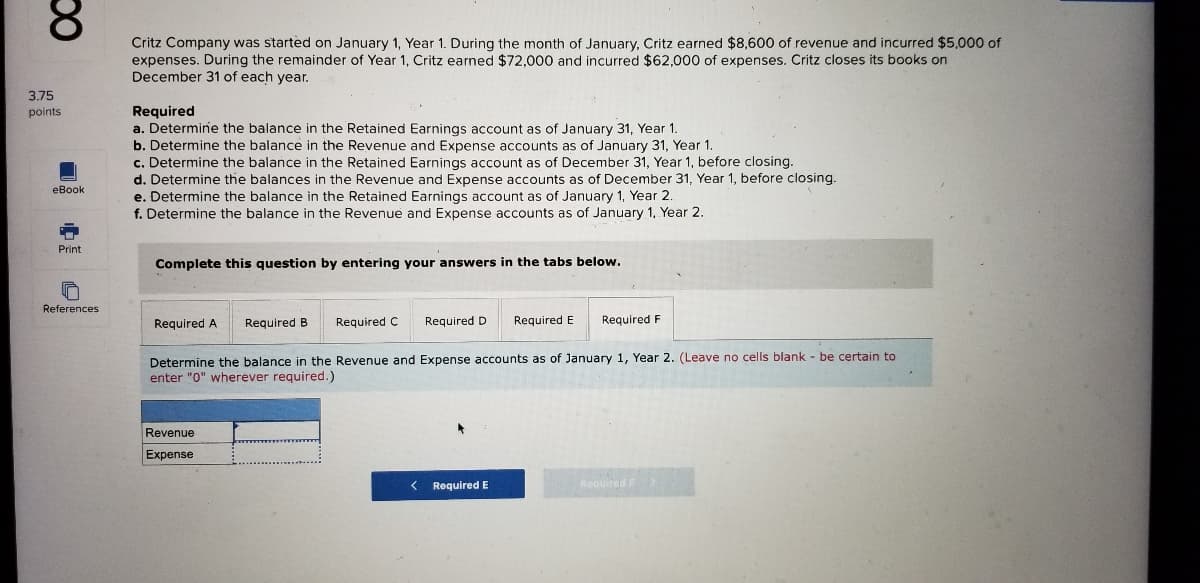

Critz Company was started on January 1, Year 1. During the month of January, Critz earned $8,600 of revenue and incurred $5,000 of expenses. During the remainder of Year 1, Critz earned $72,000 and incurred $62,000 of expenses. Critz closes its books on December 31 of each year. Required a. Determine the balance in the Retained Earnings account as of January 31, Year 1. b. Determine the balance in the Revenue and Expense accounts as of January 31, Year 1. c. Determine the balance in the Retained Earnings account as of December 31, Year 1, before closing. d. Determine the balances in the Revenue and Expense accounts as of December 31, Year 1, before closing. e. Determine the balance in the Retained Earnings account as of January 1, Year 2. f. Determine the balance in the Revenue and Expense accounts as of January 1, Year 2. Complete this question by entering your answers in the tabs below. Required A Reguired B Required C Required D Required E Required F

Critz Company was started on January 1, Year 1. During the month of January, Critz earned $8,600 of revenue and incurred $5,000 of expenses. During the remainder of Year 1, Critz earned $72,000 and incurred $62,000 of expenses. Critz closes its books on December 31 of each year. Required a. Determine the balance in the Retained Earnings account as of January 31, Year 1. b. Determine the balance in the Revenue and Expense accounts as of January 31, Year 1. c. Determine the balance in the Retained Earnings account as of December 31, Year 1, before closing. d. Determine the balances in the Revenue and Expense accounts as of December 31, Year 1, before closing. e. Determine the balance in the Retained Earnings account as of January 1, Year 2. f. Determine the balance in the Revenue and Expense accounts as of January 1, Year 2. Complete this question by entering your answers in the tabs below. Required A Reguired B Required C Required D Required E Required F

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.1.2P: Income statement, retained earnings statement, and balance sheet The amounts of the assets and...

Related questions

Question

I just need answers no work

Transcribed Image Text:8.

Critz Company was started on January 1, Year 1. During the month of January, Critz earned $8,600 of revenue and incurred $5,000 of

expenses. During the remainder of Year 1, Critz earned $72,000 and incurred $62,000 of expenses. Critz closes its books on

December 31 of each year.

3.75

Required

a. Determine the balance in the Retained Earnings account as of January 31, Year 1.

b. Determine the balance in the Revenue and Expense accounts as of January 31, Year 1.

c. Determine the balance in the Retained Earnings account as of December 31, Year 1, before closing.

d. Determine the balances in the Revenue and Expense accounts as of December 31, Year 1, before closing.

e. Determine the balance in the Retained Earnings account as of January 1, Year 2.

f. Determine the balance in the Revenue and Expense accounts as of January 1, Year 2.

points

еВоok

Print

Complete this question by entering your answers in the tabs below.

References

Required A

Required B

Required C

Required D

Required E

Required F

Determine the balance in the Revenue and Expense accounts as of January 1, Year 2. (Leave no cells blank - be certain to

enter "0" wherever required.)

Revenue

Expense

Required E

Required F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT