Cutter Enterprises purchased equipment for $72,000 on January 1, 2021. The equipment is expected to have a five-year life and a residual value of $6,000. Using the double-declining-balance method, depreciation for 2021 and the book value at December 31, 2021, would be: O $26,400 and $39,600 respectively. O $26,400 and $45,600 respectively. O $28,800 and $37,200 respectively. O $28,800 and $43,200 respectively.

Cutter Enterprises purchased equipment for $72,000 on January 1, 2021. The equipment is expected to have a five-year life and a residual value of $6,000. Using the double-declining-balance method, depreciation for 2021 and the book value at December 31, 2021, would be: O $26,400 and $39,600 respectively. O $26,400 and $45,600 respectively. O $28,800 and $37,200 respectively. O $28,800 and $43,200 respectively.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 2E: Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The...

Related questions

Question

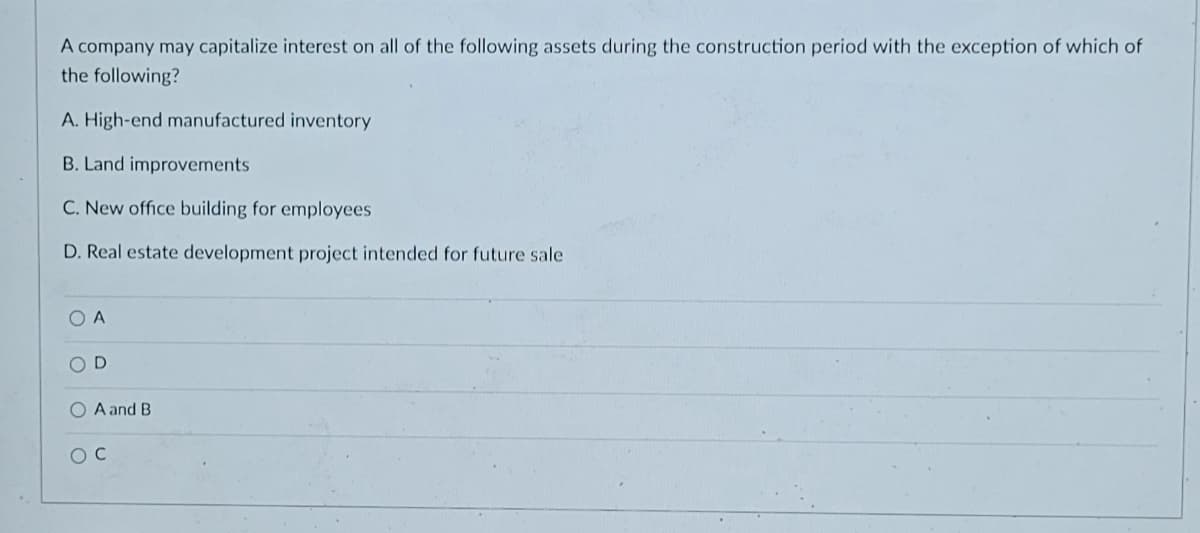

Transcribed Image Text:A company may capitalize interest on all of the following assets during the construction period with the exception of which of

the following?

A. High-end manufactured inventory

B. Land improvements

C. New office building for employees

D. Real estate development project intended for future sale

O A

O D

O A and B

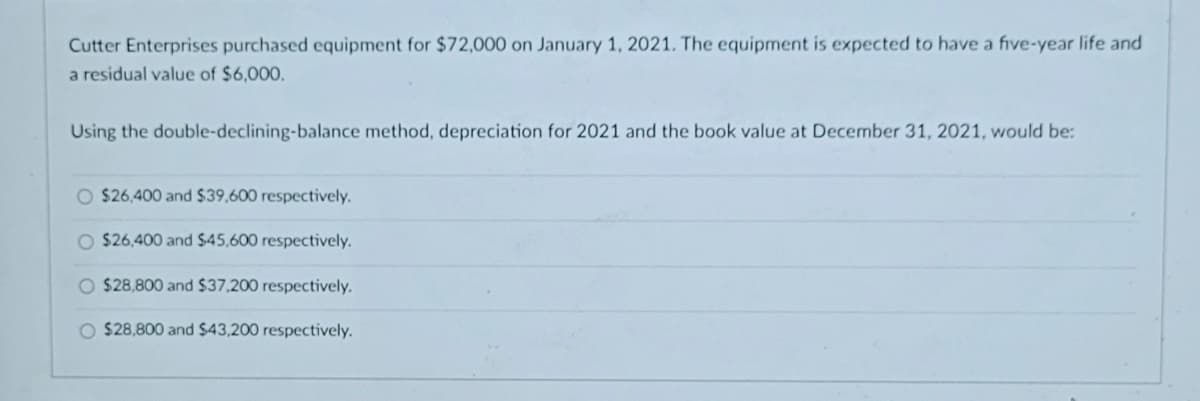

Transcribed Image Text:Cutter Enterprises purchased equipment for $72,000 on January 1, 2021. The equipment is expected to have a five-year life and

a residual value of $6,000.

Using the double-declining-balance method, depreciation for 2021 and the book value at December 31, 2021, would be:

O $26,400 and $39,600 respectively.

O $26,400 and $45,600 respectively.

O $28,800 and $37,200 respectively.

O $28,800 and $43,200 respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning