Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 9PC

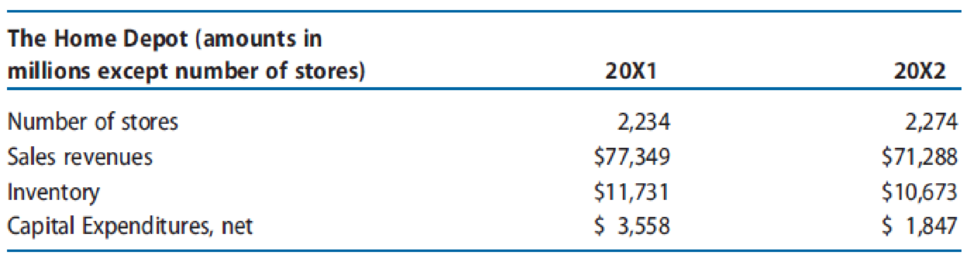

The Home Depot is a leading specialty retailer of hardware and home improvement products and is the second-largest retail store chain in the United States. It operates large warehouse-style stores. Despite declining sales and difficult economic conditions in 20X1 and 20X2, The Home Depot continued to invest in new stores. The following table provides summary hypothetical data for The Home Depot.

REQUIRED

- a. Use the preceding data for The Home Depot to compute average revenues per store, capital spending per new store, and ending inventory per store in 20X2.

- b. Assume that The Home Depot will add 100 new stores by the end of Year +1. Use the data from 20X2 to project Year +1 sales revenues, capital spending, and ending inventory. Assume that each new store will be open for business for an average of one-half year in Year +1. For simplicity, assume that in Year +1, Home Depot’s sales revenues will grow, but only because it will open new stores.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will subside; therefore, she will release the additional investment in working capital. The store manager’s pay raises are largely determined by her store’s return on investment (ROI), which has exceeded 22% each of the last three years.

Required:

1. Assuming the company’s discount rate is 16%, calculate the net present value of the store manager’s investment opportunity.

2. Calculate the annual margin, turnover, and return on investment (ROI) provided by the store manager’s investment…

Davis Stores sells clothing in 15 stores located around the southwestern United States. The managers at Davis are considering expanding by opening new stores and are interested in estimating costs in potential new locations. They believe that costs are driven in large part by store volume measured by revenue. The following data were collected from last year’s operations (revenues and costs in thousands of dollars).

Store

Revenues

Costs

101

$4,220

$4,394

102

2,347

3,134

103

5,918

5,361

104

4,222

4,298

105

3,094

4,036

106

4,263

3,739

107

7,014

5,209

108

1,959

2,974

109

6,016

5,168

110

3,588

3,319

111

4,126

4,479

112

4,990

3,440

113

3,672

2,916

114

5,297

4,895

115

2,724

3,166

Required

a. Use the high-low method to estimate the fixed and variable portions of store costs based on revenues.

b. Managers estimate that one of the proposed stores will have revenues of $3.7 million. What are the estimated monthly overhead costs, assuming no…

Davis Stores sells clothing in 15 stores located around the southwestern United States. The managers at Davis are considering expanding by opening new stores and are interested in estimating costs in potential new locations. They believe that costs are driven in large part by store volume measured by revenue. The following data were collected from last year’s operations (revenues and costs in thousands of dollars).

Store

Revenues

Costs

101

$4,240

$4,424

102

2,367

3,174

103

5,948

5,391

104

4,262

4,348

105

3,124

4,096

106

4,303

3,809

107

7,034

5,239

108

1,989

3,074

109

6,116

5,248

110

3,648

3,379

111

4,166

4,529

112

5,040

3,480

113

3,692

2,976

114

5,377

4,935

115

2,824

3,196

Required

a. Use the high-low method to estimate the fixed and variable portions of store costs based on revenues.

b. Managers estimate that one of the proposed stores will have revenues of $3.9 million. What are the estimated monthly overhead costs, assuming no…

