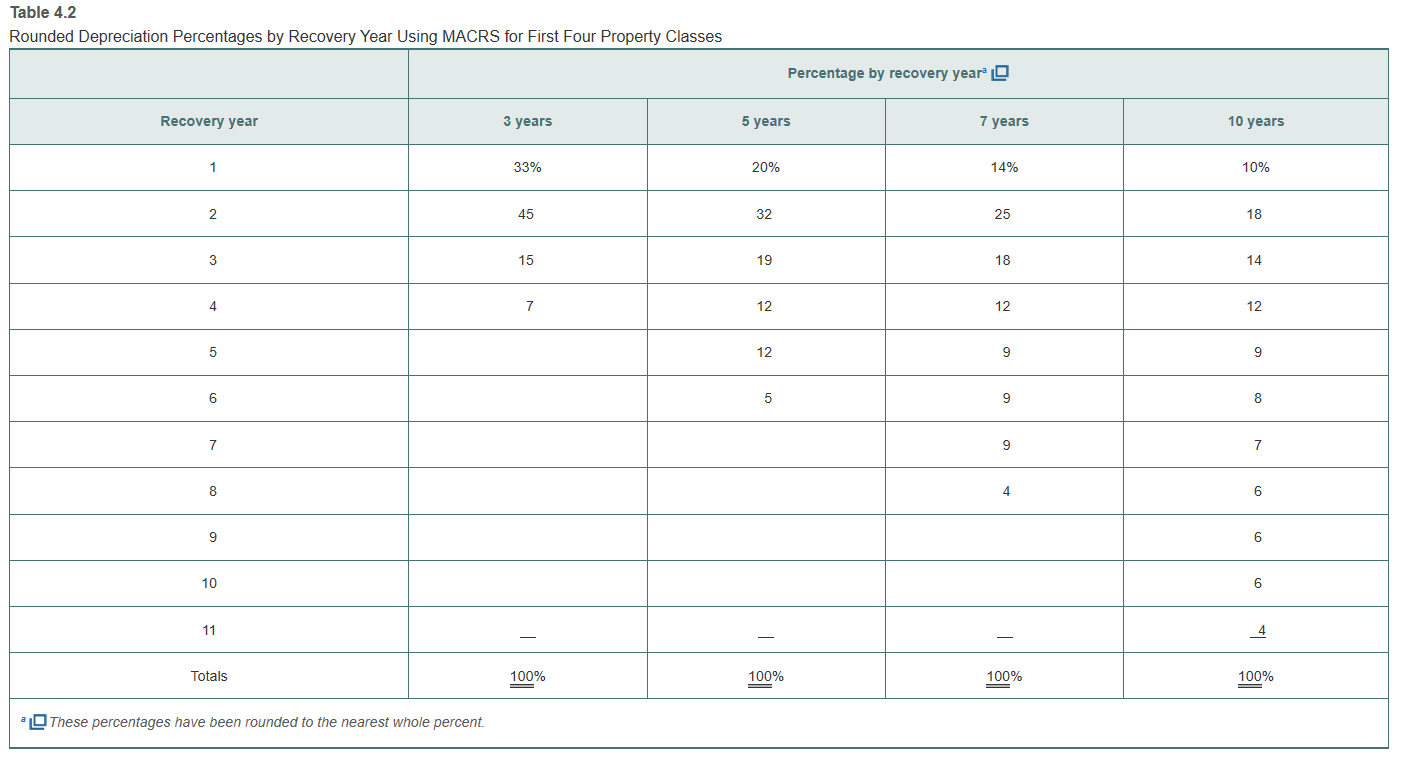

Table 4.2 Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year O Recovery year з уears 5 years 7 years 10 years 1 33% 20% 14% 10% 45 32 25 18 15 19 18 14 4 7 12 12 12 5 12 4 10 11 Totals 100% 100% 100% 100% OThese percentages have been rounded to the nearest whole percent.

Cushing Partners is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased 3 years ago at an installed cost of $20,000; it was being

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images