Cullumber Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies nanufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by precasting the year's overhead and relating it to direct labour costs. The budget for 2022 was as follows: Direct labour Manufacturing overhead $1809,000 904.500 s at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $ 113.800, and 1819c. otal direct labour charges of $ 390.200. Machine hours were 287 hours for 1768B and 647 hours for 1819C. Direct materials issu or 1768B amounted to $ 228.000. and for 1819C they amounted to $ 420.900. otal charges to the Manufacturing Overhead Control account for the year were $ 899.000, and direct labour charges made to allj mounted to $ 1.577.200.representing 248,100 direct labour hours. There were no beginning inventories. In addition to the ending work in process just described, the ending finished goods inventory ccount showed a balance of $ 561.960. ales for the year amounted to $6.203.300; cost of goods sold totalled $ 3.652.740; and sales, general, and administrative expense were $ 1.849,400. he above amounts for inventories and the cost of goods sold have not been adjusted for any over-or under-application of

Cullumber Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies nanufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by precasting the year's overhead and relating it to direct labour costs. The budget for 2022 was as follows: Direct labour Manufacturing overhead $1809,000 904.500 s at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $ 113.800, and 1819c. otal direct labour charges of $ 390.200. Machine hours were 287 hours for 1768B and 647 hours for 1819C. Direct materials issu or 1768B amounted to $ 228.000. and for 1819C they amounted to $ 420.900. otal charges to the Manufacturing Overhead Control account for the year were $ 899.000, and direct labour charges made to allj mounted to $ 1.577.200.representing 248,100 direct labour hours. There were no beginning inventories. In addition to the ending work in process just described, the ending finished goods inventory ccount showed a balance of $ 561.960. ales for the year amounted to $6.203.300; cost of goods sold totalled $ 3.652.740; and sales, general, and administrative expense were $ 1.849,400. he above amounts for inventories and the cost of goods sold have not been adjusted for any over-or under-application of

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

Problem 10E: Compute the total job cost for each of the following scenarios: a. If the direct labor cost method...

Related questions

Question

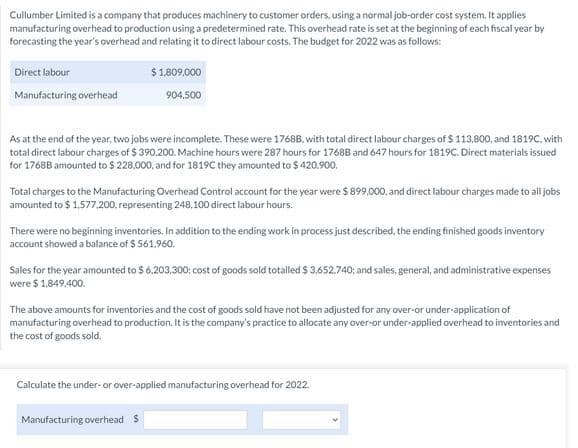

Transcribed Image Text:Cullumber Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies

manufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by

forecasting the year's overhead and relating it to direct labour costs. The budget for 2022 was as follows:

Direct labour

$1809.000

Manufacturing overhead

904,500

As at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $ 113,800, and 1819C. with

total direct labour charges of $ 390,200. Machine hours were 287 hours for 1768B and 647 hours for 1819C. Direct materials issued

for 1768B amounted to $ 228.000. and for 1819C they amounted to $ 420.900,

Total charges to the Manufacturing Overhead Control account for the year were $ 899,000, and direct labour charges made to all jobs

amounted to $ 1,577.200, representing 248,100 direct labour hours.

There were no beginning inventories. In addition to the ending work in process just described, the ending finished goods inventory

account showed a balance of $ 561.960.

Sales for the year amounted to $ 6.203.300; cost of goods sold totalled $ 3.652.740; and sales, general, and administrative expenses

were $ 1.849,400.

The above amounts for inventories and the cost of goods sold have not been adjusted for any over-or under-application of

manufacturing overhead to production. It is the company's practice to allocate any over-or under-applied overhead to inventories and

the cost of goods sold.

Calculate the under- or over-applied manufacturing overhead for 2022.

Manufacturing overhead $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,