Chapter 10 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 10 - Prob. 1QECh. 10 - The chapter encourages analysts to develop...Ch. 10 - Prob. 3QECh. 10 - Suppose you are analyzing a firm that is...Ch. 10 - Use the following hypothetical data for Walgreens...Ch. 10 - Prob. 6QECh. 10 - Prob. 7QECh. 10 - Prob. 8QECh. 10 - The Home Depot is a leading specialty retailer of...Ch. 10 - Prob. 10PC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Glencoe First National Bank operated for years under the assumption that profitability can be increased by increasing dollar volumes. Historically, First Nationals efforts were directed toward increasing total dollars of sales and total dollars of account balances. In recent years, however, First Nationals profits have been eroding. Increased competition, particularly from savings and loan institutions, was the cause of the difficulties. As key managers discussed the banks problems, it became apparent that they had no idea what their products were costing. Upon reflection, they realized that they had often made decisions to offer a new product which promised to increase dollar balances without any consideration of what it cost to provide the service. After some discussion, the bank decided to hire a consultant to compute the costs of three products: checking accounts, personal loans, and the gold VISA. The consultant identified the following activities, costs, and activity drivers (annual data): The following annual information on the three products was also made available: In light of the new cost information, Larry Roberts, the bank president, wanted to know whether a decision made two years ago to modify the banks checking account product was sound. At that time, the service charge was eliminated on accounts with an average annual balance greater than 1,000. Based on increases in the total dollars in checking, Larry was pleased with the new product. The checking account product is described as follows: (1) checking account balances greater than 500 earn interest of 2 percent per year, and (2) a service charge of 5 per month is charged for balances less than 1,000. The bank earns 4 percent on checking account deposits. Fifty percent of the accounts are less than 500 and have an average balance of 400 per account. Ten percent of the accounts are between 500 and 1,000 and average 750 per account. Twenty-five percent of the accounts are between 1,000 and 2,767; the average balance is 2,000. The remaining accounts carry a balance greater than 2,767. The average balance for these accounts is 5,000. Research indicates that the 2,000 category was by far the greatest contributor to the increase in dollar volume when the checking account product was modified two years ago. Required: 1. Calculate rates for each activity. 2. Using the rates computed in Requirement 1, calculate the cost of each product. 3. Evaluate the checking account product. Are all accounts profitable? Compute the average annual profitability per account for the four categories of accounts described in the problem. What recommendations would you make to increase the profitability of the checking account product? (Break-even analysis for the unprofitable categories may be helpful.)arrow_forwardBannister Company, an electronics firm, buys circuit boards and manually inserts various electronic devices into the printed circuit board. Bannister sells its products to original equipment manufacturers. Profits for the last two years have been less than expected. Mandy Confer, owner of Bannister, was convinced that her firm needed to adopt a revenue growth and cost reduction strategy to increase overall profits. After a careful review of her firms condition, Mandy realized that the main obstacle for increasing revenues and reducing costs was the high defect rate of her products (a 6 percent reject rate). She was certain that revenues would grow if the defect rate was reduced dramatically. Costs would also decline as there would be fewer rejects and less rework. By decreasing the defect rate, customer satisfaction would increase, causing, in turn, an increase in market share. Mandy also felt that the following actions were needed to help ensure the success of the revenue growth and cost reduction strategy: a. Improve the soldering capabilities by sending employees to an outside course. b. Redesign the insertion process to eliminate some of the common mistakes. c. Improve the procurement process by selecting suppliers that provide higher-quality circuit boards. Required: 1. State the revenue growth and cost reduction strategy using a series of cause-and-effect relationships expressed as if-then statements. 2. Illustrate the strategy using a strategy map. 3. Explain how the revenue growth strategy can be tested. In your explanation, discuss the role of lead and lag measures, targets, and double-loop feedback.arrow_forwardGlobal Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)arrow_forward

