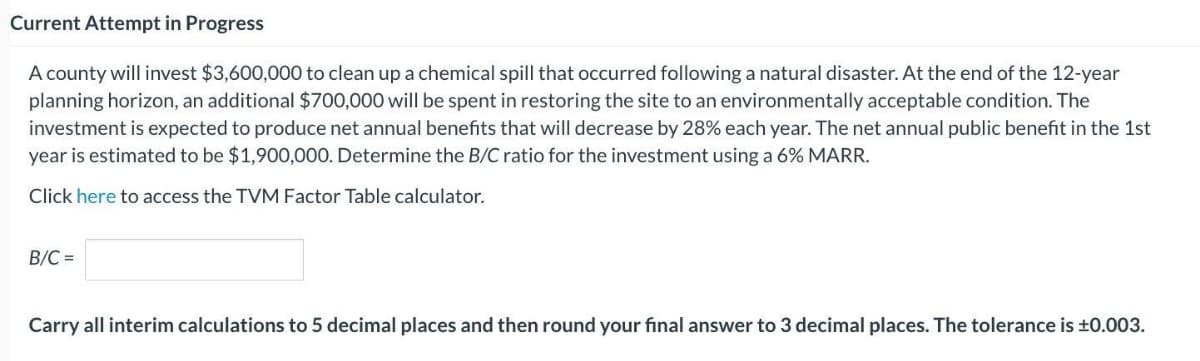

Current Attempt in Progress A county will invest $3,600,000 to clean up a chemical spill that occurred following a natural disaster. At the end of the 12-year planning horizon, an additional $700,000 will be spent in restoring the site to an environmentally acceptable condition. The investment is expected to produce net annual benefits that will decrease by 28% each year. The net annual public benefit in the 1st year is estimated to be $1,900,000. Determine the B/C ratio for the investment using a 6% MARR. Click here to access the TVM Factor Table calculator. B/C= Carry all interim calculations to 5 decimal places and then round your final answer to 3 decimal places. The tolerance is ±0.003.

Current Attempt in Progress A county will invest $3,600,000 to clean up a chemical spill that occurred following a natural disaster. At the end of the 12-year planning horizon, an additional $700,000 will be spent in restoring the site to an environmentally acceptable condition. The investment is expected to produce net annual benefits that will decrease by 28% each year. The net annual public benefit in the 1st year is estimated to be $1,900,000. Determine the B/C ratio for the investment using a 6% MARR. Click here to access the TVM Factor Table calculator. B/C= Carry all interim calculations to 5 decimal places and then round your final answer to 3 decimal places. The tolerance is ±0.003.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 12P

Related questions

Question

3

Transcribed Image Text:Current Attempt in Progress

A county will invest $3,600,000 to clean up a chemical spill that occurred following a natural disaster. At the end of the 12-year

planning horizon, an additional $700,000 will be spent in restoring the site to an environmentally acceptable condition. The

investment is expected to produce net annual benefits that will decrease by 28% each year. The net annual public benefit in the 1st

year is estimated to be $1,900,000. Determine the B/C ratio for the investment using a 6% MARR.

Click here to access the TVM Factor Table calculator.

B/C=

Carry all interim calculations to 5 decimal places and then round your final answer to 3 decimal places. The tolerance is ±0.003.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College