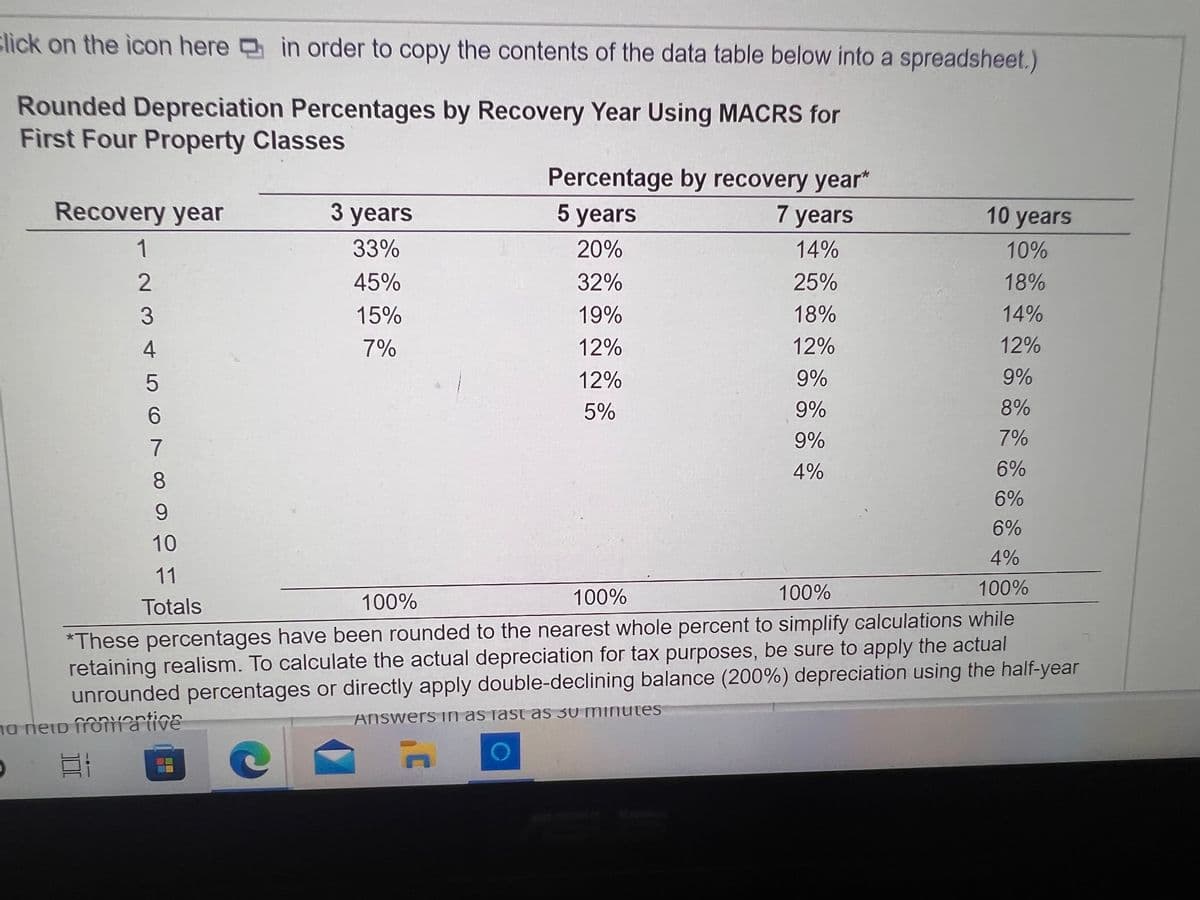

Cushing Corporation is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased 3 years ago at an installed cost of $20,300; it was being depreciated under MACRS using a 5-year recovery period. (See table attached) for the applicable depreciation percentages.) The existing machine is expected to have a usable life of at least 5 more years. The new machine costs $35,900 and requires $4,900 in installation costs; it will be depreciated using a 5-year recovery period under MACRS. The existing machine can currently be sold for $25,800 without incurring any removal or cleanup costs. The firm is subject to a 21% tax rate. Calculate the initial cash flow associated with the proposed purchase of a new grading machine.

Cushing Corporation is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased 3

years ago at an installed cost of $20,300; it was being depreciated under MACRS using a 5-year recovery period. (See table attached) for the applicable

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images