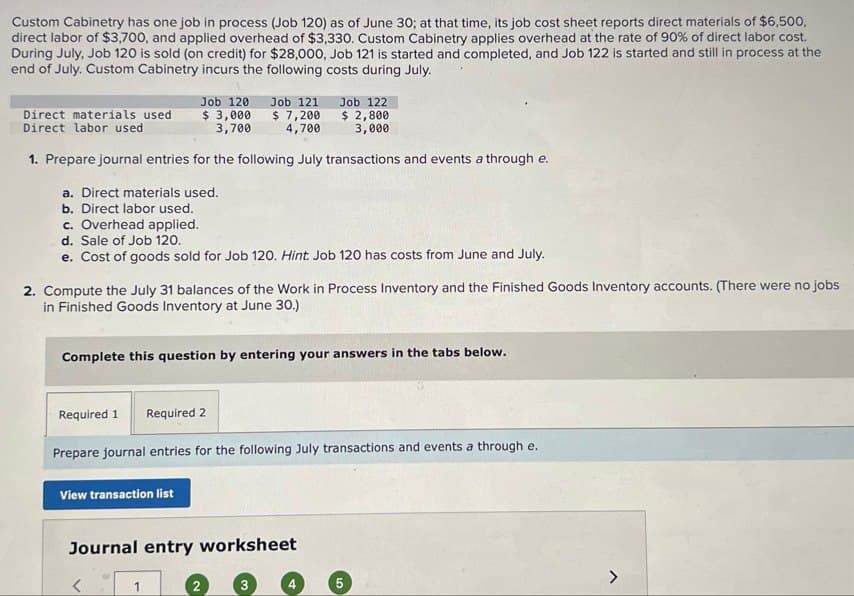

Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,500, direct labor of $3,700, and applied overhead of $3,330. Custom Cabinetry applies overhead at the rate of 90% of direct labor cost. During July, Job 120 is sold (on credit) for $28,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Direct materials used Direct labor used Job 120 $ 3,000 3,700 Job 121 Job 122 $ 7,200 4,700 $2,800 3,000 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint: Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June 30.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries for the following July transactions and events a through e. View transaction list Journal entry worksheet < 1 4 5

Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,500, direct labor of $3,700, and applied overhead of $3,330. Custom Cabinetry applies overhead at the rate of 90% of direct labor cost. During July, Job 120 is sold (on credit) for $28,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Direct materials used Direct labor used Job 120 $ 3,000 3,700 Job 121 Job 122 $ 7,200 4,700 $2,800 3,000 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint: Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June 30.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries for the following July transactions and events a through e. View transaction list Journal entry worksheet < 1 4 5

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

Problem 17P: Luna Manufacturing Inc. completed Job 2525 on May 31, and there were no jobs in process in the...

Related questions

Question

please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no

Transcribed Image Text:Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,500,

direct labor of $3,700, and applied overhead of $3,330. Custom Cabinetry applies overhead at the rate of 90% of direct labor cost.

During July, Job 120 is sold (on credit) for $28,000, Job 121 is started and completed, and Job 122 is started and still in process at the

end of July. Custom Cabinetry incurs the following costs during July.

Direct materials used

Direct labor used

Job 120

$ 3,000

3,700

Job 121 Job 122

$ 7,200

4,700

$2,800

3,000

1. Prepare journal entries for the following July transactions and events a through e.

a. Direct materials used.

b. Direct labor used.

c. Overhead applied.

d. Sale of Job 120.

e. Cost of goods sold for Job 120. Hint: Job 120 has costs from June and July.

2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs

in Finished Goods Inventory at June 30.)

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare journal entries for the following July transactions and events a through e.

View transaction list

Journal entry worksheet

<

1

4

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,