- Haglund Department Store is located in the downtown area of a small city. While the store had been profitable for many years, it is facing increasing competition from large national chains that have set up storeson the outskirts of the city. Recently the downtown area has been undergoing revitalization, and the ownersof Haglund Department Store are somewhat optimistic that profitability can be restored.In an attempt to accelerate the return to profitability, management of Haglund Department Store is inthe process of designing a balanced scorecard for the company. Management believes the company shouldfocus on two key problems. First, customers are taking longer and longer to pay the bills they incur usingthe department store’s charge card, and the company has far more bad debts than are normal for the industry. If this problem were solved, the company would have more cash to make much needed renovations.Investigation has revealed that much of the problem with late payments and unpaid…arrow_forwardCalculate Sanchez’s operating income if it keeps the Rhode Island store open and opens another store with revenues and costs identical to the Rhode Island store (including a cost of $22,000 to acquire equipment with a one-year useful life and zero disposal value). Opening this store will increase corporate overhead costs by $4,000. Is Maria Lopez’s statement about the effect of adding another store like the Rhode Island store correct? Explain.arrow_forwardPlease send answer in chart set up Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). Investment Center Sales Income AverageInvested Assets Electronics $ 39,840,000 $ 2,988,000 $ 16,600,000 Sporting goods 25,200,000 2,142,000 12,600,000 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company?2. Assume a target income level of 11% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company?3. Assume the Electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted?arrow_forward

- ZNet Co. is a web-based retail company. The company reports the following for the past year. The company’s CEO believes that sales for next year will increase by 20% and both profit margin (%) and the level of average invested assets will be the same as for the past year. 1. Compute return on investment for the past year. 2. Compute profit margin for the past year. 3. If the CEO’s forecast is correct, what will return on investment equal for next year? 4. If the CEO’s forecast is correct, what will investment turnover equal for next year? Sales . $5,000,000 Operating income . $1,000,000 Average invested assets . $12,500,000arrow_forwardHarrison Jones is a marketer of facial care products. It plans on introducing a new product line next year and is not quite certain whether its sales team can accomplish the sales objectives. It must determine how much dollar business it must do to at least break even. Its historical average annual sales has been $10,000,000 and its cost of sales has been $4,500,000. Its planned investment in the new business is $450,000. How much dollar business must Harrison Jones do in order to recoup its planned investment?arrow_forwardCarni’s boss stated that after reviewing first-quarter earnings, the companydecided to invest in only one store in the city. After evaluating the performanceof the store, the company will determine if it wants to increase itspresence in the area.a. If you were Carni, what method of evaluation would you use to recommenda site for a new video store?b. Explain how you would determine which site to invest in.arrow_forward

- Richmond, Inc., operates a chain of 44 department stores. Two years ago, the board of directors of Richmond approved a large-scale remodeling of its stores to attract a more upscale clientele. Before finalizing these plans, two stores were remodeled as a test. Linda Perlman, assistant controller, was asked to oversee the financial reporting for these test stores, and she and other management personnel were offered bonuses based on the sales growth and profitability of these stores. While completing the financial reports, Perlman discovered a sizable inventory of outdated goods that should have been discounted for sale or returned to the manufacturer. She discussed the Situation with her management colleagues; the consensus was to ignore reporting this inventory as obsolete because reporting it would diminish the financial results and their bonuses. Required: According to the IMA’s Statement of Ethical Professional Practice, would it be ethical for Perlman not to report the inventory…arrow_forwardFitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year: Sales Net operating income Average operating assets 720,000 $ 12,240 $ 100,000 The following questions are to be considered independently. Assume that the manager of the club is able to reduce expenses by $2,880 without any change in sales or average operating assets. What would be the club's return on investment (ROI)?arrow_forwardDuring the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. Assume that you are Cochran’s assistant and that you must help her answer the following questions: What effect did the expansion have on sales and net income? What effect did the expansion have on the asset side of the balance sheet? What effect did it have on liabilities and equity? What do you conclude from the statement of cash flows?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License